XRP Funding Rate Signals Bullish Reset Amid Price Consolidation

Market analyst Crypto Melania indicates that XRP ($XRP) has recently seen significant changes in its funding rate, pointing to crucial implications for traders and investors.

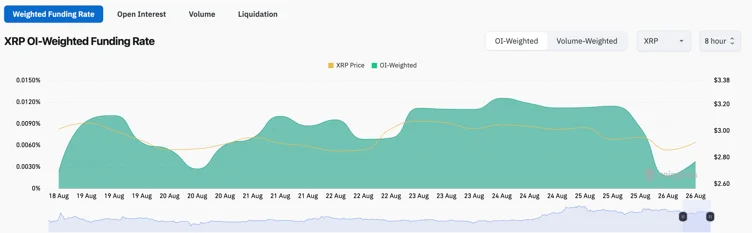

From August 18 to 19, XRP’s funding rate increased over 0.009%, indicating a strong long positioning as the price neared $3.30. This uptick reflected an elevated bullish sentiment, with traders heavily leveraging their positions in anticipation of further price increases.

Funding rates serve as a crucial metric in cryptocurrency derivatives, illustrating the cost of holding long versus short positions. A positive funding rate typically indicates that longs are compensating shorts, showcasing market optimism and high leverage.

In the case of XRP, the mid-August spike demonstrated traders’ confidence and their readiness to use leverage, suggesting that momentum favored a price continuation above $3.30.

However, by August 25, market dynamics had evolved. Both funding rates and XRP’s price had cooled, with funding nearing almost 0%. Crypto Melania notes that such a situation is frequently indicative of a “reset” in market leverage.

Notably, funding rates close to zero signal a balanced market sentiment, indicating neither longs nor shorts are dominating, leading to reduced leverage, lower speculation, and enhanced price stability.

This situation unfolds with XRP recently regaining the psychological price of $3, thanks to 25 million daily inflows.

XRP Gains Major Boost as Chinese Fintech Giant Embraces Its Ledger

XRP has gained considerable momentum following a significant development in China. Leading on-chain metrics provider Coin Bureau reports that Chinese fintech major Linklogis has announced its integration of its trillion-dollar supply chain finance platform with the XRP Ledger.

This announcement has created a stir within both crypto and traditional finance sectors, showcasing the growing adoption of blockchain technology in enterprise finance.

Linklogis, recognized for its substantial role in supply chain financing, stated that its platform will utilize the XRP Ledger for better transaction efficiency, transparency, and liquidity management.

The XRP Ledger is renowned for its low transaction costs and near-instant settlement times, making it an ideal infrastructure for Linklogis to improve financing across global supply chains. This integration is poised to enhance cross-border payments and enable quicker, more reliable financial transactions among businesses.

The market responded swiftly to the news, with Linklogis’ stock surging an impressive 23% within 24 hours, mirroring investor confidence in the strategic alliance with XRP.

Crypto markets reflected this optimism, as XRP showed renewed bullish sentiment while traders and institutional investors speculated about the long-term effects of such high-profile corporate integration.

Experts consider XRPL’s connection to a trillion-dollar supply chain finance network a testament to its expanding real-world applications. Coin Bureau emphasizes that such collaborations underscore the ledger’s practical capabilities and may attract substantial institutional interest in the coming months.

Additionally, Linklogis’ move highlights China’s cautious yet increasing interest in blockchain technologies beyond traditional cryptocurrencies.

Despite the ongoing high regulatory scrutiny, businesses are venturing into blockchain solutions to enhance their financial operations. XRP’s efficiency in fulfilling these requirements could position it as a preferred option for global fintech partnerships.

Conclusion

Linklogis’ integration with the XRP Ledger represents a pivotal moment for both the cryptocurrency and traditional finance arenas.

By incorporating XRP into a trillion-dollar supply chain finance system, this partnership highlights XRPL’s practical utility, speed, and efficiency.

Conversely, the recent shifts in XRP’s funding rates indicate a market adjustment. Following a phase of intense long positioning, the reduction in leverage brings funding close to zero, preparing the ground for more organic and sustainable price movements.