Pi Coin is experiencing a prolonged downtrend, trading perilously close to its historical low. This level was last reached in early August, and indicators suggest a potential retest in September.

Investor sentiment shows increasing pessimism, with selling pressure preventing the altcoin from regaining previous support levels.

Pi Coin Is Under Pressure

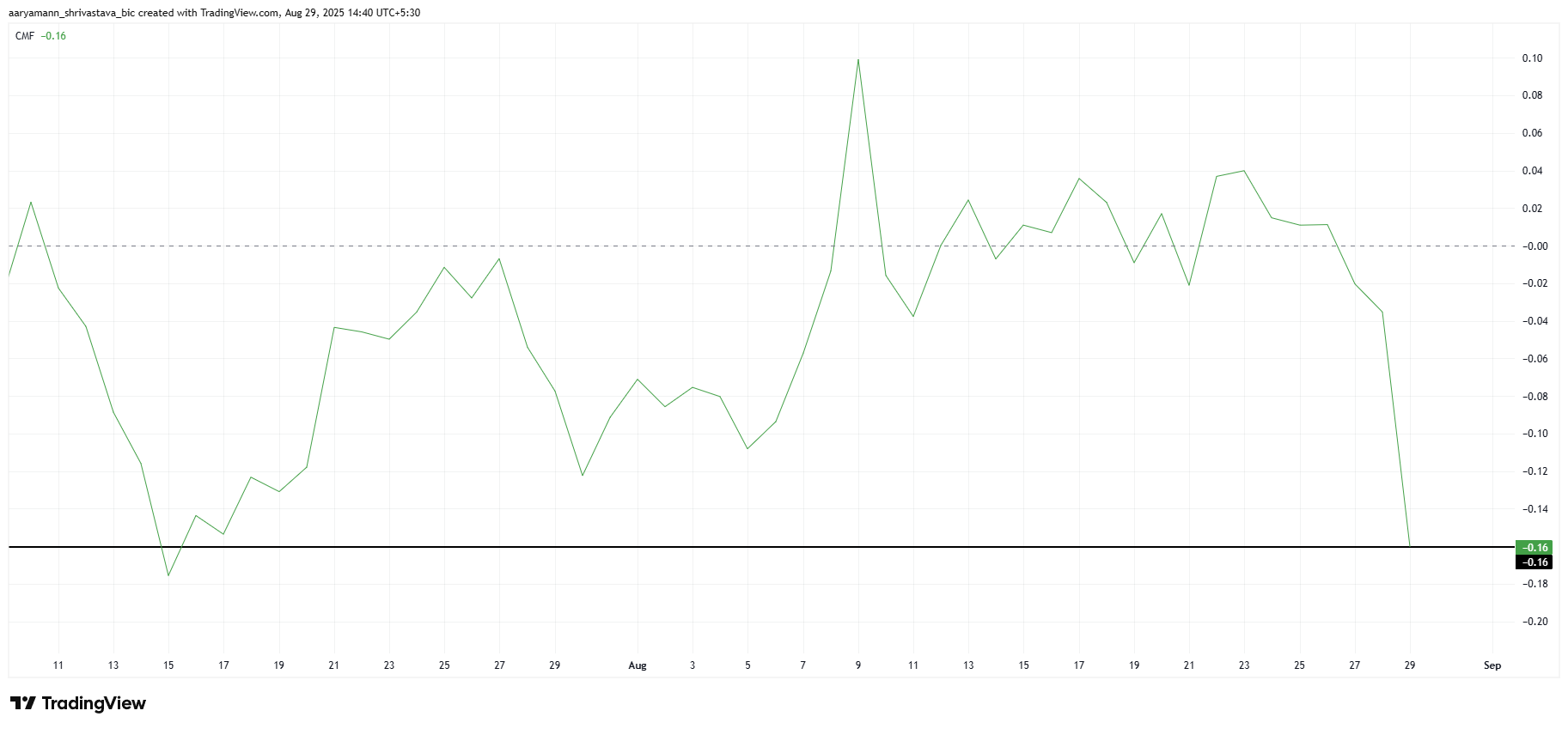

The Chaikin Money Flow (CMF) indicates significant outflows from Pi Coin currently. The indicator has hit its lowest point in six weeks, underscoring substantial selling pressure. Investors are withdrawing capital from the asset, diminishing the likelihood of a rebound as it hovers near crucial support.

These ongoing outflows signal a decline in confidence regarding Pi Coin’s stability. As investors liquidate their holdings, new inflows are lacking, restricting possible price recoveries. With the token lingering close to its all-time low, sentiment is becoming more negative, indicating increased susceptibility to further losses in the near-term market landscape.

Interested in more insights about tokens? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

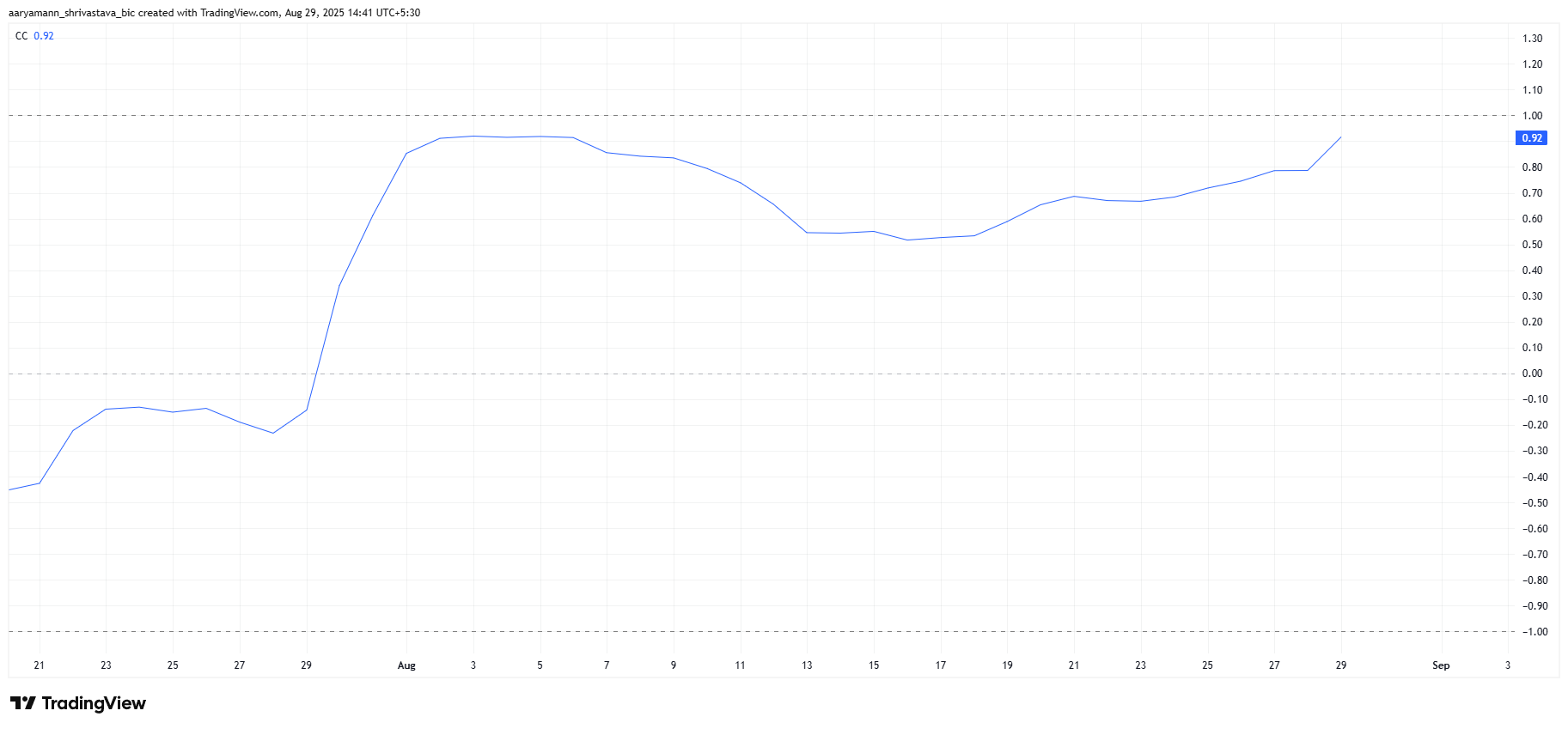

Correlation with Bitcoin adds to Pi Coin’s vulnerability. Currently, the correlation coefficient is at 0.92, one of the highest levels this year. This strong connection means Pi Coin is likely to follow Bitcoin’s movements, irrespective of independent developments or minor technical signals on its own chart.

Throughout August, this correlation kept Pi Coin in a downtrend alongside Bitcoin’s troubles. BTC has struggled to reclaim $115,000 as a stable support level, increasing the risk of ongoing weakness. If Bitcoin continues to decline, Pi Coin is expected to mirror this movement, potentially dropping to new multi-month lows.

PI Price Must Break Free

Pi Coin is trading at $0.353, slightly below resistance at $0.362. The altcoin has been caught in a downtrend for more than three months. Efforts to break free have failed four times, leaving the token exposed and close to its all-time low as selling pressure increases.

If these conditions persist, Pi Coin may lose support at $0.344. A drop to $0.322 would test its all-time low, and continued selling might even push the price down to $0.300. Such a decline would indicate new weakness and establish new historic lows for the token.

If Pi Coin manages to break the downtrend and re-establish $0.362 as support, it could rise towards $0.401. This recovery would stabilize the market structure and counter the current bearish conditions. A rebound of this scale would challenge the prevailing selling narrative and offer short-term relief to investors holding the token.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be regarded as financial or investment advice. BeInCrypto is dedicated to delivering accurate and unbiased reporting; however, market conditions are subject to change without notice. Always conduct your own research and consult a professional prior to making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.