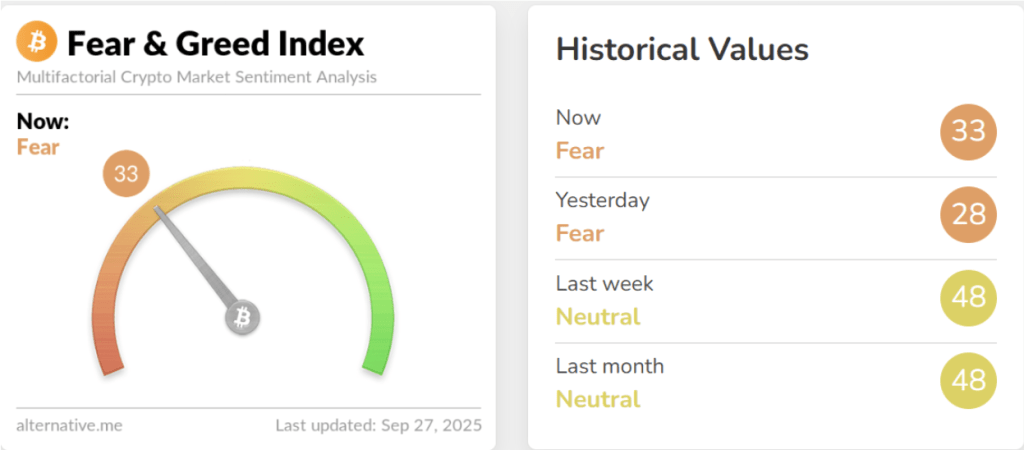

The atmosphere in the cryptocurrency market is tense after Bitcoin dropped crucial price levels this week, negatively impacting investor sentiment. This resulted in a significant decline of the Bitcoin Fear & Greed Index by 16 points in just one day, with it plummeting to 28 yesterday, marking its lowest point since March. As of this writing, the index has slightly rebounded to 33, yet it remains in the Fear territory. While this may cause unease among investors, historical trends indicate that such fearful conditions could actually be advantageous for Bitcoin holders.

Related Reading

Bitcoin Fear & Greed Index Falls To 28

This week has proven challenging for numerous cryptocurrencies, particularly Bitcoin. The cryptocurrency began the week above $115,000 but entered a prolonged decline, dropping below $110,000, which led to liquidations exceeding $1 billion across the sector. Additionally, this downturn caused Ethereum to dip below $4,000, along with altcoins such as XRP and Solana continuing their downward slide.

Collectively, these developments reversed the cautious optimism from last week, when the index stood at a neutral score of 48. Instead, Bitcoin’s Fear and Greed Index plummeted to as low as 28, reflecting a dramatic 16-point decrease in just one day.

This drop in the Bitcoin Fear and Greed Index illustrates how quickly market sentiment can shift when critical price levels are breached. Yet, while the prevailing fearful sentiment might suggest bearish trends, these conditions could present opportunities for long-term investors. Historically, the Fear and Greed Index acts as a contrarian indicator, where extreme fear levels often precede substantial recoveries.

Earlier in March, the index had similarly low readings, while Bitcoin was trading at a relative low of around $83,000. Currently, even after dipping below 30 on the index again, Bitcoin is approximately $27,000 higher than its March levels.

Bitcoin Fear And Greed Index. Source: Alternative.me

Positive Outlook For The Upcoming Weeks

The key takeaway from the shift in sentiment is that the crypto market may be approaching its next recovery phase sooner than anticipated. The index’s slight increase to 33 today from yesterday’s low of 28 indicates that some traders are already positioning themselves for a potential turnaround. For savvy investors, Bitcoin’s current prices could present an opportunity to accumulate at more favorable rates.

Bitcoin tends to avoid sustaining rallies amid overwhelming greed. Instead, periods of consolidation and correction reset sentiment, paving the way for healthier growth. Crypto analyst Michael Pizzino noted in a post on X that the recent fear may be the turning point that Bitcoin and the crypto market has been awaiting.

Related Reading

In this context, the current fearful environment could be setting the stage for Bitcoin, Ethereum, and other altcoins to gain bullish momentum once selling pressure subsides.

Ultimately, the critical factor is for the Bitcoin price to stabilize above $110,000. As of this writing, Bitcoin is trading at $109,220.

Featured image from Unsplash, chart from TradingView