Bitcoin (BTC) experienced a modest increase earlier today, rising from $113,000 to approximately $117,000 at the time of writing. This contrasts with forecasts from various crypto analysts who anticipated a downturn in risk-on assets stemming from the US government shutdown.

Bitcoin Climbs Amid US Government Shutdown

The US federal government entered a shutdown at midnight on September 30, following a failure to reach a funding agreement between President Donald Trump and Congress. The two parties were particularly divided over enhanced Obamacare subsidies, each reluctant to accept responsibility.

Related Reading

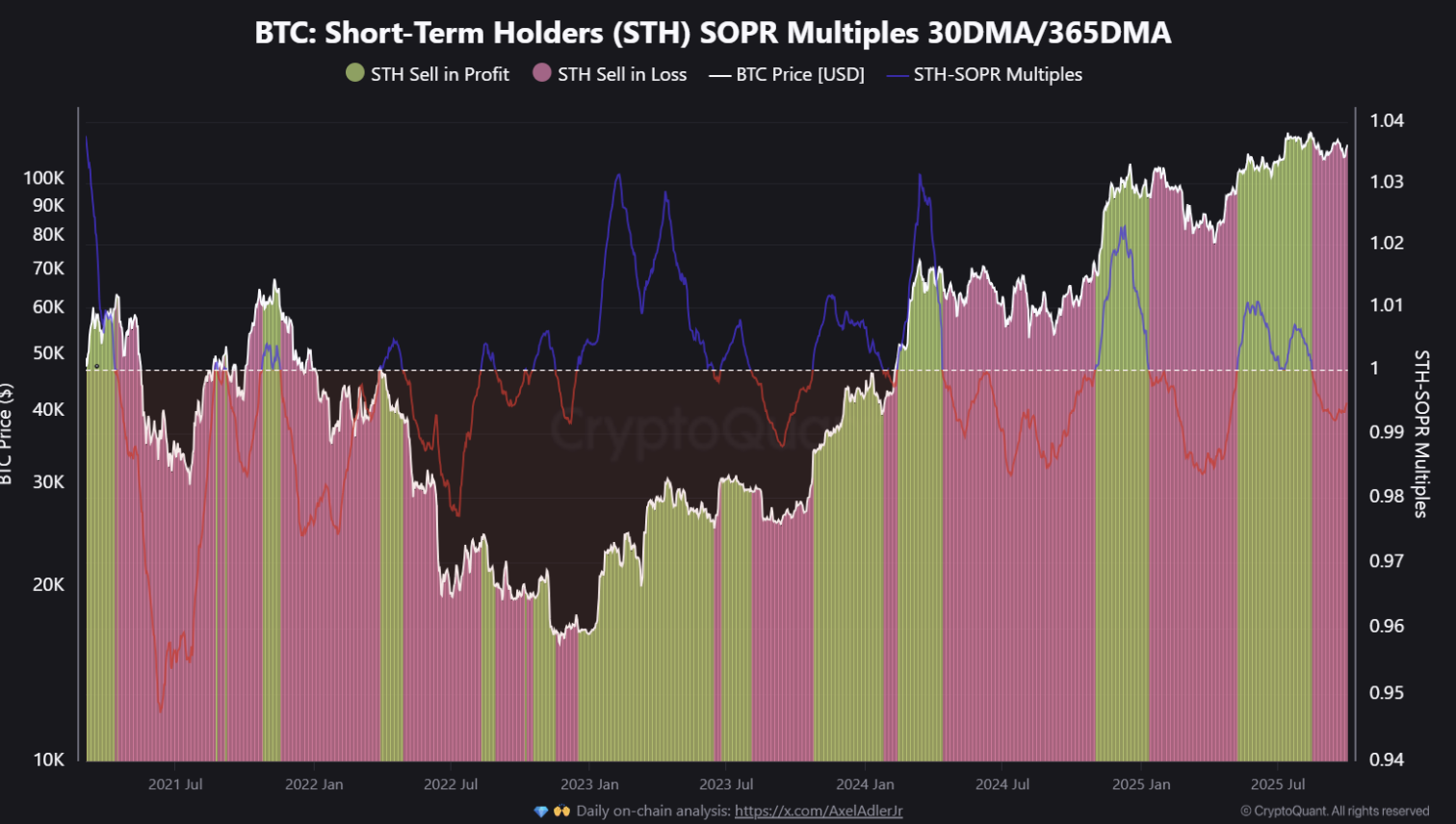

Surprisingly, Bitcoin surged despite the uncertainty surrounding the US government shutdown, making notable gains earlier today. CryptoQuant analyst Kripto Mevsimi noted that September brought significant losses for short-term holders (STH), as their Spent Output Profit Ratio (SOPR) dipped to as low as 0.992.

Consequently, the majority of September was characterized by STH offloading their BTC holdings at a loss. That said, the metric has slightly bounced back to 0.995, though it remains beneath August’s figure of 0.998.

Currently, the STH-SOPR is showing signs of stabilization after a period of decline. Notably, this recovery coincides with BTC trading in the high $110,000 range, just shy of a significant resistance zone.

Historical data indicates two possible outcomes following such a reset in the STH-SOPR. Firstly, it might hint at weakening momentum for BTC, as prolonged loss realization could precede corrective phases where weaker hands capitulate.

Conversely, a more optimistic scenario suggests that it could signify a healthy reset. Rapid absorption of realized losses frequently sets the stage for more robust rallies, potentially driving BTC to achieve new all-time highs (ATH) shortly. The CryptoQuant analyst also commented:

As BTC consolidates just under resistance, this rebound in STH-SOPR serves as a crucial indicator of market health. If buyers persist in absorbing weak-hand selling, it might replicate past resets that facilitated the next upward leg.

Could BTC Experience a Decline in Q4 2025?

Although the diminishing active circulating supply of Bitcoin provides some encouragement for bulls, others maintain a more cautious outlook. Recent analysis by CryptoQuant analyst Axel Adler indicates that demand for BTC has faded after it failed to sustain levels above $115,000.

Related Reading

Meanwhile, crypto analyst Doctor Profit recently predicted that BTC may face an additional 20% decline from its current price, forecasting it to reach a target range between $90,000 and $94,000. At the time of this report, BTC is trading at $117,226, reflecting a 3.5% increase over the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com