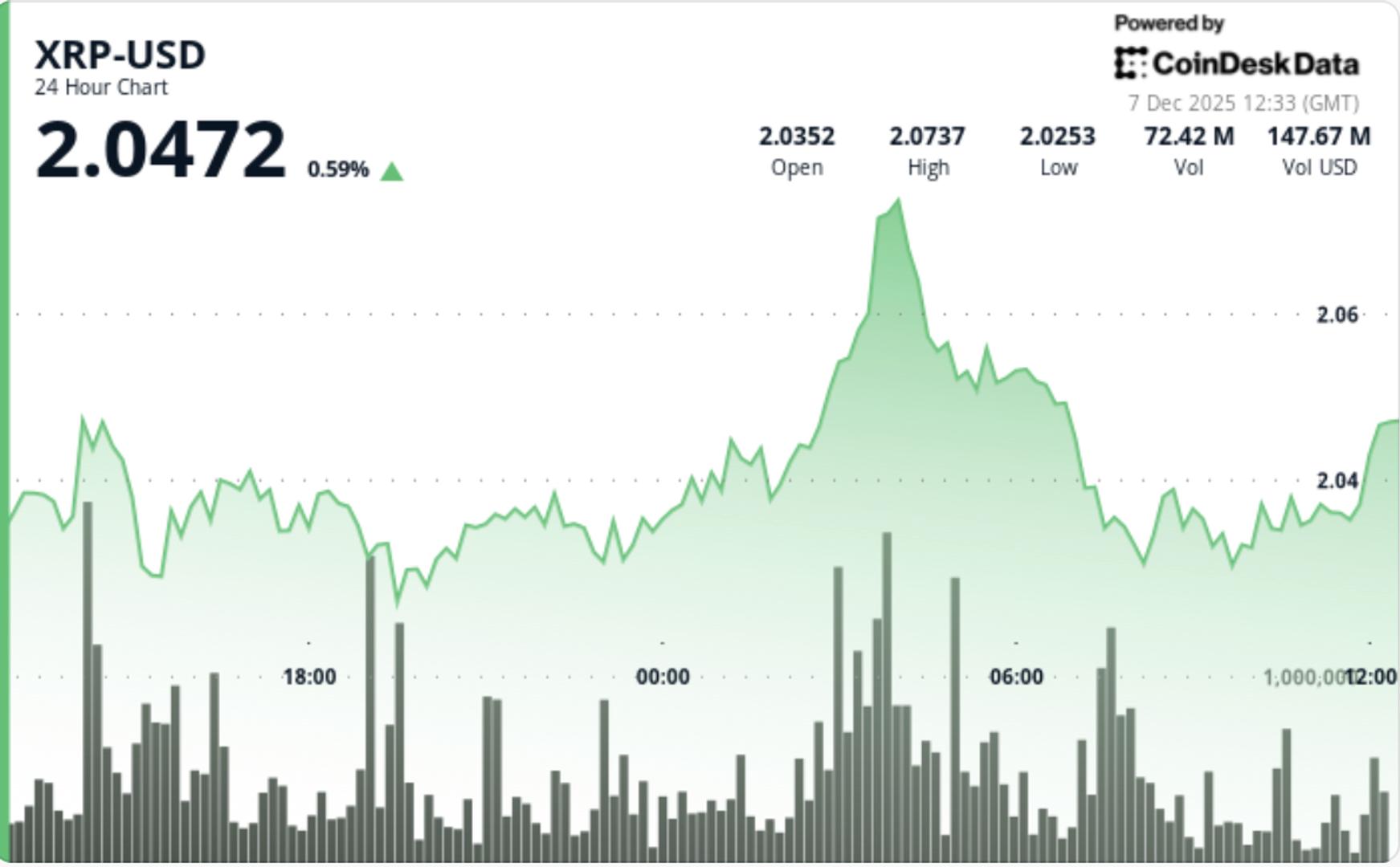

Despite brief breakout attempts above the $2.05 resistance during overnight trading, technical indicators across various timeframes indicate structural weakness.

News Background

- XRP is under pressure as its weekly performance slips to -7.4%, contributing to a multi-session downtrend that has persisted into early December.

- In spite of ongoing price weakness, institutional demand via U.S. spot XRP ETFs remains robust, having attracted $906 million in net inflows since launch, with no recorded outflow days.

- Meanwhile, social sentiment has plummeted to extreme fear levels, matching lows from October, with Santiment documenting the highest bearish commentary in over five weeks.

- Historically, such extremes have preceded short-term rebounds, including the recovery seen on November 21.

- On-chain data reveals mixed positioning: 6–12 month holders significantly reduced their exposure, dropping from 26.18% to 21.65%, while long-term ETF-driven demand continues to build quietly in the background.

Technical Analysis

- XRP’s initial attempt to break higher was successful, achieving a price above $2.05 on a 68% volume surge at 03:00. The breakout led to a quick rally to $2.07, but the movement lacked follow-through. Diminishing volume during the retrace indicated fading momentum, with sellers quickly reclaiming control.

- A consistent descending channel has formed on the 60-minute chart, showing successive lower highs and a tightening price compression. This pattern suggests an organized decline, not a panic liquidation.

- Each bounce has faced distribution, particularly near the $2.04–$2.05 zone, which now acts as immediate resistance.

Momentum oscillators trend downward across shorter timeframes, while the weekly TD Sequential indicator quietly signals a potential reversal. - This creates a scenario of short-term weakness accompanied by early-stage long-term stabilization signals.

Price Action Summary

- XRP fluctuated within a $0.0563 range (2.8%), moving between $2.02 and $2.07 before closing near $2.032.

- The breakout to $2.07 was propelled by a 44.99M volume spike (68% above SMA), but the rally fully retraced as volume diminished.

- The 60-minute structure indicates XRP declining from $2.040 to a support test at $2.029, with 1.08M volume during the low — suggesting clear institutional distribution rather than opportunistic buying.

- XRP is currently consolidating around $2.030, where maintaining this pivot is crucial to avoid a deeper test of the $2.020–$2.025 region.

What Traders Should Know

- XRP’s short-term trajectory remains tenuous as technical forces overshadow otherwise supportive fundamentals like ETF inflows and long-term accumulation.

- A reclaim of $2.035 is essential to restore intraday momentum, while a clean break above $2.05 is necessary to invalidate the descending channel.

- If $2.030 fails, traders should prepare for a retest of the $2.020–$2.025 zone, with psychological support at $2.00 marking a critical level before broader downside potential.

- Sentiment remains deeply negative, which historically aligns with early reversal setups, but until a technical trigger appears, the prevailing trend is downward.