The recent shutdown of the US government has led to uncertainty in financial markets, driving investors to explore alternative, safer assets.

With the US dollar facing slight depreciation due to political impasses, liquidity is increasingly being funneled into the crypto sector. This influx has enhanced the performance of various crypto-related stocks, alongside their ongoing ecosystem advancements. Here are some to keep an eye on this week.

Sponsored

Sponsored

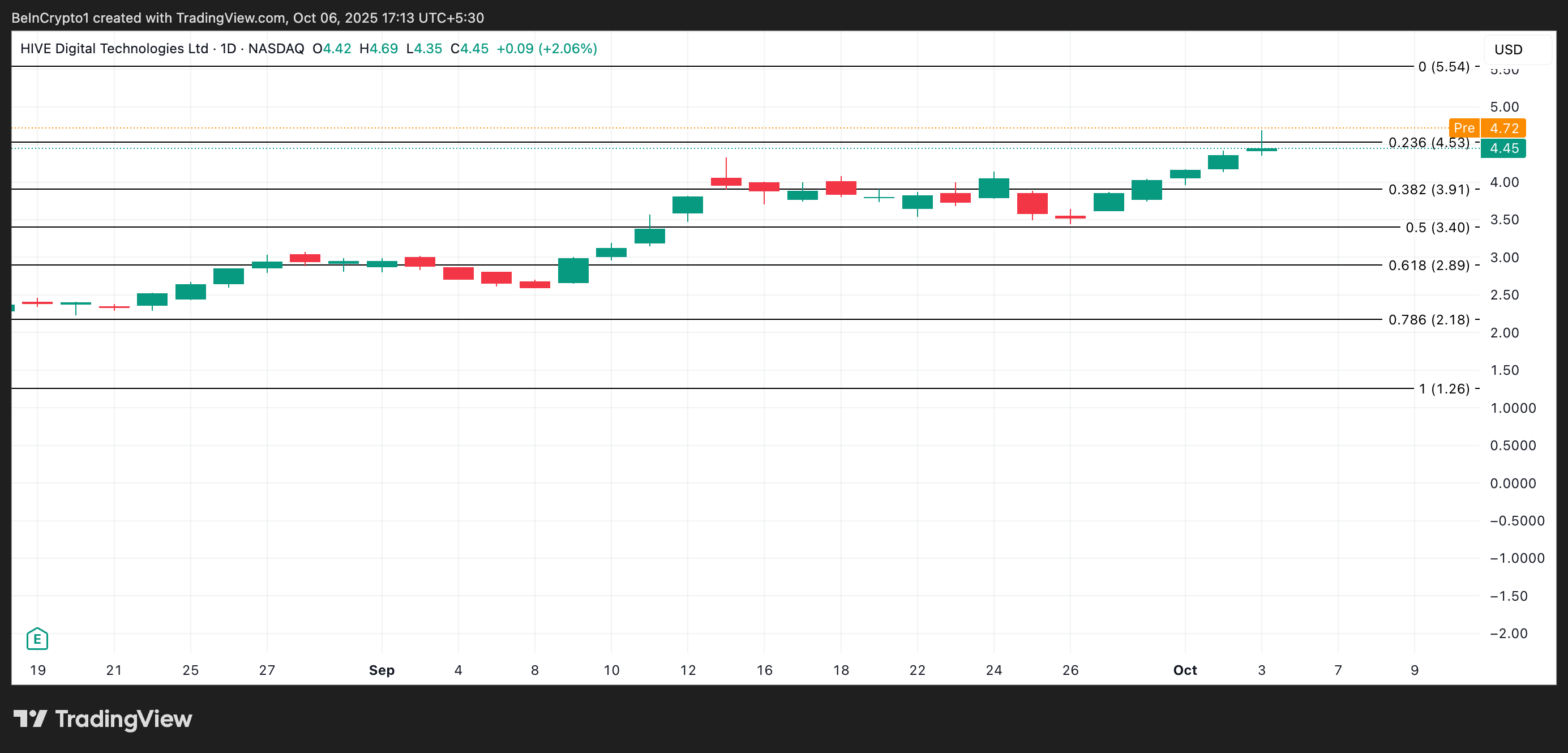

HIVE Digital Technologies Ltd (HIVE)

HIVE Digital shares ended Friday at $4.46, marking a 2.29% increase for the day. The crypto stock is worth monitoring this week following the strong production report for September and rapid advancements at its new facility.

In a report dated October 6, the mining giant revealed it produced 267 BTC in September, reflecting an 8% month-over-month increase from August’s 247 BTC and a 138% year-over-year rise from 112 BTC in September 2024.

The report also confirmed the nearing completion of HIVE Digital’s 100 MW Phase 3 Valenzuela facility, which is ahead of expectations. HIVE’s production efficiency continues to surpass broader market challenges, with September’s 267 BTC being its highest monthly output of 2025.

This robust operational outlook and improving market sentiment position HIVE as a key crypto stock to watch this week.

If buying momentum strengthens, HIVE’s share price might break above $5 and potentially surge towards $5.54.

However, if selling pressure mounts, the stock could retreat to around $3.91.

Sponsored

Sponsored

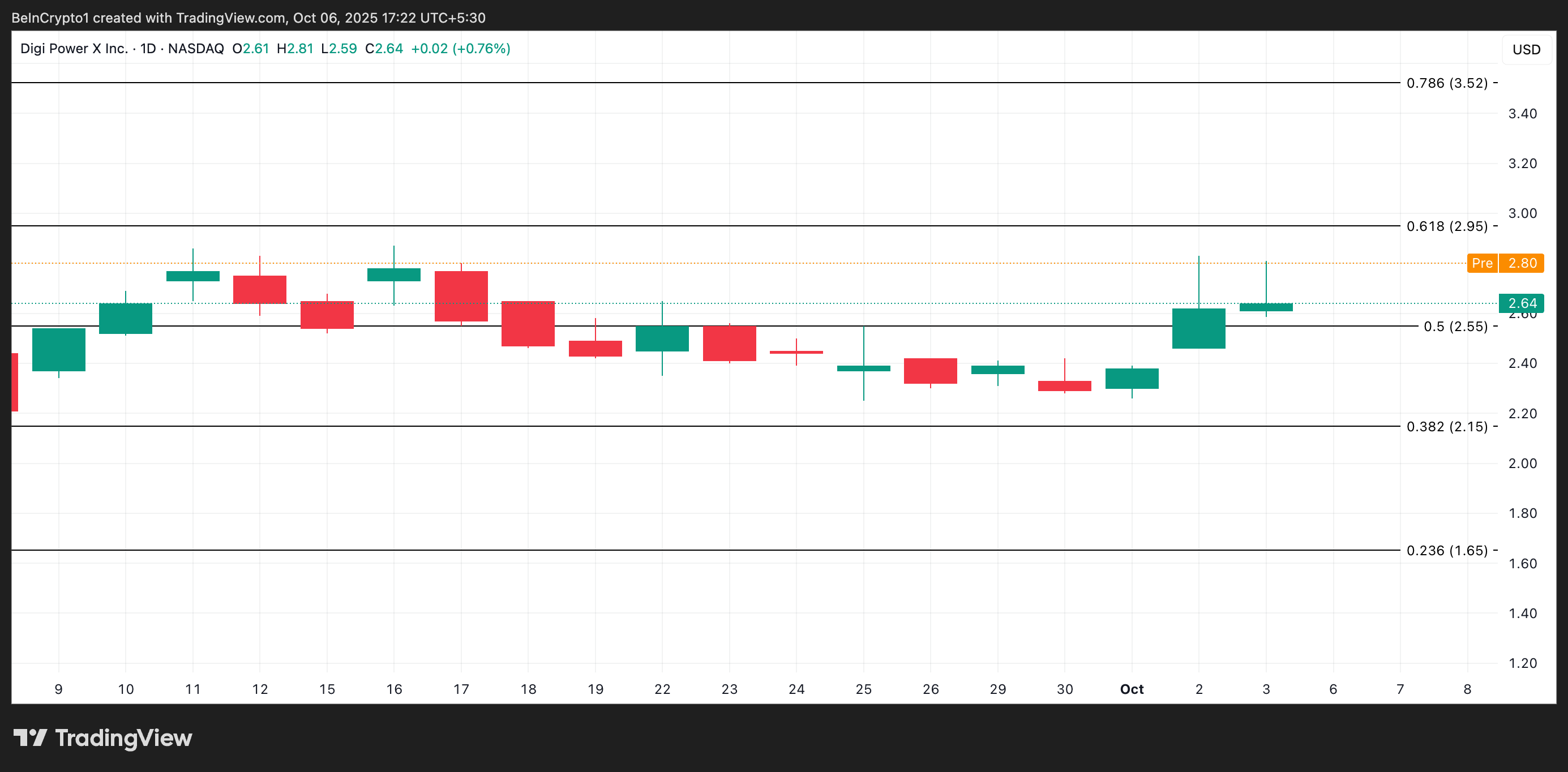

Digi Power X (DGXX)

DGXX concluded Friday at $2.64, marking a modest 1% uptick. This small increase indicates cautious optimism as investors absorb the company’s latest operational update.

On October 1, the company disclosed that its ARMS 200 (AI-Ready Modular Solution) has received Tier III certification under the ANSI/TIA-942 standard, validated by EPI. This achievement places Digi Power X among a select few global providers with certified modular AI data center solutions.

The first Tier III-certified ARMS 200 pod is anticipated to arrive at the company’s Alabama facility by November, with commissioning expected in December.

Digi Power X has also strengthened its collaboration with Super Micro Computer (Supermicro) to incorporate AI-optimized rack-scale systems into the ARMS platform.

Sponsored

Sponsored

Financially, Digi Power X remains well-funded, possessing around $29 million in cash, Bitcoin (BTC), Ethereum (ETH), and deposits as of September 30.

If these updates stimulate buy-side pressure as the week progresses, DGXX could rise towards $2.95, with a potential breakout on strong volume.

Nonetheless, if selling pressure escalates, the stock’s price might drop below $2.55.

Sponsored

Sponsored

Riot Platforms (RIOT)

Last Friday, RIOT saw a slight uptick of 1%, closing at $19.44. The company has also released its operational update for 2025, which could influence trading behavior this week.

The report from October 3 indicated that Riot Platforms produced 445 BTC in September, reflecting a 7% decline from the previous month but an 8% increase year over year.

The company averaged 14.8 BTC daily, down from 15.4 BTC in August. Riot sold 465 BTC during the month, generating $52.6 million in net proceeds at an average price of $113,043 per BTC. Despite the slight dip in output, the company’s deployed hash rate remained robust at 36.5 EH/s, marking a 29% increase from the same period last year.

If the news of the decline in Riot’s Bitcoin production during September affects investor sentiment negatively, demand for the stock may decrease, pushing the price below $18.84 in the next few sessions.

Conversely, if buying activity increases as the week unfolds, the stock could ascend toward $23.66.