The cryptocurrency industry has been omitted from the annual outline of financial risks presented by the Financial Stability Oversight Council (FSOC) regarding the U.S. financial system. This omission reflects a broader trend, as the report has significantly reduced its emphasis on “vulnerabilities” within the financial landscape.

The FSOC was created in response to the 2008 financial crisis to serve as an early warning system that identifies potential threats. Historically, the digital assets sector has been regularly mentioned, though past reports cautioned against its limited market size while noting that instruments like stablecoins and ETFs might introduce risks if overly intertwined with traditional finance. However, this concern is notably absent from the 2025 report released by regulators from the Trump administration.

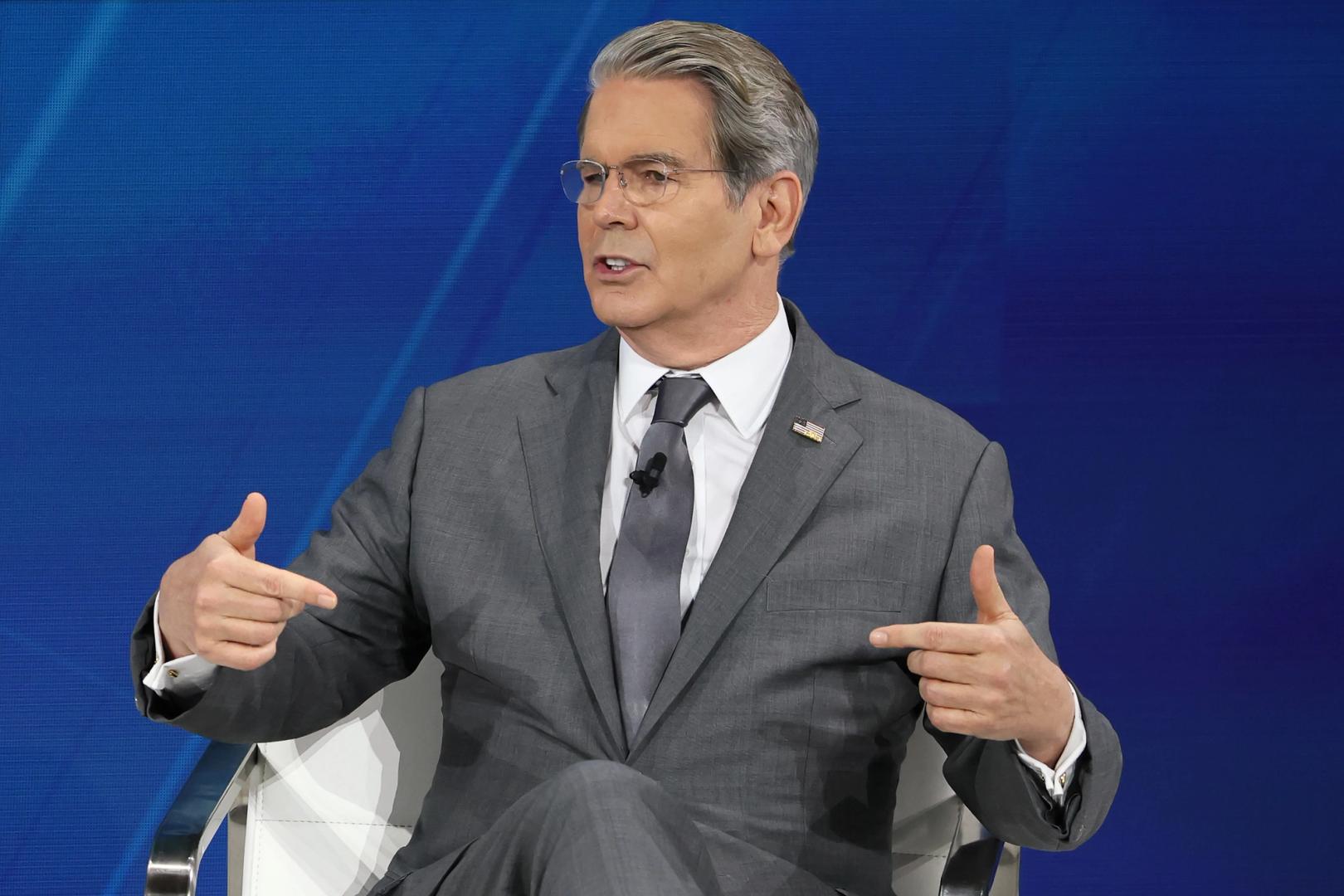

The report’s table of contents has entirely removed the term “vulnerabilities,” and Treasury Secretary Scott Bessent remarked in the opening letter that previous analyses aimed to highlight threats to the financial system.

“Monitoring and addressing these vulnerabilities is crucial, but it isn’t enough for ensuring financial stability,” he asserted. “Achieving financial stability is closely linked to sustainable long-term economic growth and security.”

The 2024 report, a comprehensive 140-page document from the Biden administration, primarily focused on urging Congress to regulate stablecoins and establish specific regulations for spot markets. In contrast, this year’s condensed 87-page report lacks “recommendations” for digital assets or explicit concerns regarding the industry.

The digital assets section includes a “further actions” subsection that references this year’s President’s Working Group report on U.S. crypto activity, which outlines recommendations for Congress and various government agencies to foster innovation in digital financial technologies.

The 2025 FSOC document illustrates how U.S. financial regulators have shifted their previous stance, which generally warned regulated firms about the risks of engaging with the crypto industry. The report primarily highlights the sector’s strengths, although it does caution in the “illicit finance” section that stablecoins could be “misused to facilitate illegal transactions.”

Nonetheless, it also conveys that the “ongoing use of U.S. dollar-denominated stablecoins is anticipated to bolster the role of the U.S. dollar in the global financial landscape over the next decade.”

Read More: FSOC’s Concerns About Stablecoins Persist