The real-world asset (RWA) sector has experienced a downturn, with RWA tokens decreasing by 3.7% in the last month, trailing behind trends like liquid staking and GameFi. Nevertheless, the long-term growth narrative remains resilient.

Despite this correction, several RWA altcoins to monitor in September are demonstrating robust fundamentals and appealing price structures.

Chainlink (LINK)

Chainlink continues to be the most prominent RWA altcoin, reinforced by a recent partnership announcement with the US Department of Commerce aimed at bringing government macroeconomic data onto the blockchain.

On-chain metrics reveal that whales and major addresses have positioned themselves advantageously. Whale holdings increased by 29.52% in August, reaching 5.03 million LINK. This translates to an addition of approximately 1.15 million LINK, valued at nearly $27 million based on the current price of $23.47.

The top 100 addresses currently hold 646.8 million LINK, reflecting a 0.47% increase, with approximately 3 million LINK added, equivalent to around $70 million. Exchange balances have decreased by 4.19%, indicating a bullish outflow trend that alleviates sell pressure.

For token TA and market updates: Interested in more insights? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

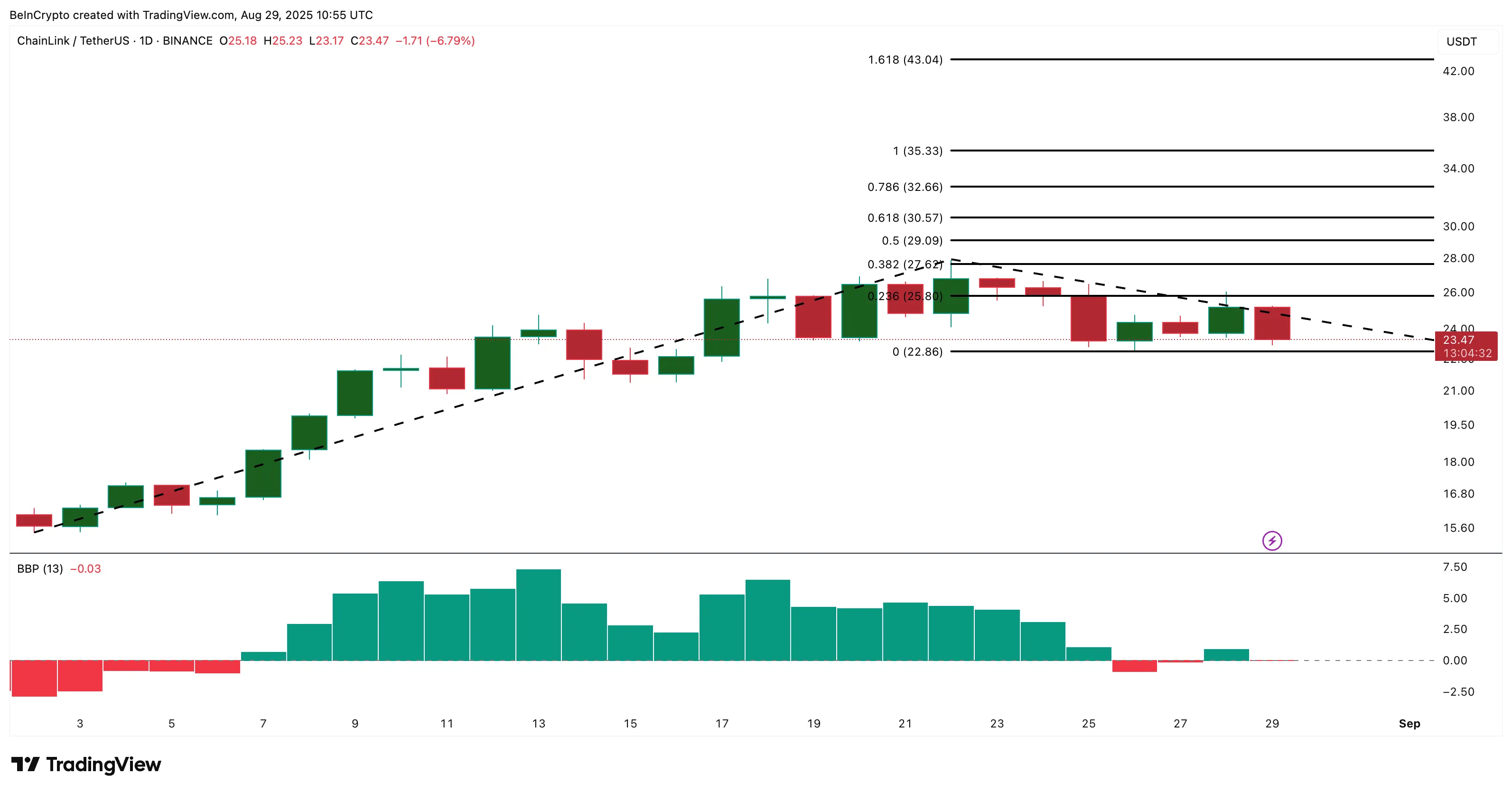

Despite a lackluster week, LINK is in an uptrend, recording over 30% gains month-on-month. Bears pushed it down by 5.9% this week; however, bulls have largely sustained control. Every time bears have attempted to dominate LINK’s price action, bulls have intervened, as evidenced by the Bull-Bear Power (BBP) indicator.

The Bull Bear Power (BBP) indicator gauges whether buyers (bulls) or sellers (bears) are dictating market momentum.

A clear breakout above $25.80 could trigger a move toward $27.62, and further Fibonacci extension targets indicate a potential rise to $43.04.

However, failing to maintain $22.86 may lead to deeper pullbacks, but current whale and exchange dynamics suggest ongoing resilience. With whales accumulating, discussions about LINK ETFs emerging, and a partnership with the government reinforcing fundamentals, Chainlink is a key RWA coin to track in September.

Ondo (ONDO)

Ondo has rapidly become a prominent name in the RWA token domain. It tokenizes real-world assets such as US Treasuries and corporate bonds for on-chain investors.

Whales have been discreetly accumulating throughout late August. The group holding between 100 million and 1 billion ONDO has increased its total from 981.38 million ONDO on August 24 to 989.53 million ONDO as of now, resulting in an addition of 8.15 million ONDO, valued at roughly $7.4 million at the current price of around $0.91.

From a technical standpoint, ONDO is exhibiting bullish divergence. Since August 19, prices have created lower lows, while the RSI has shown higher lows. This divergence suggests diminishing bearish pressure and a possible reversal. ONDO has increased by 13.2% over the past three months, indicating that the overall trend remains solid even amid short-term weaknesses.

The Relative Strength Index (RSI) evaluates the momentum of price shifts to determine if an asset is overbought or oversold. Higher values reflect stronger buying interest, while lower values point to greater selling activity.

Immediate resistance is around $0.93. A breakout beyond $0.9786 would confirm the bullish divergence and open up targets at $1.14.

Maple Finance (SYRUP)

Maple Finance is a credit marketplace centered on institutional lending, and its native Syrup (SYRUP) token has been steadily gaining recognition as one of the RWA tokens worth monitoring.

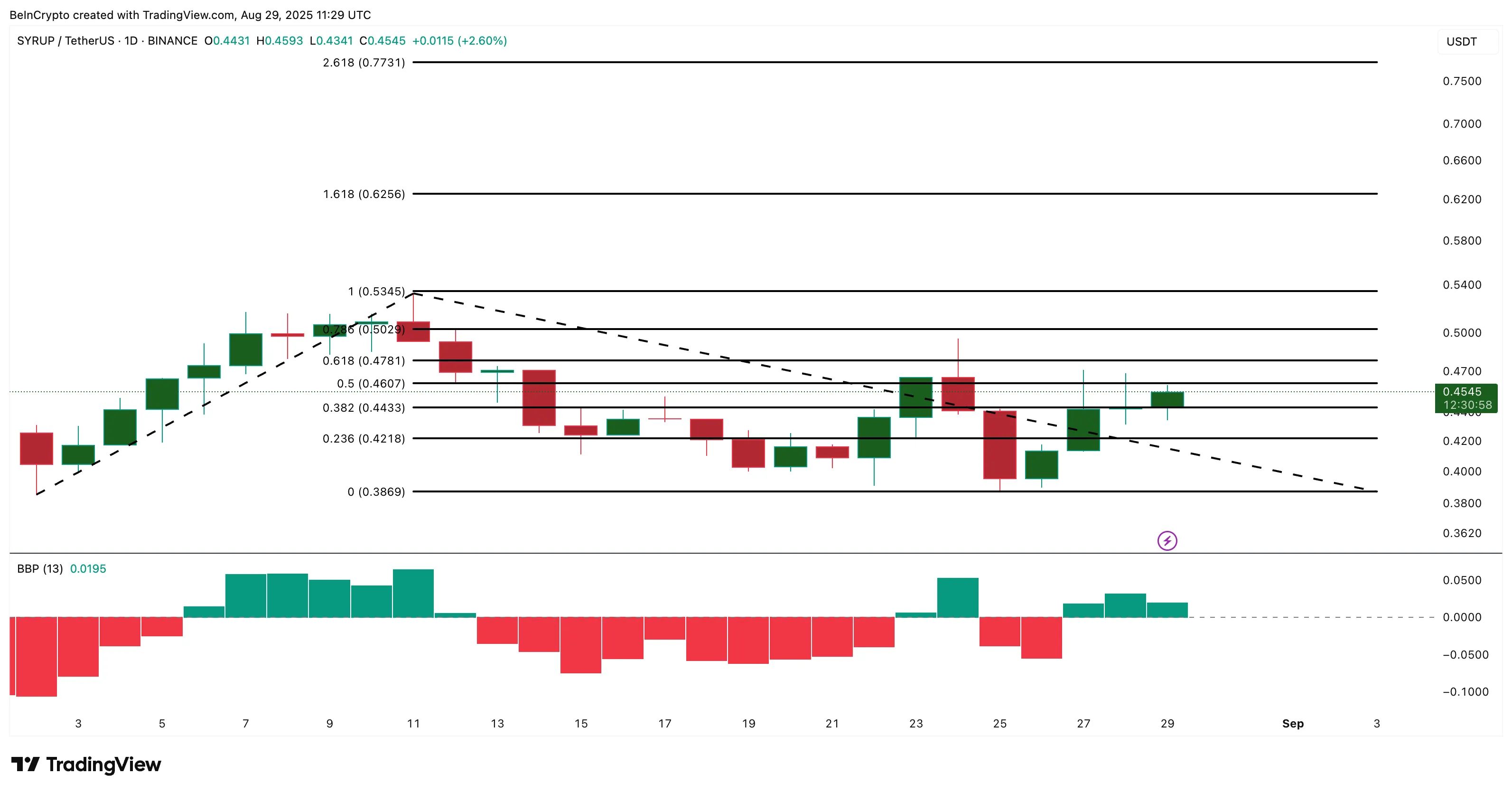

Performance has been impressive. Over the last three months, Syrup has surged by 39.9%. In the past month, it has increased by 4.2%, while seven-day gains stand at 14%. The consistency in these figures demonstrates that Syrup has not faltered amid market fluctuations.

On-chain data supports this strength. The top 100 addresses increased their holdings by 16.79%, adding around 160 million SYRUP, valued at approximately $72 million at the current price of $0.45.

Exchange balances fell by 23.51%, equating to about 69 million tokens (around $31 million), indicating a supply shortage. Whales did reduce their holdings by nearly 59%, but this impact has been overshadowed by accumulation from larger cohorts and steady withdrawals from exchanges.

Price action for SYRUP also appears constructive. A sustained hold above $0.42 keeps the bulls active. A breakout past $0.53 could drive momentum toward the $0.62–$0.77 range in September. With bulls maintaining the upper hand, as indicated by the green Bull-Bear Power candles, an upward movement seems probable.

Conversely, if Syrup drops below $0.38, the bullish scenario would be invalidated, allowing sellers to take control. Given its steady accumulation and resilience during volatile weeks, Maple Finance and its Syrup token have positioned themselves as one of the top RWA altcoins to watch this September.

Disclaimer

In compliance with the Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is dedicated to accurate, impartial reporting, though market conditions can shift without warning. Always perform your own research and seek professional guidance before making any financial choices. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.