Sure! Here’s a rewritten version of the content while keeping the HTML tags intact:

The overall cryptocurrency market capitalization fell by more than 2% in the last 24 hours, reaching $3.85 trillion on September 26, as Bitcoin dipped below the $109,000 mark, leading to liquidations exceeding $1.2 billion.

Summary

- The cryptocurrency market has experienced a decline of over 2% in the last 24 hours.

- A new round of tariffs announced by Trump has influenced the market’s downturn.

- More than $1 billion in long positions faced liquidation in the crypto market.

As reported by CoinGecko, only about 10 of the top 100 cryptocurrencies by market capitalization managed to post gains today, with prominent altcoins like BNB (BNB) and Solana (SOL) suffering losses exceeding 4% today.

Today’s decline has exacerbated weekly losses for major cryptocurrencies, with Bitcoin (BTC) dropping more than 6.5% over the past week. Other significant cryptocurrencies such as Ethereum (ETH), XRP (XRP), and Dogecoin (DOGE) have seen double-digit declines of 13.2%, 10%, and 18.4% respectively within the same timeframe.

A series of negative catalysts contributed to the widespread market sell-offs.

The crypto markets were shaken today after U.S. President Donald Trump revealed new tariffs on pharmaceuticals, big-rig trucks, home renovation materials, and furniture, reigniting fears of a renewed global trade conflict and its potential effects on risk assets.

Announcements related to Trump’s tariffs have historically increased volatility in the crypto markets, demonstrated on several occasions this year. This time, trader sentiment was already precarious due to concerns that the Federal Reserve might not lower interest rates as investors hoped.

In his most recent address, Fed Chair Jerome Powell adopted a hawkish approach regarding the potential for further rate cuts this year. Other Fed officials, including Beth Hammack and Austan Goolsbee, also urged caution regarding rate reductions.

Their comments have nurtured a risk-averse atmosphere, leaving traders with minimal incentives to hold riskier assets, diverting liquidity towards traditional safe havens such as gold.

Bitcoin options expiry

Traders are apprehensive as approximately $22.3 billion in crypto options are due to expire today, including $17.06 billion connected to Bitcoin.

🚨 Options Expiry Alert 🚨

At 08:00 UTC tomorrow, over $22.3B in crypto options expire on Deribit; one of the biggest quarter-end expiries. 🔥$BTC: Notional: $17.06B | Put/Call: 0.76 | Max Pain: $110K$ETH: Notional: $5.20B | Put/Call: 0.80 | Max Pain: $3,800

Q3’s largest… pic.twitter.com/FDT1tWomYH

— Deribit (@DeribitOfficial) September 25, 2025

As the expiry time nears, BTC’s value typically trends toward the “max pain point,” the strike level where option holders face the biggest losses, benefitting the sellers most.

This month’s expiry sees bearish positions clustered between $95,000 and $110,000. Should Bitcoin fail to recover the $110,000 level by 8:00 a.m. UTC, put options could gain an edge of around $1 billion, possibly adding further downward pressure to an already struggling market.

Crypto Fear and Greed Index hits Fear territory

Meanwhile, the current conditions have negatively impacted market sentiment. The Crypto Fear and Greed Index has dropped into the Fear zone at 29, down from this month’s high of 73.

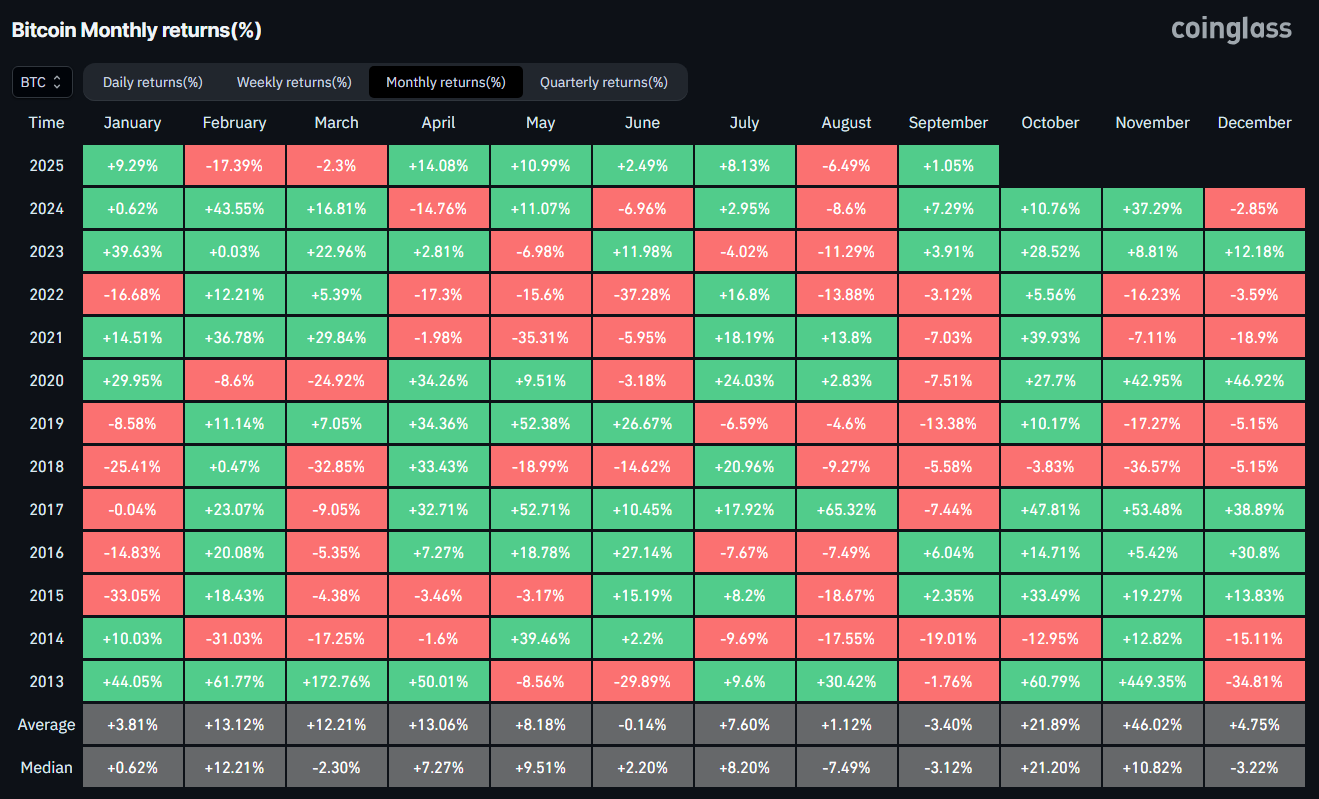

Traders also recognize that September is historically a bearish month for Bitcoin, affecting overall market sentiment. According to Coinglass data, Bitcoin’s average and median returns hover around -3%, as the leading crypto has closed eight of the last twelve Septembers in the red.

Liquidations

Another contributing factor to today’s crypto market decline is the over $1.2 billion in liquidations occurring within the last day. Nearly $1.1 billion of this came from long positions, according to data from CoinGlass.

This wave of liquidations from long positions is detrimental for traders, as it forces leveraged buyers to close their positions, creating additional selling pressure on prices and prompting traders to remain cautious until the situation stabilizes.

Disclosure: This article does not constitute investment advice. The information and materials provided on this page are solely for educational purposes.

Feel free to adjust any specific details further!