Private credit, specifically asset-backed finance (ABF), represents one of the most rapidly expanding sectors in global finance. Currently a $6.1 trillion industry, Apollo Global Management estimates the available opportunity to exceed $20 trillion.

Despite its scale and increasing significance in funding businesses and consumers globally, the industry predominantly relies on excel spreadsheets. This leads to inefficiencies like middle- and back-office bloat, cash drag, and financing costs that can be as much as 30% higher than necessary.

It’s akin to tracking work hours on a yellow sticky note, sending it in, and waiting 15 days for payment in 2025. No one would accept such a working method.

These inefficiencies arise from the current management practices of ABF.

In contrast to corporate credit, where the borrower’s full faith and balance sheet serve as the foundation, ABF relies on the contractual cash flows of underlying assets: consider BNPL loans, supply chain receivables, or financing for small businesses. To navigate this complexity, firms like Apollo and Blackstone create customized facilities for originators.

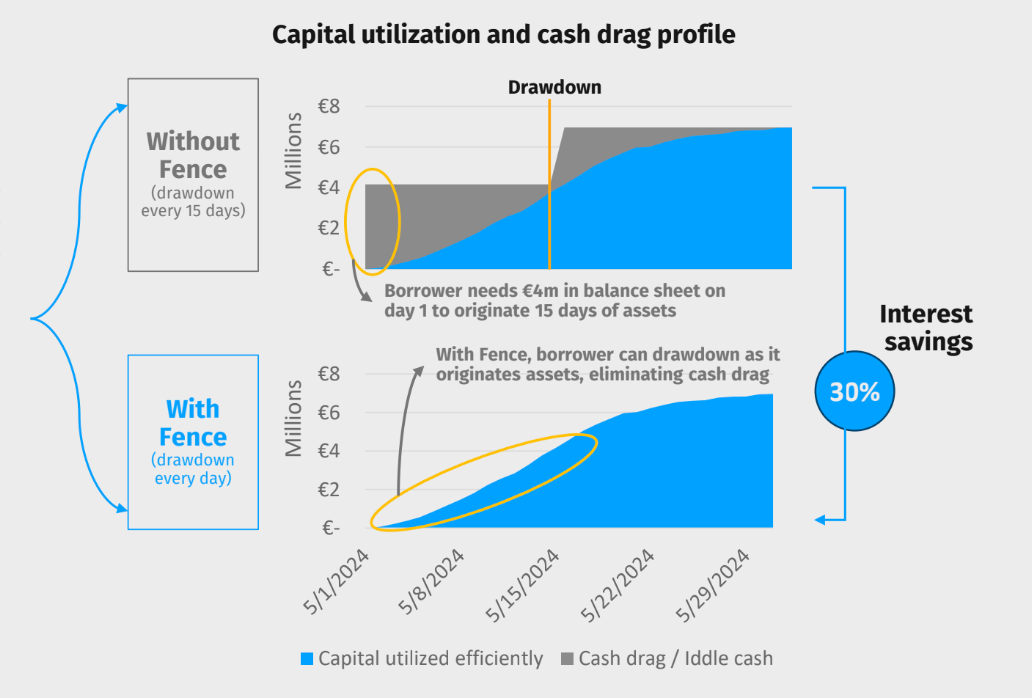

While these originators can receive thousands of loan requests monthly, drawdowns typically occur weekly at best. In the interim, capital remains unutilized, causing investors to experience cash drag (the erosion of returns from capital not being deployed into yield-generating loans), while originators turn to expensive equity to fill gaps.

Established managers employ extensive operations teams to oversee covenants, validate collateral, and manage waterfall payments. This process is labor-intensive, prone to errors, and costly.

A transformative change is currently occurring, poised to enhance ABF growth, particularly with the involvement of the web3 tech stack.

This transformation centers on improved infrastructure enabled by blockchain technology and, importantly, superior money that is programmable.

New entrants can leverage programmable credit facilities and stablecoin frameworks to accelerate origination, reduce funding costs, and scale operations. By tokenizing credit facilities and integrating smart contracts throughout the lifecycle, managers can automate verification processes, enforce real-time compliance, and complete drawdowns and repayments instantly. When combined with programmable stablecoins for funding and settlement, originators can eliminate cash drag. Platforms like Fence and Intain are already demonstrating practical applications — managing origination, reporting, and payment waterfalls through code.

Source: Fence.Finance

The consequences are significant. Large managers like Apollo and Blackstone can reduce operational inefficiencies, while smaller funds, emerging managers, and family offices can engage without the need for extensive staffing. On-chain infrastructure can ultimately democratize access to a market that has historically been limited to the largest institutions. Over time, traditional managers clinging to manual processes and conventional systems risk falling behind specialized credit funds that embrace on-chain solutions.

With a renewed interest in crypto and a focus on stablecoin issuance, ABF is already using technology to address real challenges and seize the rapidly enlarging market opportunity. Keep an eye on this space.