A proposal for Polkadot to launch its own native algorithmic stablecoin, entirely backed by DOT tokens, is gaining substantial early support.

Co-founder and CTO of Polkadot chain’s Acala, Bryan Chen, presented a proposal on Sunday aimed at creating a native stablecoin for the Polkadot network. This stablecoin would be algorithmic, fully backed by Polkadot (DOT) tokens, and would carry the pUSD ticker.

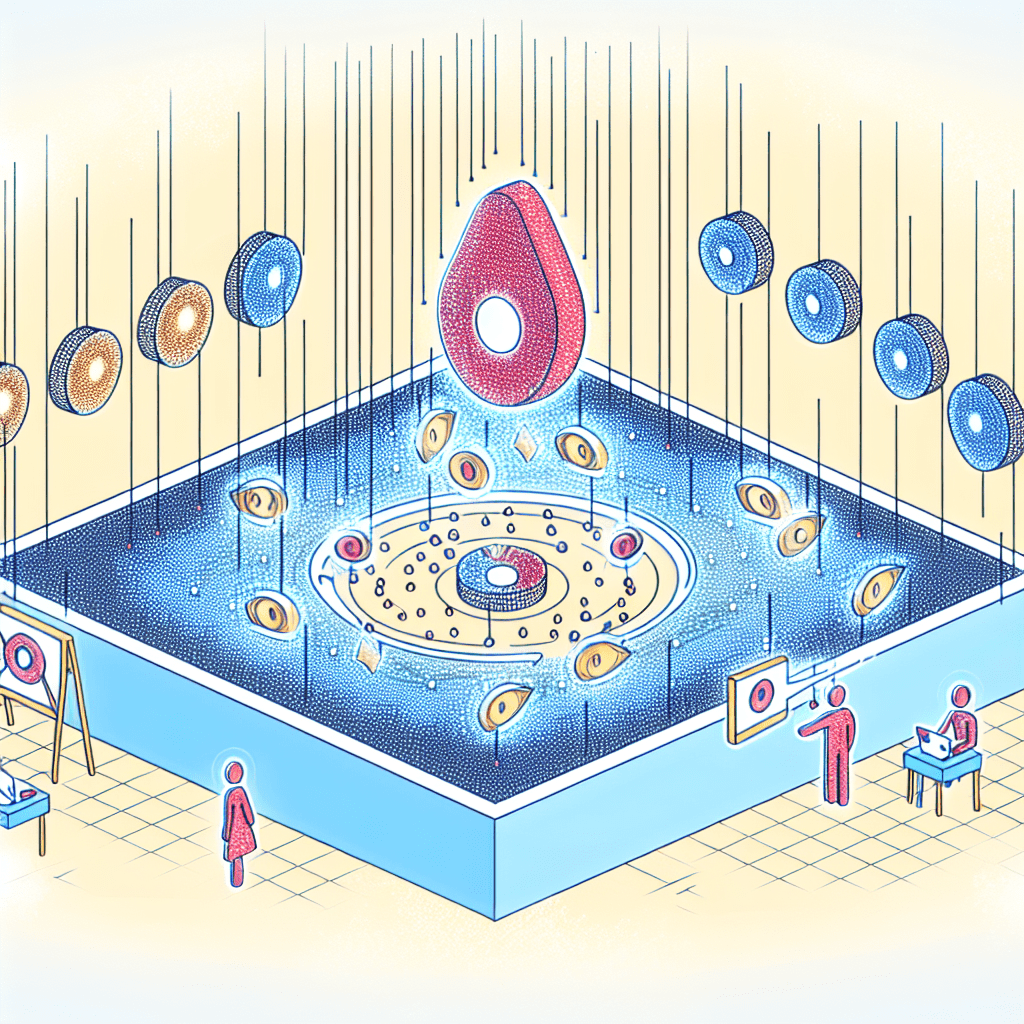

The proposed stablecoin intends to utilize the decentralized stablecoin and collateralized debt position protocol Honzon on the Acala network. The goal is to lessen or replace reliance on Tether’s USDt (USDT) and Circle’s USDC (USDC) stablecoins.

As of now, more than three-quarters of the votes have been cast in support of the proposal. However, there are still over 24 days remaining before the ballot concludes, with more than $5.6 million worth of DOT utilized for voting — over 1.4 million DOT at approximately $3.90 each.

Related: Stablecoins: Depegging, fraud, and decentralization

The design of the stablecoin

The proposed pUSD algorithmic stablecoin would be an overcollateralized debt token based on DOT. Additionally, it would feature an optional savings module, allowing holders to lock their stablecoins and earn interest from stability fees.

The underlying motivation for this plan, according to Chen, is to enhance Polkadot’s ecosystem with a native stablecoin. “Polkadot Hub should have a native DOT-backed stablecoin because it is essential; without it, we risk losing benefits, liquidity, and/or security,” the proposal states.

A decentralized algorithmic stablecoin is designed to mirror the price of a fiat currency without relying on centralized collateral held by third parties. Instead, the collateral is composed of digital assets managed on-chain and governed by smart contracts, while the peg is upheld through economic incentives programmed into these contracts.

Related: Sonic Labs shifts from algorithmic USD stablecoin to a UAE dirham alternative

Controversy surrounding algorithmic stablecoins

Algorithmic stablecoins have faced a decline in popularity following the well-publicized collapse of Terra’s native stablecoin, TerraUSD (UST), which took down the entire ecosystem. Nevertheless, this type of asset still garners significant interest, partly due to its enhanced decentralization.

This decentralization suggests a more permissionless (less controllable) design. Ki Young Ju, CEO of crypto analytics firm CryptoQuant, remarked in early May that algorithmic stablecoins might enable the emergence of “dark stablecoins” that do not adhere to regulations or sanction enforcement.

Magazine: Crypto sought to disrupt banks; now it’s becoming them in the stablecoin conflict