Whales are active once again, coinciding with one of the most significant weeks of ETF purchases for Bitcoin and Ethereum this year. Last week, both Spot Bitcoin and Ethereum ETFs experienced a return to inflows, and data indicates that several whale addresses are transferring their crypto holdings from exchanges into self-custody.

On-chain tracker Lookonchain has reported that newly established wallets have withdrawn significant quantities of Bitcoin and Ethereum from major exchanges, demonstrating large-scale accumulation by crypto whales.

Related Reading

Significant Withdrawals From Crypto Exchanges

Per data from SosoValue, Spot Bitcoin ETFs reached $3.24 billion in inflows in the past week, reversing the previous week’s outflows of $902.5 million. This week’s inflow is the largest recorded for Spot Bitcoin ETFs this year. In contrast, Spot Ethereum ETFs recorded $1.30 billion in inflows last week, which marks a dramatic shift from last week’s outflows of $795.56 million.

Moreover, this activity is not confined solely to Spot ETFs. Recent wallet activity indicates aggressive accumulation efforts among whale addresses transitioning to self-custody. In one case, on-chain analytics platform Lookonchain noted that a freshly created wallet, designated as 0x982C, withdrew 26,029 ETH worth about $118 million from Kraken.

In another instance, a new Bitcoin wallet, bc1qks, withdrew 620 BTC valued at $76 million from Binance. These transactions indicate a large-scale relocation of capital out of exchanges, hinting that whales anticipate further price increases.

Whales are purchasing $ETH and $BTC!

A newly created wallet, 0x982C, withdrew 26,029 $ETH($118M) from #Kraken 8 hours ago.

The newly established wallet, bc1qks, withdrew 620 $BTC($76M) from #Binance 6 hours ago.https://t.co/8Aa1g0BgWthttps://t.co/qsasXKFHuN pic.twitter.com/iTYhz8jwq3

— Lookonchain (@lookonchain) October 4, 2025

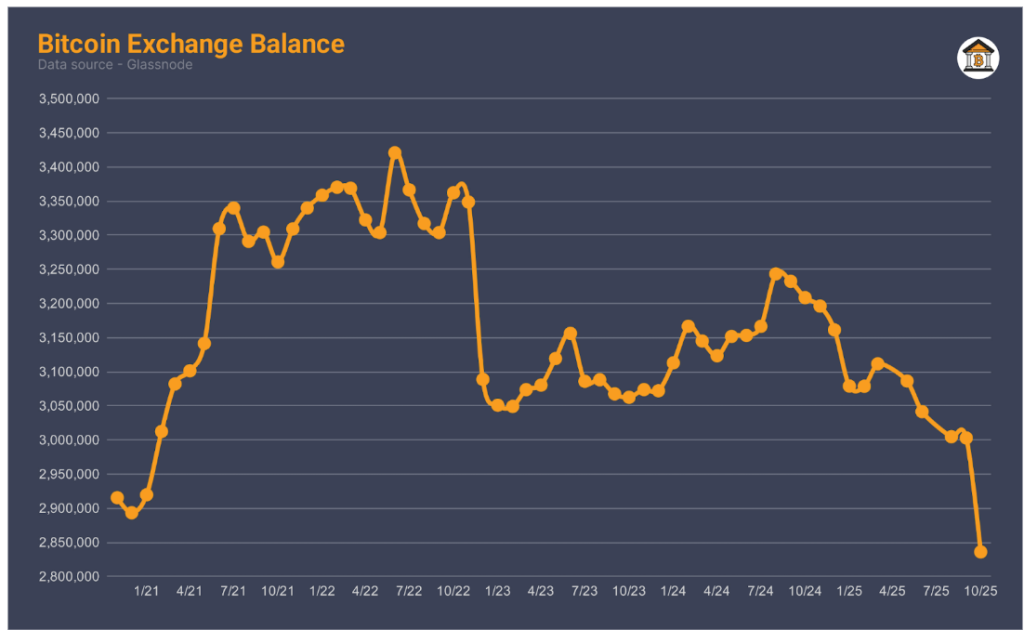

Notably, Bitcoin exchange balances have dipped to their lowest in five years. Approximately 170,000 Bitcoin have been withdrawn from crypto exchanges over the past month, with a surge of activity occurring in the concluded week. This decline has brought the Bitcoin exchange balance below 2.85 million BTC for the first time since January 2021.

Bitcoin Exchange Balance. Source: @btconexchanges on X

Price Forecast For Bitcoin And Ethereum

The influx of institutional funds combined with whale accumulation is already influencing the price movements of Bitcoin and Ethereum. Bitcoin recently surged past its former record, achieving a new all-time high of $125,506 within the past few hours, and is now trading around $124,813. This represents a significant shift from just a week ago, when Bitcoin fell below $110,000, resulting in the Bitcoin Fear and Greed Index crashing to its lowest level since March.

Related Reading

Ethereum, too, has turned optimistic and is trading at $4,575 at the moment. If the trend of Spot ETF inflows and whale accumulation continues, Bitcoin could sustain its rally throughout this week, potentially breaking the $130,000 barrier before the week’s end. However, a brief correction is also possible. Any pullback might prompt Bitcoin to retest $120,000 before rising again.

On the bullish front, Ethereum’s price could also reach new all-time highs exceeding $5,000 in the upcoming weeks.

Featured image from Unsplash, chart from TradingView