XRP experienced a nearly 6% swing in a volatile 24-hour period, bouncing back from significant losses at $2.82 to close at $2.93. This movement was driven by a notable increase in trading volume and strong support buying, despite whales selling off and the wider market absorbing $360 million in liquidations.

News Background

- XRP has encountered selling pressure following a blockchain security downgrade, raising alarms about possible vulnerabilities.

- Whale groups have been active on both ends—some have intensified sales during rallies while others have defended crucial support levels.

- The broader cryptocurrency market faced $360 million in liquidations as institutions shifted away from risk assets, impacting sentiment across major cryptocurrencies and memecoins.

- Technical analysts continue to identify $3.17 as a breakout point that could trigger a significant rally toward $5.00+, although bearish analysts caution about a potential decline to $2.65 if support levels falter.

Price Action Summary

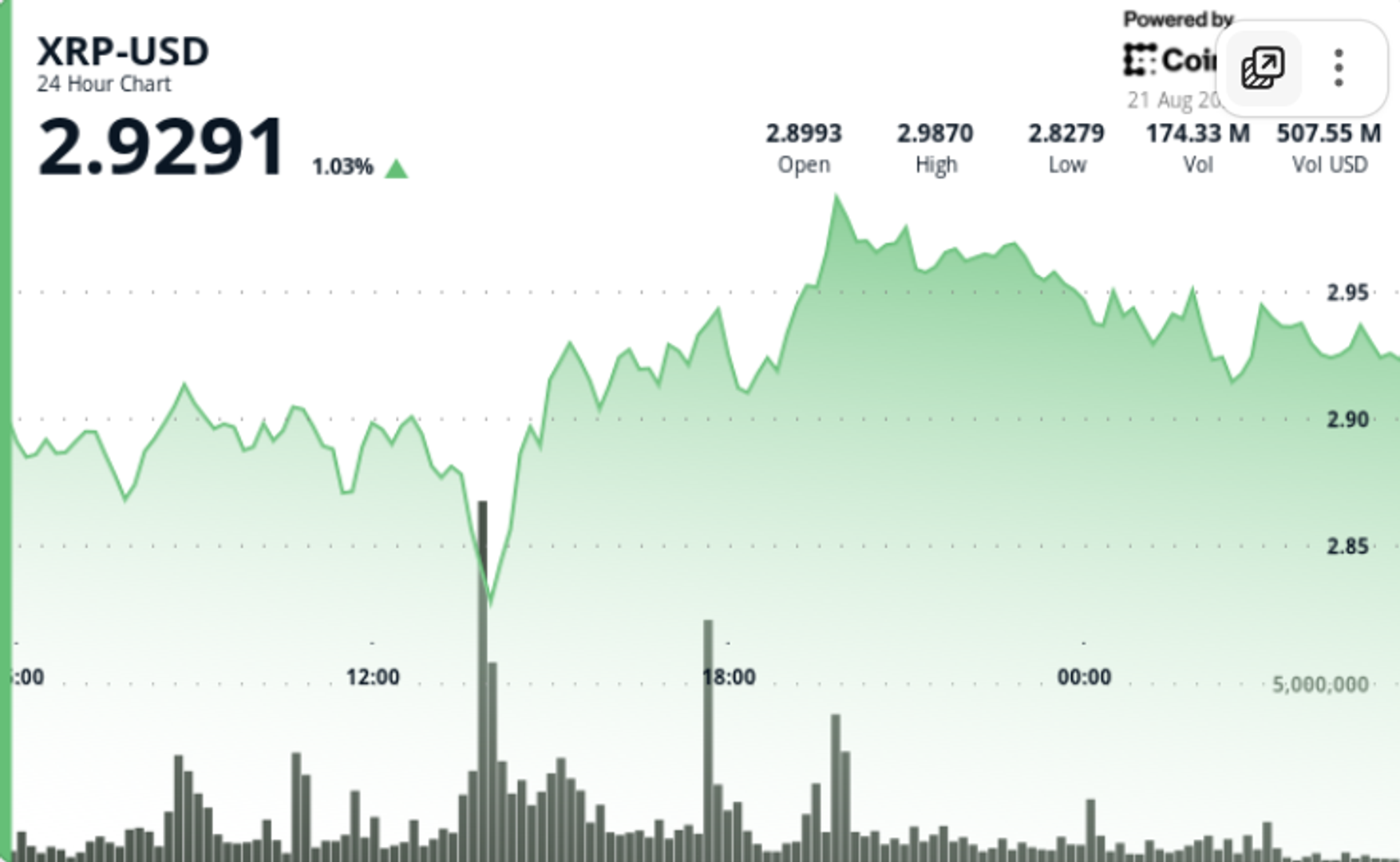

- XRP fluctuated 5.69% between Aug. 20–21, encompassing a range of $0.17 from $2.82 to $2.99.

- The token plunged to session lows during the 13:00–15:00 UTC window before launching a quick recovery back to $2.93.

- Volume soared to 155 million during the recovery hour at 14:00—almost triple the daily average of 63 million.

- Bears vigorously defended the $2.99 resistance, while bulls maintained bids at $2.82, resulting in a late-session rally.

- XRP concluded the session at $2.93, with momentum favoring bulls on robust volume confirmation.

Technical Analysis

- Support Zone: Buyers upheld $2.82 with strong conviction, reaffirming the floor on elevated flows.

- Resistance Wall: Sellers restricted movement at $2.99, establishing a distinct ceiling.

- Volume Surge: 155 million in transactions during recovery—2.5 times the daily average—signals institutional-level buying.

- Intraday Pattern: A V-shaped recovery from $2.82 to $2.93 indicates accumulating interest.

- Morning Session: XRP increased by 0.34% to $2.94, with hourly volumes of 580,000 compared to a norm of 470,000.

- Momentum Outlook: Continued bid flows at $2.92–$2.93 imply that breakout pressure is intensifying.

What Traders Are Watching

- If XRP can break and maintain levels above $2.99, paving the way for $3.17 as the next breakout target.

- Ongoing whale activity trends—especially signs of distribution versus accumulation around the $3.00 mark.

- Wider market implications, as liquidations and institutional risk appetite influence immediate flows.

- If $2.82 holds in further evaluations, establishing a solid floor before potential upside expansion.