XRP Targets $3.20 Breakout as Bullish Flag Pattern Gathers Strength

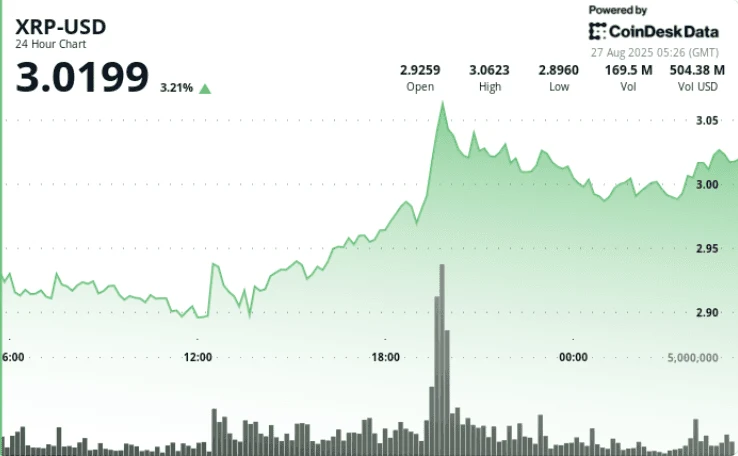

XRP is demonstrating renewed vigor, as noted by market analyst Cryptodonia. The digital asset has established a classic bullish flag pattern, with a sturdy support level at $2.89. Traders and investors are keenly observing this setup, as it suggests a potential for a significant upward movement.

A bullish flag is a technical formation that usually indicates a continuation of an existing uptrend after a short consolidation phase.

For XRP, the flag pattern suggests that the cryptocurrency could reignite its rally once it breaks through the current consolidation phase. Cryptodonia points out that a sustained move above the $3.08 mark could trigger further gains, targeting $3.20 for buyers.

Increasing trading volumes and rising XRP futures indicate building momentum. CME XRP futures open interest recently reached $1B, indicating strong institutional engagement. These market and on-chain dynamics often precede notable price movements in cryptocurrency.

With XRP maintaining the critical $3 level, market participants are eager to see if it can gain enough momentum to surpass $3.20.

Ripple’s Capacity to Revolutionize Financial Infrastructure, as Stated by Prof. Fabian Schär

Ripple, the blockchain-enabled payment protocol, has increasingly drawn the attention of financial professionals and crypto enthusiasts for its potential to transform the global financial landscape.

Prof. Dr. Fabian Schär, a leading scholar in Distributed Ledger Technologies and Fintech at the University of Basel, believes Ripple has a strong opportunity to substitute some segments of the current financial framework.

Prof. Schär emphasizes that Ripple’s network, which utilizes the XRP Ledger, is crafted for quick, economical cross-border transactions, marking a significant advance over traditional banking solutions.

In contrast to traditional interbank settlement systems, which may require days and involve several intermediaries, Ripple enables nearly instantaneous transfers while ensuring transparency and security through its decentralized ledger.

This positions XRP and RippleNet as appealing alternatives for banks, remittance companies, and financial institutions seeking enhanced efficiency and reliability.

Additionally, Ripple is effective in linking traditional finance with blockchain technology. By integrating XRP into established systems, Ripple facilitates quicker liquidity and cross-border settlements without overhauling existing infrastructure, allowing banks to adopt blockchain solutions while minimizing the risks associated with fully decentralized networks.

Meanwhile, Ripple is advancing the creation of a comprehensive oracle, allowing banks to quickly and securely access ledger information while ensuring full compliance.

Conclusion

According to Prof. Fabian Schär, the increasing adoption of Ripple by banks indicates a transition towards digital-ledger technologies, positioning it as a significant player in modern finance.

On the other hand, XRP is at a crucial juncture. A bullish flag with strong $2.89 support, rising trading volumes, and active futures signify increasing momentum.

Thus, a breakout above $3.08 could lead to a rapid climb to $3.20, as traders attentively monitor for this potential move.