Following last Friday’s market crash, Ethereum’s market sentiment remains tepid, even as broader market signs show gradual improvement.

With institutional investors pulling back, those in the spot market have also cut down their holdings. This could lead to either ongoing consolidation or a significant breakdown of the crucial $4,000 resistance level where the coin is currently situated.

Sponsored

Sponsored

Ethereum Market Stalls Amid Record ETF Withdrawals

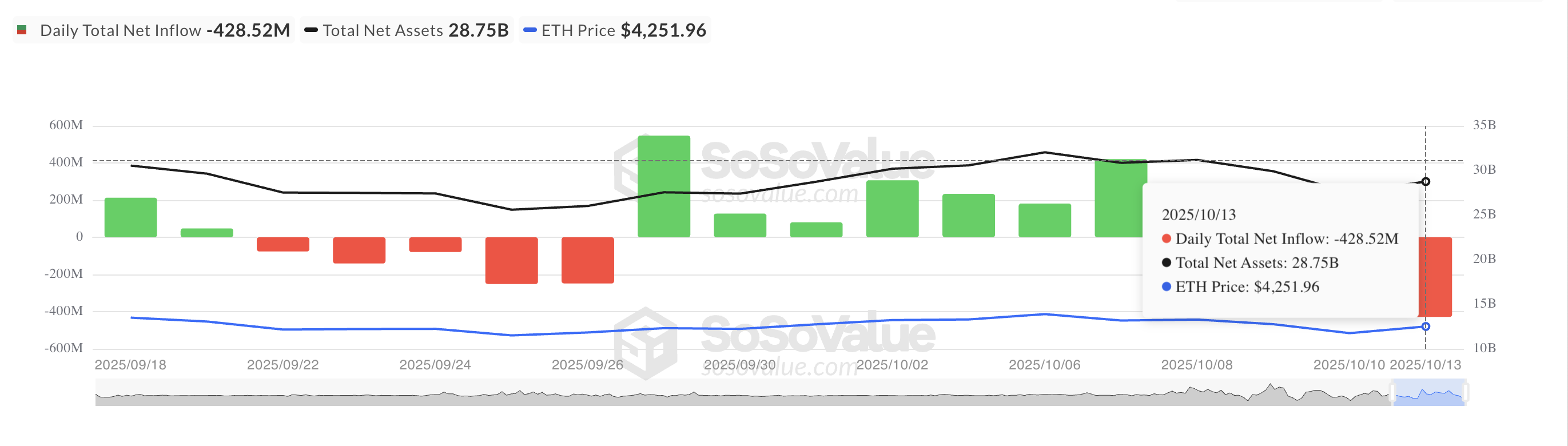

Since last Friday’s market-wide liquidation, ETH-backed exchange-traded funds (ETFs) have experienced notable outflows. Data from SosoValue indicates that these funds had outflows totaling $428.52 million on Monday.

For token TA and market updates: Seeking more token insights like this? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

Leading the outflows was BlackRock’s iShares Ethereum Trust (ETHA), which saw $310.13 million in redemptions, followed by Grayscale’s Ethereum Trust (ETHE) at $20.99 million and Fidelity’s Ethereum Fund (FETH) at $19.12 million.

Bitwise’s Ethereum ETF (ETHW) and VanEck’s Ethereum ETF (ETHV) recorded smaller declines of $12.18 million and $9.34 million, respectively, on the same day.

This marks Monday’s outflows as the largest single-day capital exit from these funds since August 4, emphasizing the diminished institutional interest post-liquidation.

This trend may continue to dampen market sentiment around the altcoin, exerting additional downward pressure on its price and restricting the coin’s short-term recovery potential.

Sponsored

Sponsored

Increased Bearish Signals for Ethereum Amid Technical Weakness

Current readings from the ETH/USD daily chart reveal that the altcoin is trading below its Super Trend indicator, which is now functioning as dynamic resistance at $4,561. Presently, ETH trades significantly lower, at $3,986.

The Super Trend indicator assists traders in determining market direction by placing a line above or below the price chart based on the asset’s volatility.

When an asset’s price is above the Super Trend line, it typically indicates a bullish trend, suggesting that the market is in an uptrend and buying pressure prevails.

Conversely, as is the case with ETH, when the asset trades below this line, it signals that the market is under bearish control. Traders usually view a position below the Super Trend as an alert for potential continuing downward momentum, complicating ETH’s chances to regain strength soon.

Bears Aim for Lower Levels While Buyers Remain Patient

Should bullish sentiment continue to be elusive, ETH might extend its decline beneath the crucial $4,000 threshold, potentially falling to $3,626. If this level weakens, a deeper drop towards $3,215 could occur.

However, an uptick in new demand for the leading altcoin could counteract this bearish outlook. In such a scenario, the coin’s price could rise to $4,211.