Bitcoin (BTC) has dropped 3% today, marking one of its sharpest intraday declines in the last 11 days. This decline is part of a wider retrenchment across the cryptocurrency market.

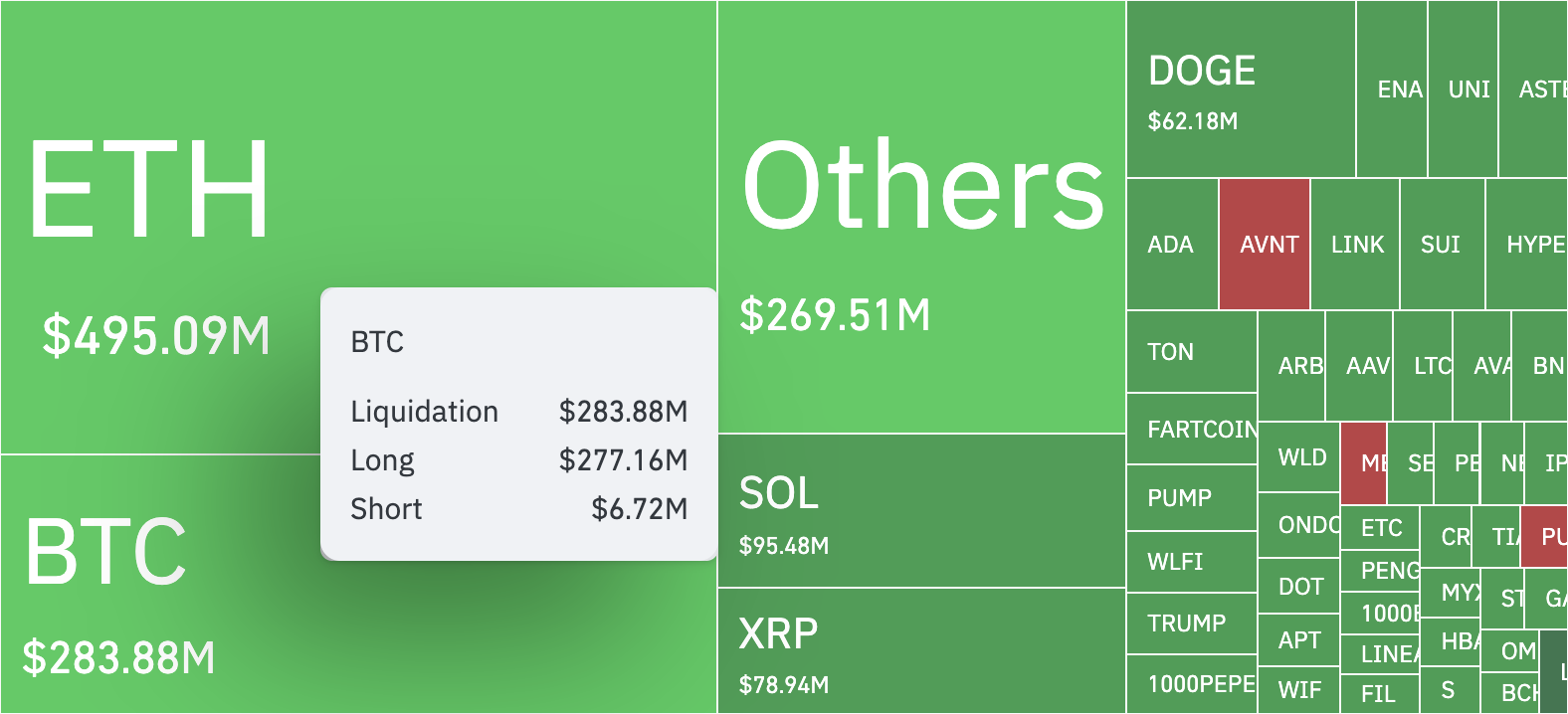

Such sell-offs have initiated a wave of liquidations, disproportionately affecting long traders. As bullish sentiment diminishes, these investors face a heightened risk of further losses.

Sponsored

Sponsored

Bitcoin’s Dip Triggers Liquidation Wave

BTC has experienced steady declines in recent days. Today, it extended its fall by 3% as the trading week began sluggishly.

This downward trend has led to a substantial wave of long liquidations in the futures market, amounting to $277 million over the last 24 hours, according to data from Coinglass.

For token TA and market updates: Looking for more insights like this? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

Liquidations happen in the derivatives market when an asset moves against a trader’s position, necessitating the closure of that position due to lack of sufficient funds. Long liquidations specifically occur when traders anticipating a price increase must sell the asset at a lower price to mitigate their losses.

In BTC’s situation, the recent price drop has forced many positions past critical limits, leading to this compelled selling.

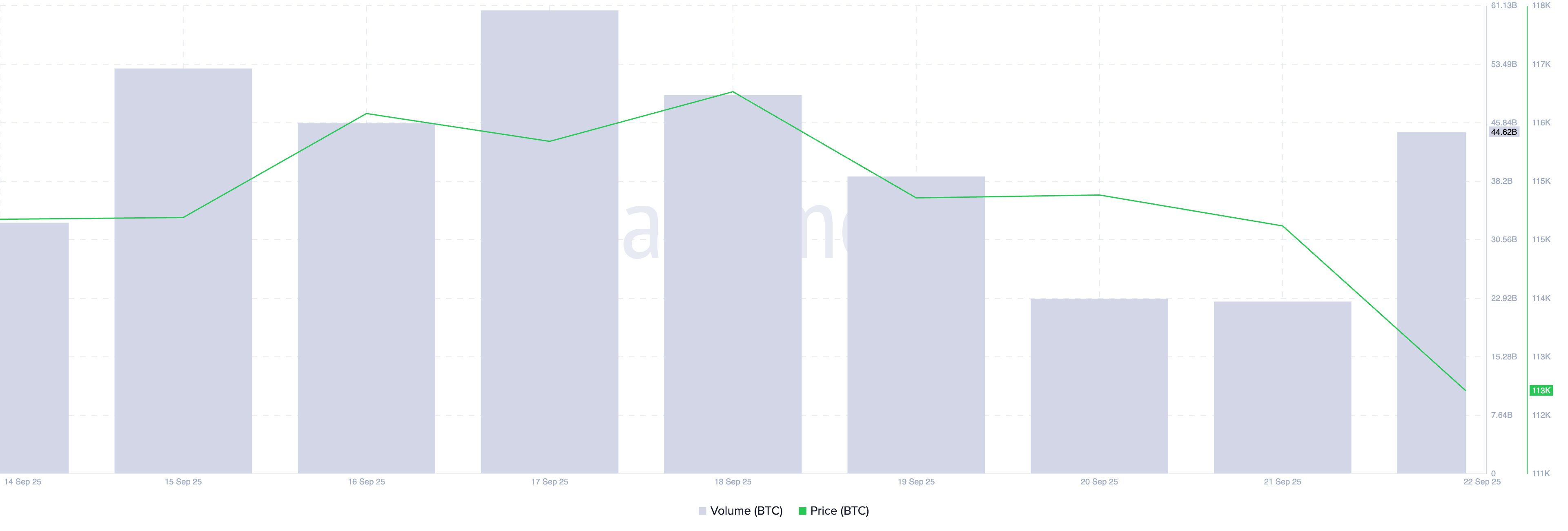

With on-chain data indicating an increase in bearish strength, additional long positions face the risk of liquidation. For instance, per Santiment, BTC’s trading volume has surged by 90% in the last day, reaching $45 billion at the time of this report.

Sponsored

Sponsored

When an asset’s price declines while its trading volume spikes, it indicates that selling pressure is growing, with more participants exiting their positions.

For BTC, this heightens the probability of further long liquidations and suggests increased distribution, as holders may be selling off in anticipation of ongoing weakness.

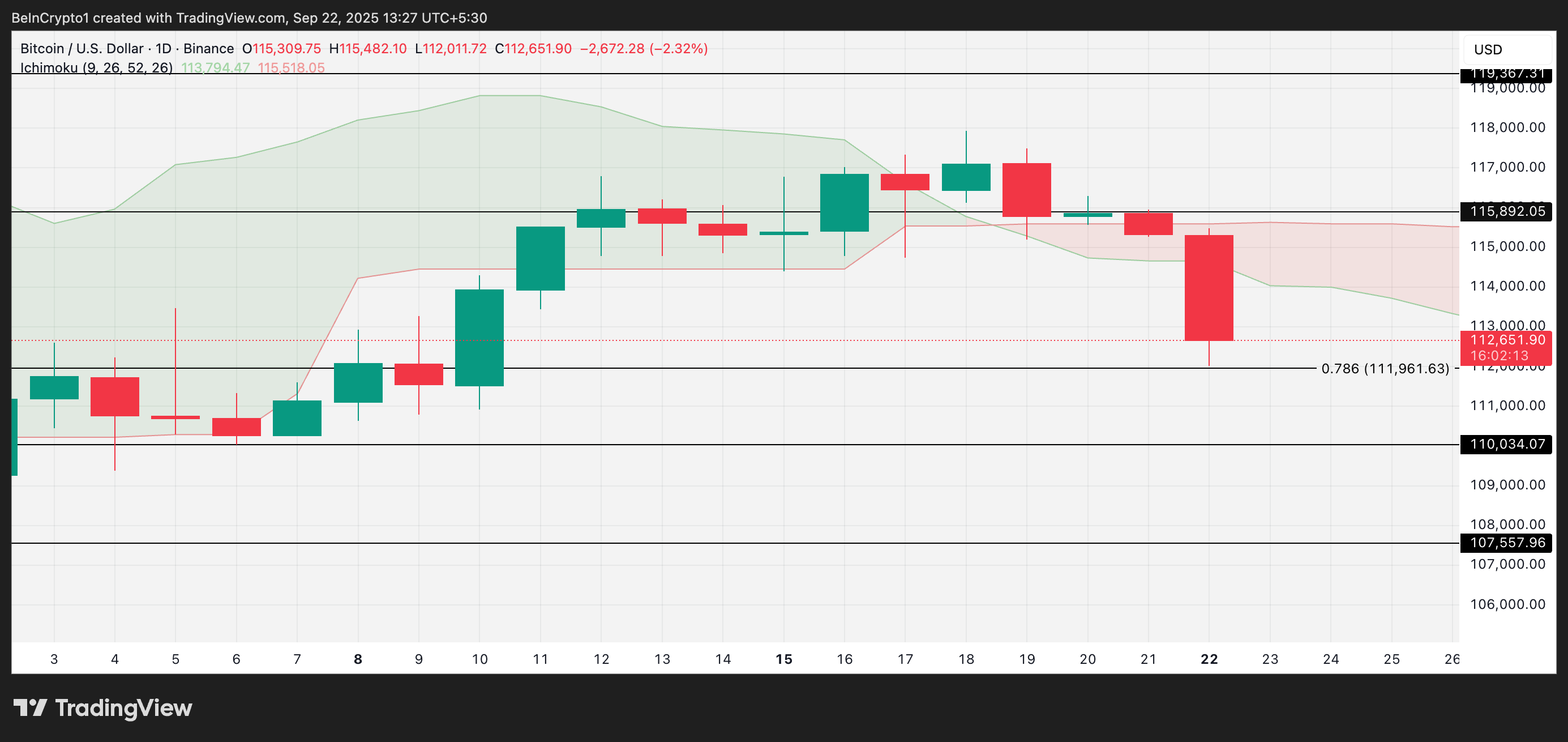

BTC Dips Below Ichimoku Cloud, May Retrace Toward $110,000

BTC’s latest dip has pushed its price beneath the Ichimoku Cloud, where Leading Spans A and B have become resistance at $113,797 and $115,518.

This indicator assesses the momentum of an asset’s market trends, pinpointing potential support and resistance levels. Trading beneath this cloud signals bearish market pressure, as demand falters and selling pressure mounts.

If this trend persists, BTC risks dropping below $111,961 and could potentially retrace to the $110,000 level.

However, should new demand enter the market, its price could regain strength and rise towards $115,892.