Sure! Here’s the rewritten content with the HTML tags preserved:

Summary

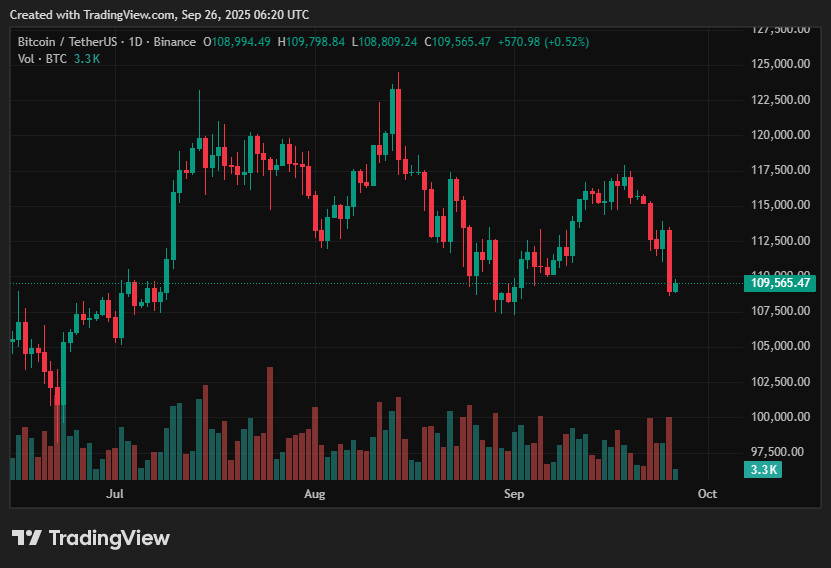

- Bitcoin is currently consolidating around $109k, with analysts noting a compression in volatility.

- Bollinger Bands and ATR indicators are at their lowest, while price action remains confined between $108k and $113k.

- Bitcoin price forecast: A breakout above $113k could aim for $120k-$125k, driven by ETF inflows and demand from large investors.

- Bearish outlook: If the price dips below $108k, liquidations could happen; target $103k-$100k or even the mid-$90k range.

- The neutral but coiled market structure suggests a potential price swing of roughly $15k once volatility returns.

As of September 26, 2025, Bitcoin is trading near $109k, following a brief period characterized by volatile shifts between fleeting gains and quick retracements.

This tight trading range has led to compressed technical indicators on intraday charts, prompting market participants to monitor both traditional macro triggers (such as Fed/PCE data and rate discussions) and crypto-specific factors, including ETF flows and a significant options expiry this week.

This scenario underscores the importance of the current Bitcoin price predictions as traders prepare for the next major price movement.

Current Bitcoin Price Prediction Scenario

In recent days, BTC has fluctuated within a narrow band, with data clustering around the $108k and $113k ranges; exchanges and price aggregators currently report prices around $109k.

This compression is observed across various timeframes: intraday Bollinger Bands have contracted, and Average True Range (ATR) readings have declined from the highs witnessed in August, indicating reduced realized volatility amid ongoing macroeconomic uncertainty. This range-bound market has led to diminished directional activity, lowered leveraged positions, and clustered liquidity at key levels, which could amplify reactions when support or resistance levels are breached. Analysts suggest that the BTC price forecast is closely linked to how long this compression can last before a breakout occurs.

Upside Outlook for Bitcoin Price

If Bitcoin (BTC) manages to break above and maintain levels above the mid-$113k mark, there’s a clear technical pathway to the $120k-$125k range, propelled by liquidity gaps and previous supply clusters.

Spot ETF inflows and a renewed interest from institutions remain the key bullish catalysts: several recent reports and order flow metrics indicate net inflows into ETFs, alongside some renewed accumulation among large holders, which could provide structural support beneath the price and expedite movement towards higher targets.

Momentum above broken resistance may trigger short-covering and incite new buying from systematic strategies that utilize breakouts as entry indicators.

However, any positive continuation will need to navigate strong options positions and profit-taking that occurred before the August surge. In this context, the Bitcoin outlook appears constructive, with higher projections towards $125k aligning with structural inflows and market positioning.

Downside Risks to BTC Price

A notable breach below the recent range’s lower edge, around $108k, poses a risk of cascading liquidations, with technical stops and futures funding pressure potentially driving prices down to $103k-$100k swiftly.

On-chain data and derivatives indicators reveal strong open interest, with a significant options expiry clustered around this timeframe, which can amplify price movements while also creating asymmetrical risk: should volatility spike to the downside, forced deleveraging might push prices through various support levels.

Moreover, macro events (such as governmental balance-sheet adjustments, unexpected economic reports, or hawkish statements from central banks) could abruptly alter market sentiment; September has historically been a month marked by high volatility for risk assets—a seasonal trend traders should be aware of. Some bearish analysts anticipate a deeper correction into the $95k range if pivotal supports fail.

Bitcoin Price Prediction Based on Current Levels

With the current price range between $108k and $113k, the immediate outlook is straightforward: a breakout above $113k likely paves the way to $120k-$125k, while a drop below $108k raises the chances of a move toward $100k or even slightly lower as liquidity absorbs forced selling.

Given the current derivatives positioning and upcoming expirations, a movement of approximately $10k-$15k from current levels is feasible once volatility resumes; the direction will depend on market flow (ETF and institutional purchases versus macro-driven risk aversion) and whether the major options expiry resolves in a way that favors one side of the market.

In summary, while the market structure tends to lean neutral-to-slightly bullish, short-term risks remain heightened due to concentrated derivatives exposures and compressed volatility.

Disclosure: This article does not constitute investment advice. The content and materials on this page are intended for educational purposes only.