As per an analytics report, XRP was trading close to $2.06 on Friday after a significant shift in social sentiment surrounding the token, which declined approximately 30% over the past two months.

Related Reading

Traders and analytics firms noted a sharp increase in negative messages, contrasting with the previously mixed perspectives observed earlier this year. The atmosphere in crypto markets has tightened up, with XRP being affected as well.

Crowd Sentiment Turns to Fear

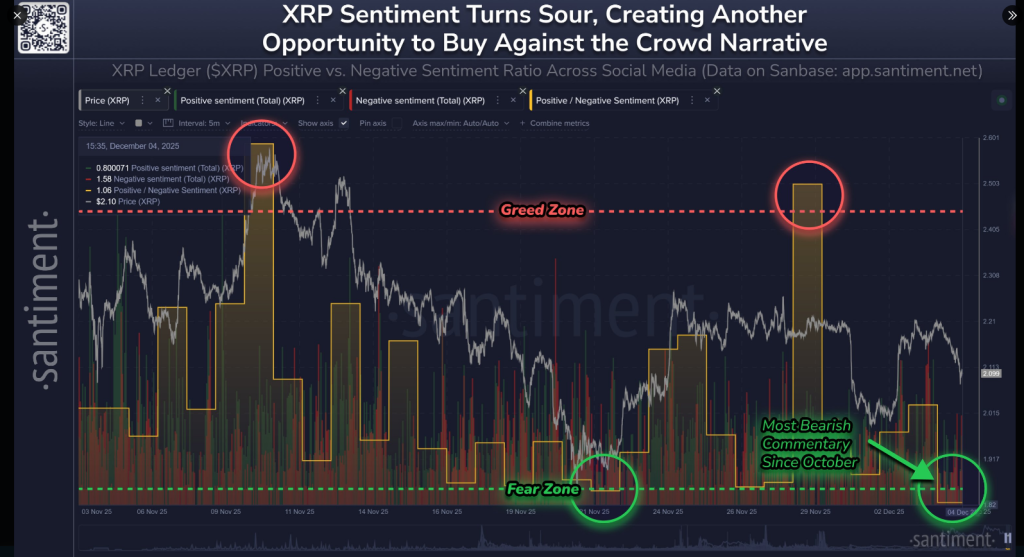

According to reports from Santiment, their data illustrates XRP’s price in relation to both positive and negative comments, alongside a combined sentiment measure reflecting public sentiment.

Recent analyses have indicated that the sentiment has moved into what Santiment defines as the fear zone, where negative discourse prevails over positivity. Their model also pointed to November 21 as a notable comparable period.

At that time, XRP surged over 20% within three days before the gains tapered off. This previous movement is now a key reference for traders closely observing social indicators.

😨 XRP (-31% in the past 2 months), unlike Bitcoin, is experiencing the highest levels of fear, uncertainty, & doubt (FUD) since October, based on our social data.

🔴 Circles mark days with significantly higher BULLISH comments compared to BEARISH comments regarding XRP (Greed Zone)… https://t.co/lJNW8zlRwK pic.twitter.com/ZoFmwrtw3h

— Santiment (@santimentfeed) December 4, 2025

Short Squeezes and Reflexive Rebounds

Deep-rooted negativity can act as a catalyst. When weaker holders opt to sell and shorts increase, a swift reversal can put pressure on sellers and significantly boost prices. Many traders are keeping an eye on this scenario: the prevailing bearish discourse could set the stage for a rebound if buying activity increases.

Santiment advised followers to monitor their dashboard for rapid sentiment changes, noting that crowd sentiment often precedes price movements in the very short term.

Price Trends and Market Context

XRP was recently reported to be down approximately 4% to $2.04, extending a monthly loss of roughly 6%. The entire crypto market value dipped about 1% to $3.22 trillion on the same day, impacting many altcoins even while liquidity remains predominantly with the larger tokens.

Order books for smaller pairs have become thinner, and leveraged positions have been reduced, leading to reduced capacity to handle major moves. Traders have also pointed to uncertainty regarding upcoming US policy decisions as a reason for cautious strategies.

Institutional Initiatives and On-Ledger Activity

Analysts tracking the token believe XRP has the potential to rise towards $2.50 to $2.75 if cross-border liquidity increases and stablecoin initiatives on the XRP Ledger gain traction. Reports indicate that Ripple is actively expanding its institutional presence.

Buy XRP. Stop focusing on any other Crypto Coins

They don’t matter

— Cameron Scrubs (@imcameronscrubs) December 2, 2025

Last month, Ripple launched digital asset spot prime brokerage services in the US following the acquisition of Hidden Road, integrating it into Ripple Prime—a combined trading and custody solution for professional clientele. This move is viewed as a potential long-term boost for demand.

Related Reading

Vocal Advocates and Market Indicators

In spite of the FUD surrounding XRP, Cameron Scrubs, founder of Tradeship University, has once again encouraged his followers to “buy XRP,” asserting that other crypto assets “don’t matter.” In earlier statements, he also urged to “sell everything and buy XRP.”

Traders are closely monitoring these remarks as sentiment shifts, while on-chain data and social signals are being observed for signs that the current negative discussions may begin to dissipate.

Featured image from Gemini, chart from TradingView