Hyperliquid has made a significant advancement in its on-chain ecosystem with the introduction of USDH, a native stablecoin meant for the decentralized exchange.

The new token is now available for trading after its launch this week by Native Markets, the team at Hyperliquid responsible for this initiative.

Sponsored

Sponsored

Native Market Launches USDH, Stakes HYPE

On September 27, Native Markets announced that USDH is now accessible on the exchange’s decentralized spot and derivatives markets.

As per the company, traders can pair the asset with HYPE — Hyperliquid’s governance token — and USDC, providing users with a stable unit of account directly integrated into the platform.

The team has also locked 200,000 HYPE for three years to facilitate the listing, aimed at bolstering liquidity and governance alignment.

Prior to the launch, Native Markets pre-minted $15 million USDH through HyperEVM, collaborating with the network’s Assistance Fund to ensure initial liquidity.

According to Native Markets, USDH is backed by cash and short-term US Treasuries, with reserves managed via a combination of off-chain assets and on-chain transparency tools, including oracle feeds that confirm real-time balances.

Additionally, a portion of the returns from these reserves will finance periodic HYPE buybacks, enhancing the token’s economic framework.

The release follows a governance contest earlier this month where Native Markets secured community approval to introduce Hyperliquid’s first stablecoin, outperforming proposals from competitors and major issuers like Paxos and Agora.

Sponsored

Sponsored

Hyperliquid’s Dominance Under Threat

The introduction of USDH coincides with Hyperliquid facing increasing competitive and operational pressures.

In recent weeks, rival exchange Aster — supported by YZi Labs, the family office of Binance founder Changpeng Zhao— has witnessed a surge in trading activity.

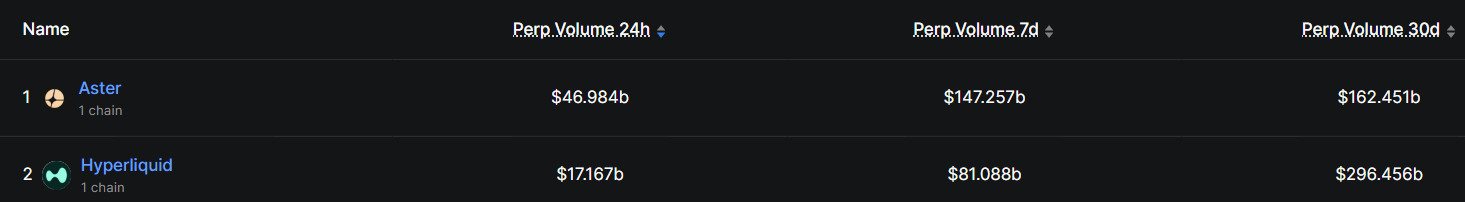

Data from DeFiLlama indicates Aster generated $147 billion in perpetual volume over the past week, surpassing Hyperliquid’s $81 billion.

Nevertheless, Hyperliquid remains the larger platform over a 30-day span, recording $296 billion in total volume compared to Aster’s $162 billion.

However, analysts at Maelstrom caution that this lead could diminish due to an upcoming token unlock event.

Beginning in November, the DEX platform will progressively unlock approximately 237.8 million HYPE tokens valued at about $12 billion over the next two years.

This forthcoming unlock could have a considerable impact on the market performance of a digital asset that has decreased by more than 20% in the past week.