October appears to be on the brink of derailing Uptober, as cryptocurrency values dipped following a substantial multi-billion-dollar liquidation. Nevertheless, analysts suggest that consistent ETF demand could still facilitate a recovery.

Summary

- October began robustly for Bitcoin, driven by ETF inflows and institutional interest that propelled crypto prices to new all-time highs, aligning with historical trends that designate the month as one of the most profitable for cryptocurrencies.

- This upward momentum was swiftly disrupted by a $19 billion liquidation event, exacerbated by thin order books and a crowded derivatives market.

- However, analysts believe that the seasonal rally still holds potential.

October had a promising start, resembling a typical Uptober, with ETF inflows lifting crypto prices and a healthy number of buyers in the market. Unfortunately, a sudden liquidity crunch and a political upheaval quickly derailed the rally.

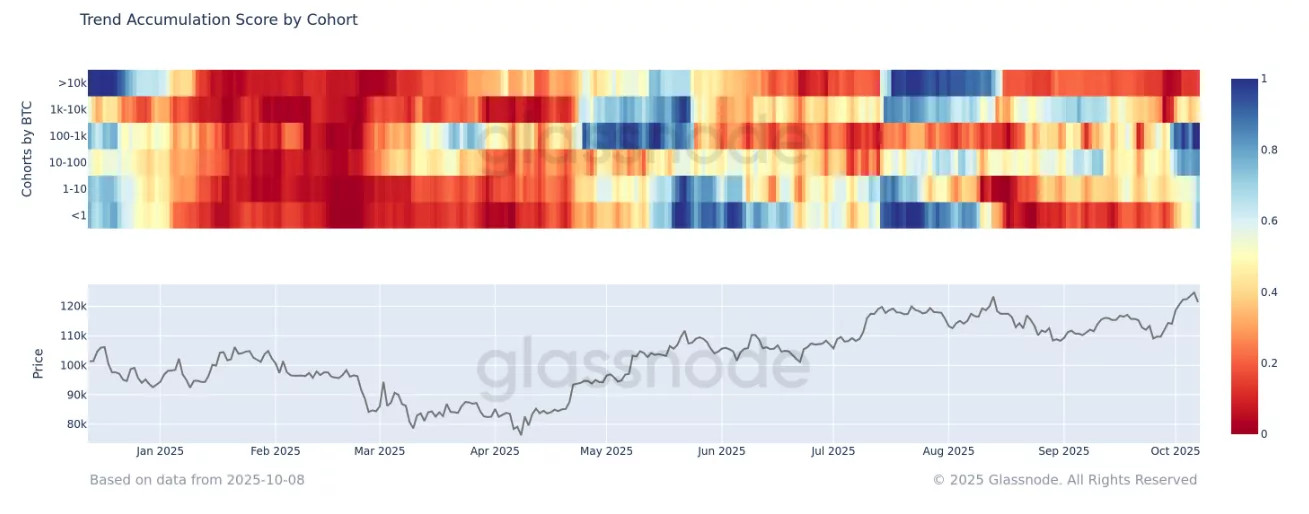

In the month’s early days, Bitcoin (BTC) surged to new heights, achieving a price exceeding $126,000. Analysts from Glassnode highlighted in a research report that Bitcoin “surpassed the $114k–$117k supply zone, reaching a new all-time high near $126k, bolstered by significant ETF inflows and renewed buying from mid-tier investors.”

Historically, October is celebrated as “Uptober” in the crypto ecosystem, a month renowned for substantial gains. Data from CoinGlass reveals that since 2013, Bitcoin has recorded an average return exceeding 46% in October, marking it as one of the top-performing months for the cryptocurrency.

Yet, the highs were followed by a shock: on Oct. 11, the market experienced the largest single-day liquidation in history, erasing approximately $19 billion from leveraged positions and driving BTC down to around $102,000 before a partial recovery.

Liquidity, leverage and the short squeeze

Some analysts observed that the price fluctuations of Bitcoin stemmed not only from selling pressure but also from thin order books, amplifying the impact of the movements. Kaiko’s mid-October note succinctly illustrated the market-making aspect:

“Volumes surged on Friday as fear spread through crypto markets, revealing a significant liquidity gap across BTC order books. As selling intensified, there wasn’t enough resting depth to accommodate the flow; order books on various exchanges thinned dramatically, appearing almost empty for extended periods across major BTC marketplaces.”

Kaiko

Despite the sudden crash, some analysts argue that the seasonal narrative is still intact. K33 Research mentioned in a research piece that post-deleveraging, they’re becoming “increasingly optimistic” as excessive leverage has been eliminated, reducing structural risks, thus making the market condition seem “far healthier.”

“We see the upcoming weeks as a favorable opportunity for capital investment in BTC, anticipating the reset in perpetual contracts and a return to normal funding dynamics to establish a solid foundation for renewed upward momentum.”

K33 Research

Glassnode noted that prior to the liquidation incident, institutional demand was notably strong, with over $2.2 billion in U.S. spot-ETF inflows recorded within a short period, and steady mid-tier accumulation causing “almost all circulating supply to return to profit,” historically indicating late-stage but resilient rallies.

Thus far, Uptober reveals two contrasting narratives: significant institutional inflows elevated prices, yet a singular liquidity event—compounded by thin order books and crowded derivatives—can swiftly reverse that progress.

Moving forward, outcomes hinge less on speculation and more on whether market makers, institutional purchasers, and option sellers can reestablish depth. If they succeed, Uptober might still conclude impressively. Conversely, if they falter, October will be marked as the month when the rally confronted a liquidity barrier and retreated.