News Background

- XRP continued its rally from late August, increasing almost 9% over the week while trading closely around the $3.00 psychological milestone.

- Gemini introduced an XRP-rewards Mastercard in collaboration with WebBank, providing up to 4% cashback in XRP. This launch elevated Gemini’s ranking over Coinbase in U.S. iOS apps.

- Institutional investments in XRP-related products soared to approximately $25 million daily, enhancing market dynamics.

- Analysts are on the lookout for breakout patterns, with long-term targets estimated near $27 if the current consolidation phase breaks upwards.

Price Action Summary

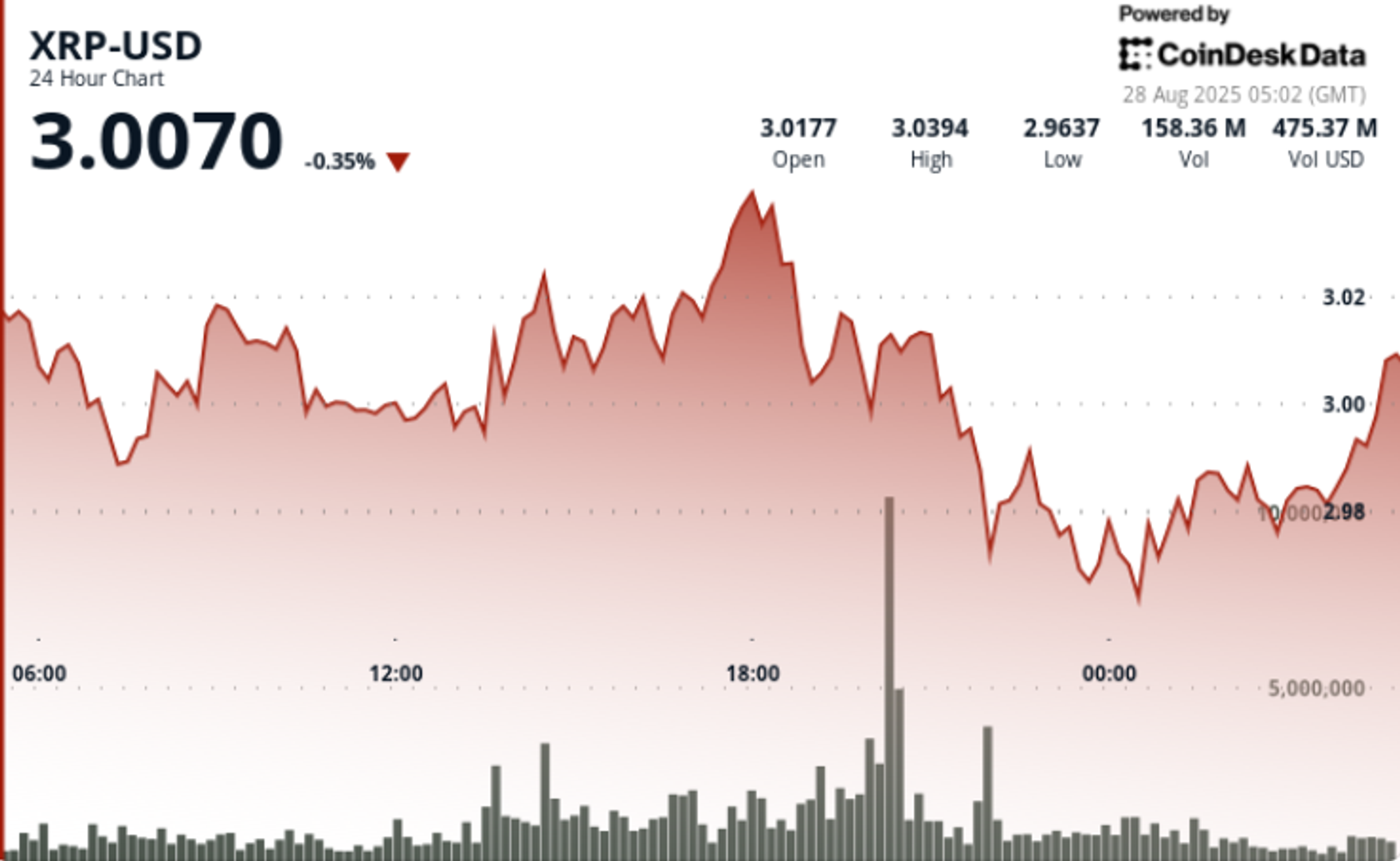

- In the 24-hour period concluding August 27 at 04:00 GMT, XRP fluctuated within a $0.09 range between $2.95 and $3.05, finishing at $2.98, marking a 1.3% intraday drop.

- The highest activity occurred at 20:00 GMT when volumes surged to 273.15 million — over four times the daily average of 62.47 million — as XRP briefly hit $3.05 before sellers intervened.

- During the closing hour (03:04–04:03 GMT), XRP traded within a $0.11 range from $2.97–$3.08, with repeated tests on the $2.975 support securing its position.

- Volume spikes of 1.31M at 03:59 and 1.19M at 03:07 GMT coincided with brief rallies toward the $2.99 resistance level.

Technical Analysis

- Support: The $2.975–$2.98 range continues to serve as a crucial psychological barrier after several successful defenses.

- Resistance: The $3.02–$3.04 range persists in restricting upward movements due to significant selling pressure.

- Momentum: RSI remains steady in the mid-50s, indicating a neutral stance; MACD histogram is converging towards a potential bullish crossover.

- Volume: The peak turnover of 273M underlines institutional activity while also revealing strong profit-taking at resistance levels.

- Patterns: The ongoing consolidation around $3.00 indicates a base-building phase, with prospects for continuation if the $3.04 resistance is breached.

What Traders Are Watching

- Bullish traders aim for $3.20 if the $3.02–$3.04 resistance zone is surmounted.

- Bearish traders point to $2.96 as the initial downside catalyst, with $2.94 as the next support level.

- Market analysts are monitoring whether Gemini’s Mastercard launch leads to increased retail interest in XRP.

- Maintaining daily institutional inflows above $25M is crucial for retaining momentum.