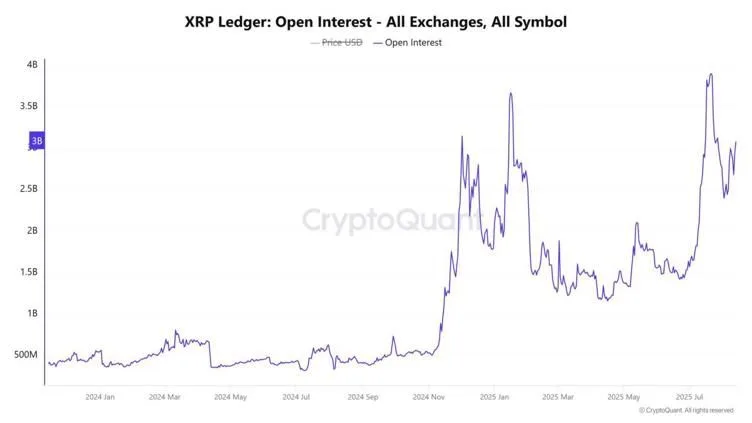

XRP Open Interest Surges Above $3 Billion

XRP’s open interest has surged back above $3 billion, signaling a notable shift in market dynamics. This resurgence follows months of subdued activity, indicating that traders are re-engaging with significant positions.

Open interest refers to the total value of outstanding futures and options contracts. An increase in open interest suggests that more traders are entering the market, often with leveraged positions, which can amplify price movements. The recent spike in XRP’s open interest indicates a growing confidence among traders and a potential buildup of volatility.

This uptick in open interest coincides with XRP’s price trading at $3.11, within a range between $3.04 and $3.14. Technical indicators suggest that XRP is approaching a critical juncture.

A breakout above the $3.40 resistance level could pave the way for a rally toward the $3.65 all-time high. Conversely, failure to maintain support at $3.00 might lead to a decline toward lower support levels.

The resurgence in open interest is also mirrored in the futures market. XRP futures have seen a significant increase in open interest, with some exchanges reporting levels as high as $8.68 billion.

This indicates a substantial influx of capital and heightened speculative activity. The weighted funding rate, a metric indicating the cost of holding long positions, has also risen, suggesting that traders are increasingly betting on upward price movements.

Market analysts view this resurgence as a precursor to potential increased volatility. The combination of rising open interest, technical resistance levels, and speculative positioning sets the stage for a significant price movement in the near future.

XRP ETFs Offer a Paradigm Shift

Ripple CEO Brad Garlinghouse is clear, “XRP ETFs represent the transition from speculative retail trading to institutional adoption.”

His words capture a simple market truth that exchange-traded funds (ETFs) don’t just expand access, they transform ownership and usage.

If XRP follows suit, the playbook is clear just like spot Bitcoin ETFs, a regulated XRP ETF would provide compliant custody, tickered access for institutions, and a frictionless path for long-term capital, potentially reshaping market structure as $65 billion did for Bitcoin.

The infrastructure is already in motion fast with major asset managers, such as Bitwise, Grayscale, and 21Shares, having already filed for XRP products, with U.S. regulators formally acknowledging several proposals, a key step signaling imminent approvals and listings.

Regulatory uncertainty around XRP has eased in 2025, such as the conclusion of the Ripple vs SEC case, paving the way for mainstream products, a backdrop fueling manager filings and Ripple CEO Garlinghouse’s optimism.

What Garlinghouse’s statement really signals is a change of narrative. ETFs recast XRP from an exchange-traded speculative token into an investable institutional asset class candidate, one that could sit alongside stocks and bonds in portfolios rather than only in crypto wallets.

If regulators and exchanges follow through, the next wave of inflows would be less about retail FOMO and more about strategic allocation, liquidity, and productized access, the hallmarks of institutional adoption.

Conclusion

Garlinghouse’s point is precise that an approved XRP spot ETF would shift XRP from a retail-driven, OTC asset to a mainstream institutional investment.

Meanwhile, the resurgence of XRP’s open interest above $3 billion is a clear indicator that traders are re-engaging with the asset.

This renewed interest, coupled with favorable legal developments, sets the stage for potential heightened volatility and significant price movements in the near future.