Key takeaways:

XRP’s (XRP) decline toward $2.80 was preceded by substantial transfers from large holders, which some analysts suggest could lead to a deeper price correction.

Whales are offloading their XRP

XRP whales, or those holding large quantities of the token, have increased their selling activity as the price sank below $3.

Related: Ripple plans to introduce RLUSD stablecoin to Bahrain through a new partnership

According to XRP Whale Flow data, utilizing a 30-day moving average, CryptoQuant analyst Maartunn reported that $50 million worth of XRP is exiting whale wallets on a daily basis.

He further stated:

“Selling pressure remains.”

This coincides with an increase in XRP supply on centralized exchanges during late September and early October, as indicated by data from Glassnode.

This “strongly indicates whales are preparing for a notable sell-off,” noted trader CryptoOnchain in an X analysis on Oct. 3, adding:

“The data indicates significant selling pressure, heightening the risk of a sharp correction. Conditions are favorable for a pronounced price drop.”

This may continue to exert downward pressure on XRP’s price in the upcoming weeks, especially amidst increasing market anxiety, which has returned to levels not seen since the sell-off triggered by President Donald Trump’s tariff announcements in April.

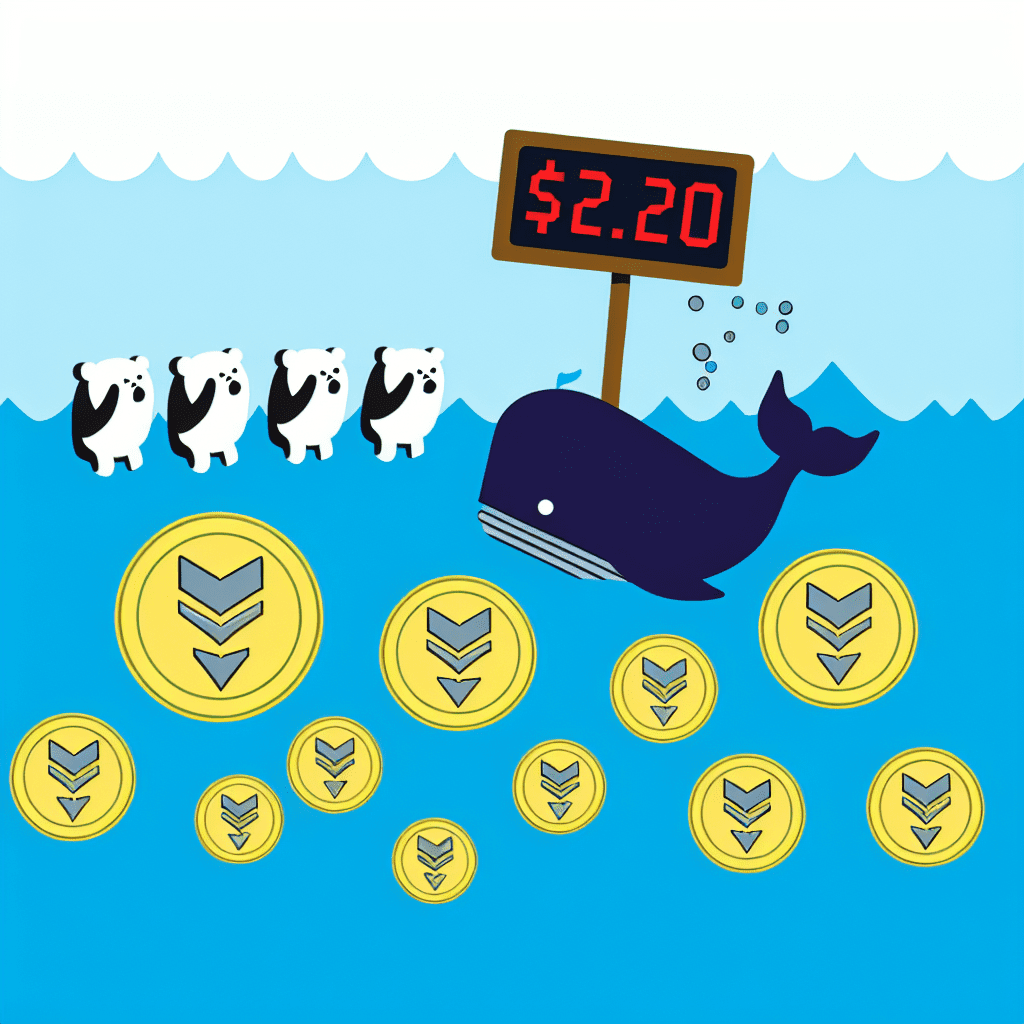

XRP’s descending triangle targets $2.20

Trader Peter Brandt identified XRP as a “short candidate” if it completes a descending triangle formation.

Brandt’s technical analysis suggests more downside potential if the price breaks under the triangle’s support line at $2.75. He remarked:

“$XRP is on my list of short candidates, but this is contingent upon the completion of the descending triangle.”

The target of the pattern, calculated by adding the triangle’s height to the breakout point, is $2.20, indicating a 22% decrease from the current price.

As Cointelegraph reported, the range between $2.75 and $2.80 remains a crucial support zone for XRP, and maintaining this level is vital to prevent further losses.

On another note, optimism for the approval of an XRP ETF persists. Market commentator XRP Update stated that the US Securities and Exchange Commission might greenlight an XRP ETF by Oct. 18, adding:

“This could represent a turning point for institutional adoption and market credibility.”

Such developments could assist bulls in regaining their momentum, though a “sell-the-news” decline is also conceivable, particularly if whales use it as a selling point.

This article does not provide investment advice or recommendations. All investments and trading carry risks, and readers should perform their own research before making any decisions.