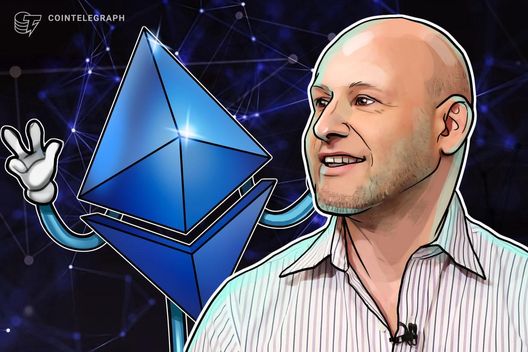

Drawing from Michael Saylor’s Bitcoin strategies, Joseph Lubin argues that Ethereum treasury firms could yield greater returns for investors compared to their Bitcoin equivalents.

In an exclusive interview with Cointelegraph during Token2049 in Singapore, the Ethereum co-founder elaborated on his belief that Ether (ETH) digital asset treasuries (DATs) offer better opportunities than the Bitcoin treasury strategies made popular by Saylor.

“I would prefer assets that have a more significant impact. Ether is undoubtedly as robust as Bitcoin, and I’d contend it’s even more robust due to its functionality and organic demand for transaction and storage fees,” Lubin stated.

The Ethereum co-founder is actively advocating for ETH DATs since he has become chairman of SharpLink Gaming, an ETH-based treasury firm.

The Nasdaq-listed iGaming company has purchased over $2 billion in Ether since establishing a treasury strategy in August.

Inspired by Michael Saylor

Lubin acknowledged that his motivation to lead an ETH treasury firm stemmed from Saylor’s financial engineering concepts, which utilize Bitcoin as a reserve asset.

“I had the privilege of dining with him in December and learned his reasoning behind all his initiatives. It centered on discovering better treasury capital assets for his business,” Lubin explained.

“I discussed with my colleagues, and it was evident that Ether would make a superior treasury asset since it generates productive yields.”

Lubin has a highly optimistic vision for Ethereum’s medium-term prospects, predicting that the ecosystem will reach its “broadband moment” in 2025, becoming both horizontally and vertically scalable, and needing more affordable, abundant block space.

Related: ‘The Fight for Ethereum’s Soul,’ a Cointelegraph documentary

He added that Ethereum scaled too rapidly in the previous 18 months, leading to a surplus of block space, with insufficient builders, applications, and transactions to occupy it.

“I genuinely believed our ecosystem faced some stagnation, primarily due to price factors, as there was an oversupply of Ether and inexpensive block space,” Lubin noted.

The answer? Initiate a movement of ETH DATs that voraciously acquire the underlying tokens and actively stake and invest Ether.

“We thought we might ignite some energy in the Ethereum ecosystem, and it has worked out quite well. We have several companies and are setting ourselves apart in exciting ways,” he remarked.

Supply-demand dynamics to boost Ether

The Ethereum DAT landscape is quickly expanding, yet it is primarily led by two major players: Lubin’s SharpLink and Tom Lee’s BitMine.

The latter is considered the proverbial whale. Driven by Lee’s bullish stance on Ether, BitMine has amassed 2.65 million ETH as of October 8. Its holdings are valued at $11 billion, overshadowing SharpLink’s 839,636 ETH worth $3.69 billion.

Related: SharpLink Ether holdings near $1B in unrealized gains as ETH rallies

Lubin shared with Cointelegraph that while he initially expected a rapid accumulation of ETH, this perception shifted after Lee announced his intention to acquire 5% of Ether’s total supply publicly.

“We didn’t have a specific limit in mind, but we acknowledged that we couldn’t accumulate too much ETH, or we’d face backlash from the ecosystem.”

Lubin’s long-term objective is to enhance the concentration of Ether per fully diluted share while maintaining equity price stability. After that, SharpLink aims to continue generating yield from its staked Ether.

Lubin foresees a future where SharpLink capitalizes on its ETH holdings, investing in Ethereum-focused ventures and contributing to supporting protocols.

“The true opportunity is to become the Berkshire Hathaway of the upcoming decentralized global economy.”

Weighing up the risks

The DAT movement is poised to become one of the overarching narratives of 2025. However, some skeptics express concerns regarding the systemic risks treasury companies assume by incurring considerable debt to acquire protocol tokens.

Lubin diminished fears of a catastrophic collapse due to DATs but cautioned against excessive leverage among companies.

“The greatest risk lies in not pursuing this, as it represents a groundbreaking new model.”

Lubin anticipates that ETH prices will rise as supply-demand dynamics tighten, propelled by the purchasing actions of ETH DATs.

“The financial sector is rapidly entering our ecosystem,” he asserted. “Other businesses are flocking to us. This is our broadband moment, and we are drawing significant attention. We won’t overextend ourselves.”

Magazine: Meet the Ethereum and Polkadot co-founder who wasn’t in Time Magazine