In August, US-based crypto ETFs have experienced a shift in dynamics, with inflows favoring Ethereum ETFs. However, last week’s trend of substantial inflows concluded with significant outflows on Friday; Ethereum ETFs led this decline with $164.64 million, followed by Bitcoin ETFs with $126.64 million. This abrupt reversal coincided with troubling inflation data, unsettling institutional investors.

Related Reading

A Sudden Reversal At Week’s End

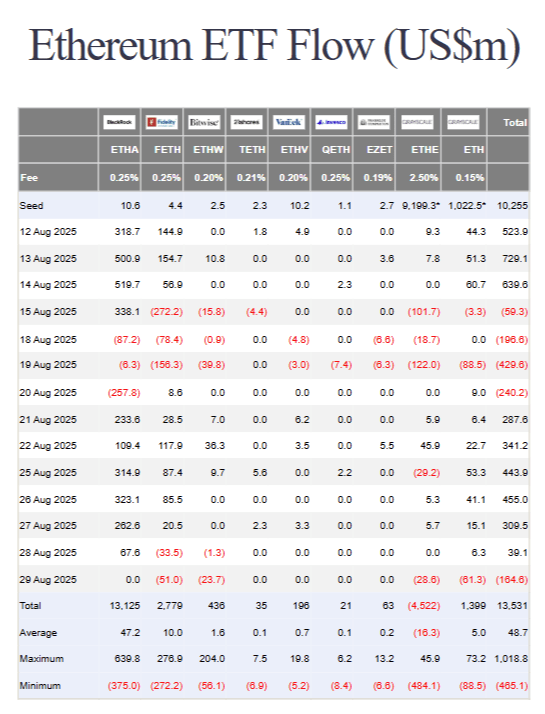

Data from Farside Investors reveals that US-based Spot Ethereum ETFs finished the week with $164.64 million in outflows. The outflows included $51 million from Fidelity’s FETH, $23.7 million from Bitwise’s ETHW, $28.6 million from Grayscale’s ETHE, and $61.3 million from Grayscale’s ETH. Conversely, BlackRock saw no inflows or outflows for its Spot ETH ETFs, similarly to 21Shares, VanEck, Invesco, and Franklin Templeton Ethereum ETFs.

The outflows on Friday marked a stark contrast to the upward trend that characterized Ethereum’s Spot ETFs since August 21. Ethereum’s inflow streak of six days, which added approximately $1.876 billion, was abruptly interrupted by the outflows on Friday, resulting in total assets under management for Spot Ethereum ETFs dropping to $28.58 billion.

Ethereum ETF Flow: Farside Investors

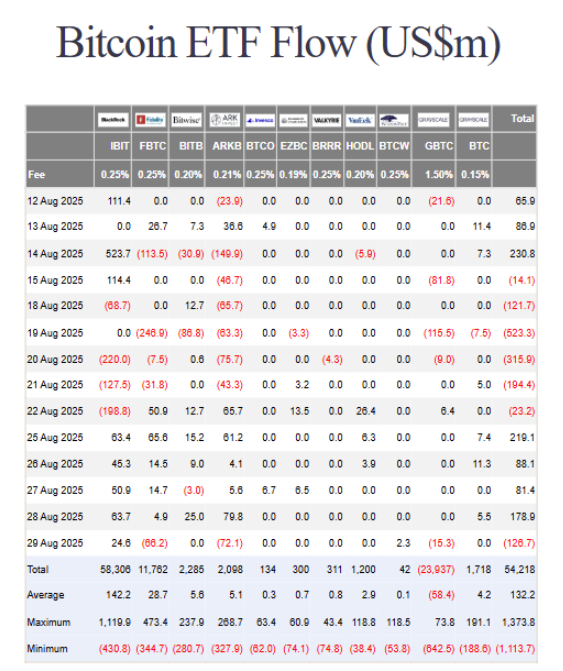

Simultaneously, Spot Bitcoin ETFs logged their first daily drop since August 22, with $126.64 million in outflows on Friday, leading to a total assets under management fall to $139.95 billion.

Despite this, not all Bitcoin issuers felt the brunt of the outflows; Fidelity’s FBTC led the outflows with $66.2 million, followed by ARKB with $72.07 million and GBTC with $15.3 million. Notably, BlackRock’s IBIT still garnered $24.63 million in inflows, while WisdomTree’s BTCW attracted $2.3 million amid broader outflows.

Bitcoin ETF Flow: Farside Investors

The outflows stem from investors evaluating the latest Friday inflation data. In particular, the US core Personal Consumption Expenditures (PCE) index rose 2.9% year-over-year in July, reaching its fastest pace since February, igniting concerns that the Federal Reserve may delay rate cuts.

What May Lie Ahead This Week

As the new trading week kicks off, the flow of Spot ETFs in both Ethereum and Bitcoin is likely to hinge on how investors interpret the data. Persistent inflation pressures could lead to further institutional retreat at the week’s onset. However, any indication of easing could revive inflows mid-week, particularly towards Ethereum, where the fundamentals appear favorable.

From a pricing perspective, Bitcoin maintaining above the $108,000 level may provide some relief. However, it needs to stay above $110,000 for any upward movement to gain traction. At the moment, Bitcoin trades at $109,910.

Related Reading

For Ethereum, closing above $4,500 may signal a return of bullish confidence, whereas a dip below $4,400 could indicate further weakness. Currently, Ethereum is trading at $4,470, reflecting a 1.7% increase in the last 24 hours.

Featured image from Unsplash, chart from TradingView