Ethereum (ETH) is experiencing heightened selling pressure as a record number of wallet addresses enter profit.

The asset has fallen below $4,500, with analysts divided on the potential for further corrections, while some continue to hold an optimistic long-term outlook for ETH.

Ethereum Whales Begin Profit-Taking Amid Historic Profitability Levels

Sponsored

Sponsored

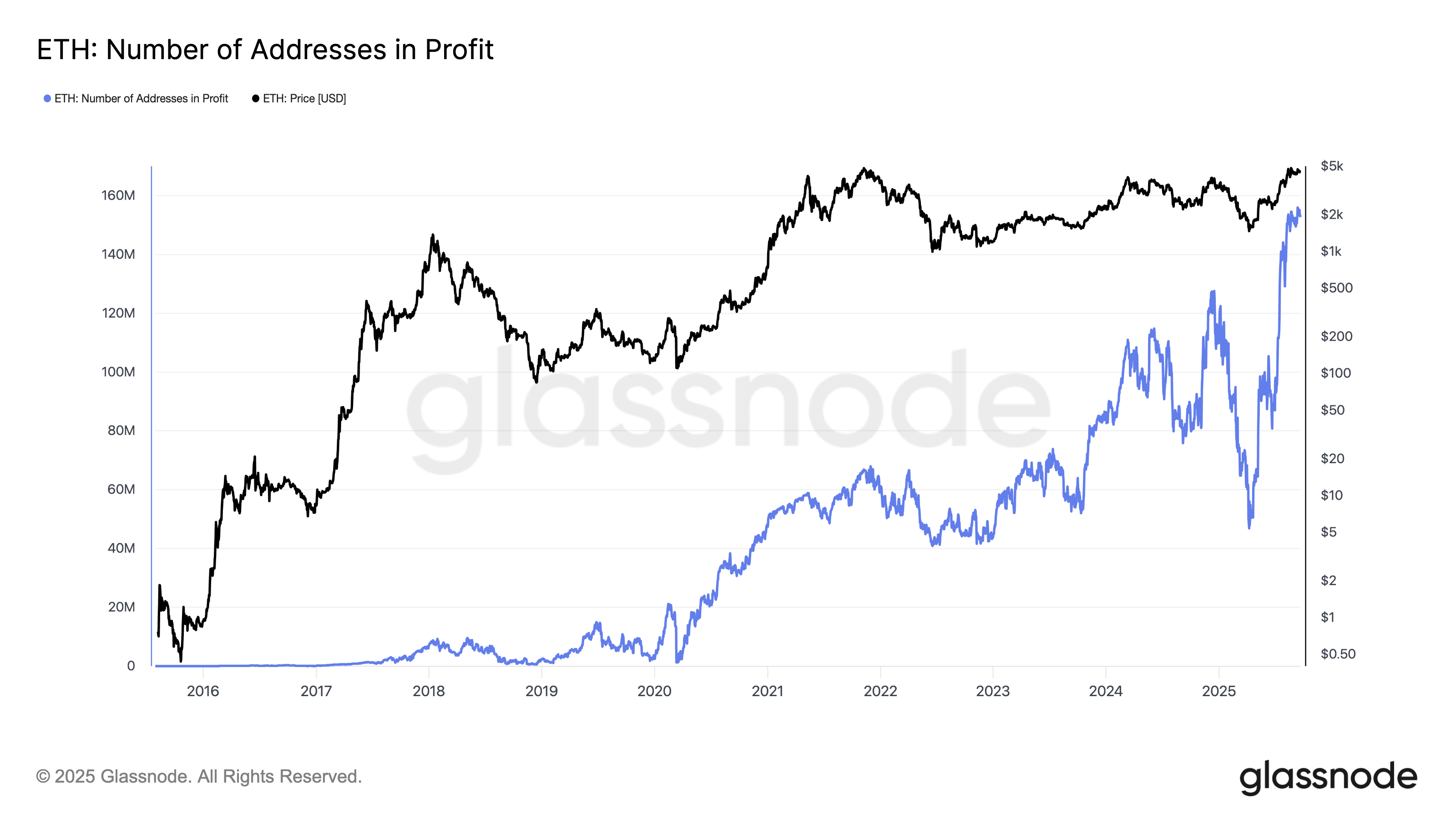

According to data from Glassnode, the number of ETH addresses in profit surged to a record high of over 155 million in September.

“ETH addresses in profit reached an all-time high! Over 155 million ETH wallets are now profitable, marking the fastest rate ever,” Coin Bureau noted.

This milestone showcases the asset’s long-term strength and widespread investor interest. However, it simultaneously heightens the risk of short-term volatility, as increased profitability often signals potential sell-offs.

On-chain metrics indicate this risk is materializing. Blockchain analytics firm Lookonchain reported that Trend Research transferred 16,800 ETH, worth roughly $72.88 million, to Binance.

This transaction has sparked speculation about a change in direction, as some perceive it as preparation for sales amidst secured profits.

“Is Trend Research About to Start Selling ETH Again? The ETH transferred originated from a total of 43,377 ETH they purchased in early September. After these acquisitions, they held a total of 152,000 ETH, with an average cost close to $2,869,” analyst EmberCN added.

Sponsored

Sponsored

Other whales have also been seen taking profits. Address (0xB04) sold 3,000 ETH for $13.14 million, yet still retains 9,804.32 ETH, valued at approximately $42.57 million.

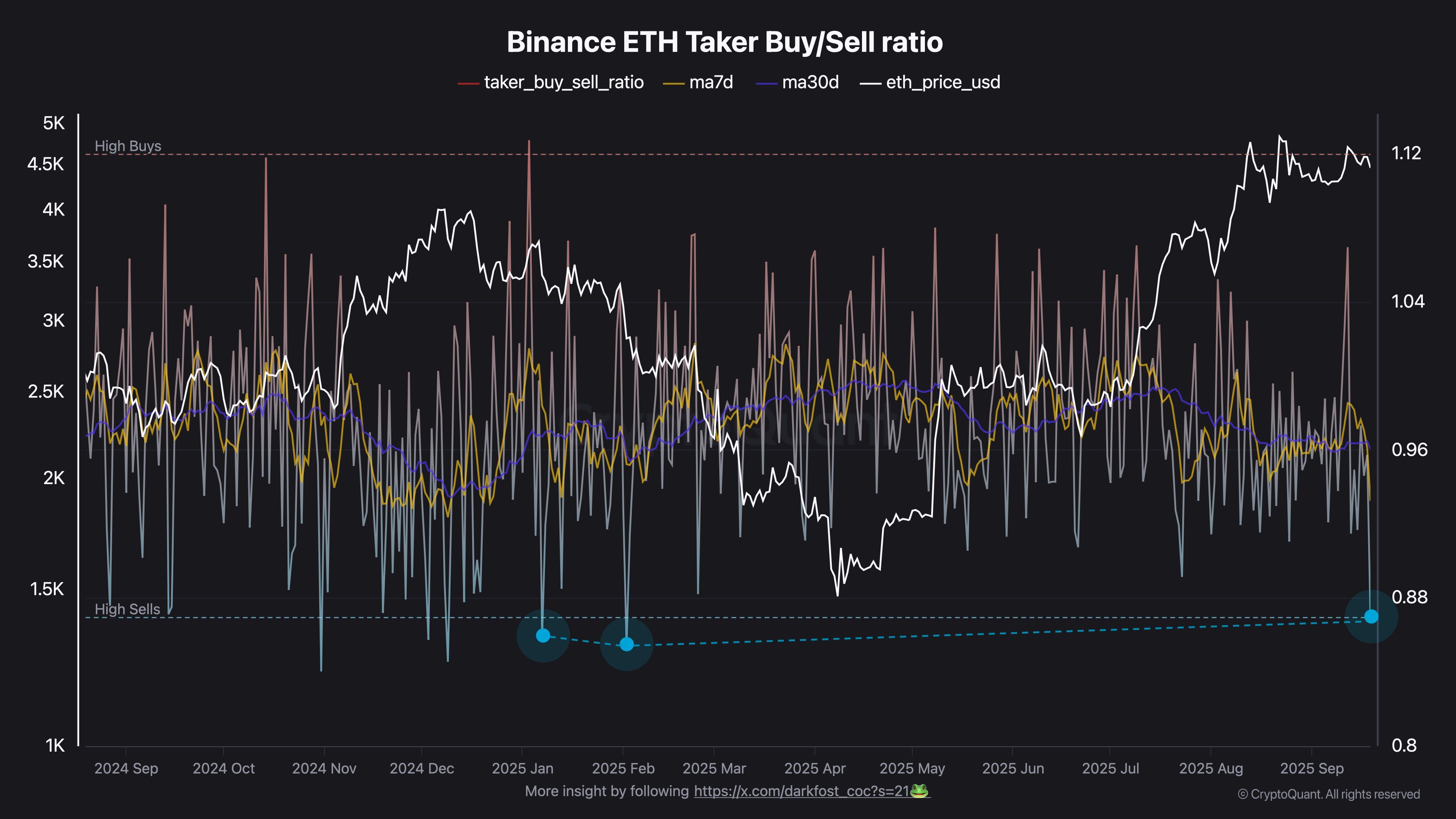

Derivatives markets reflect the prevalent bearish sentiment. An analyst notes that ETH traders on Binance have turned notably negative, with the Taker Buy/Sell ratio dipping below 0.87 on September 19.

“This represents only the third instance this year that it has fallen to this level. In January and February, the ratio hit as low as 0.85, coinciding with a bearish trend that drove ETH below $1,500. The current 7-day average sits at 0.93, marking the lowest level of the year,” Darkfost commented.

Why ETH’s Price Could Fall Below $4,000

Sponsored

Sponsored

In light of these pressure signals, ETH’s price dynamics are evident. BeInCrypto Markets data shows the altcoin has fallen by 10.5% over the past week.

This decline has followed the Federal Reserve’s recent 25-basis-point rate cut, but ETH remains below its recent highs, as its ascent toward $5,000 has stalled. As of this writing, the second-largest cryptocurrency is priced at $4,153, dropping 7.37% in the last day.

Meanwhile, some market experts believe further declines could occur, potentially taking ETH below the $4,000 mark.

“ETH is likely to test the $3,900 to $4,000 ranges again. It seems to be lacking one strong upward movement. I don’t foresee hitting $6,000 in this cycle,” trader Philakone predicted.

Sponsored

Analyst Ted Pilows also noted that ETH continues to have an unfilled CME gap in the $3,000–$3,500 range.

“Most CME gaps tend to be filled prior to significant movements, indicating that a correction may be on the horizon,” Pilows added

Despite these challenges, a long-term optimistic sentiment persists. In another post, the analyst emphasized that Coinbase’s stock chart, a common leading indicator, suggests a likely correction followed by new highs, similar to what ETH may experience.

“The current global M2 supply could forecast ETH prices reaching $18,000-$20,000 by the cycle’s peak. Even if $ETH captures only half of that, it would trade above $10,000. I remain bullish on Ethereum for the long-term and believe a test of the $4,000 liquidity zone might occur before a reversal,” Pilows forecasted.

Hence, although short-term risks are apparent, Ethereum’s trajectory supports a generally bullish outlook over the long haul.