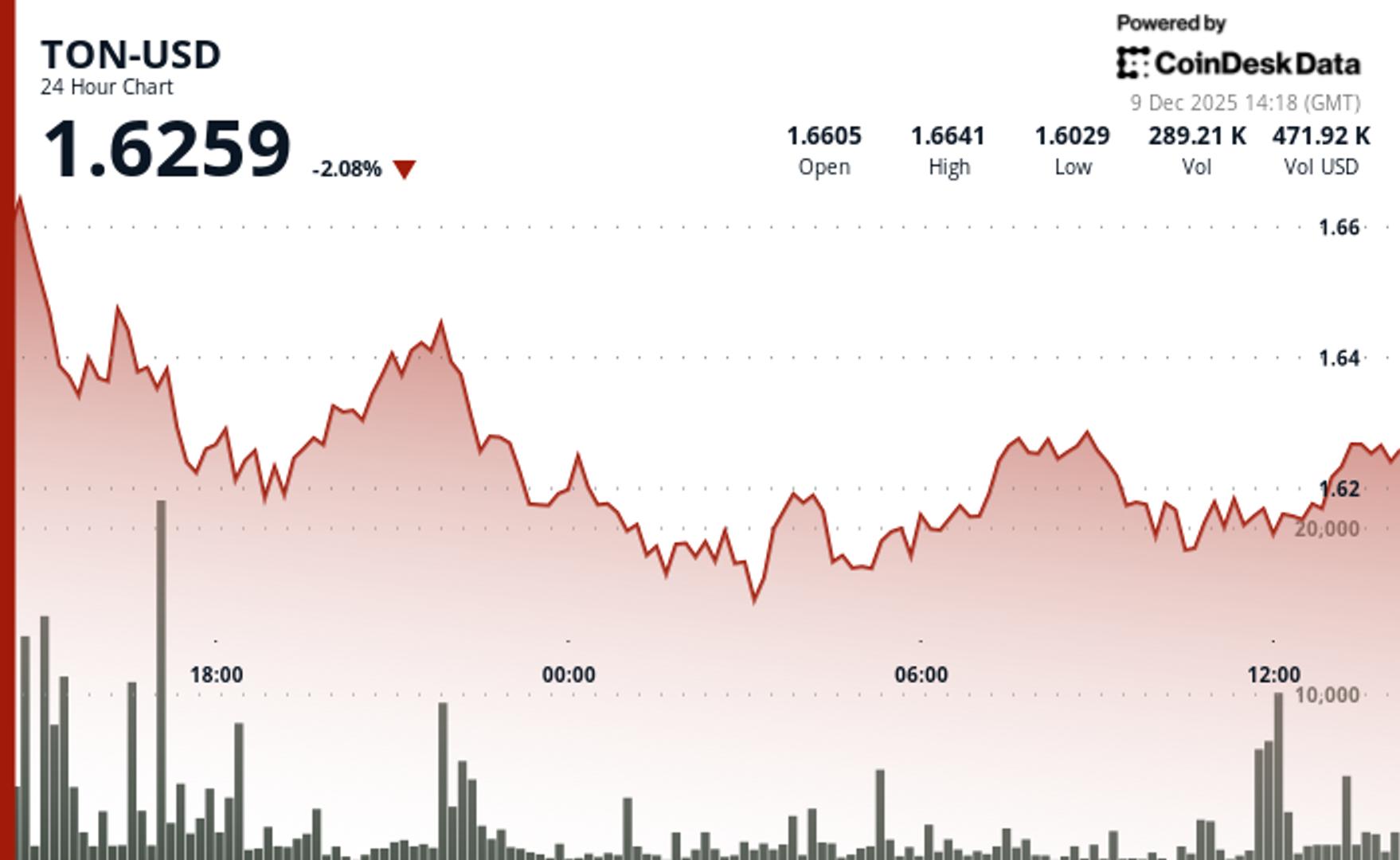

experienced a drop over the last 24 hours, declining over 2% to $1.625 as selling pressure pushed the token down, leading to an approximate 72% decrease in value over the past year.

This shift occurred following an unsuccessful breakout around $1.668, resulting in a clear downtrend characterized by lower highs and lows within a tight range.

During the selloff, trading volume surged to 3.02 million TON, marking a 43% increase over the daily average, as per CoinDesk Research’s technical analysis data model. This increase in trading activity coincided with a breach of critical support levels, further negative impact on market sentiment.

Nevertheless, TON’s price action found a support level at $1.6025. Repeated retests of this support have remained strong as volume decreased, indicating that aggressive selling has subsided.

Importantly, the latest trading activity indicates a possible shift in momentum. The price rose above $1.620 with increasing volume, establishing an ascending pattern of higher lows that typically suggests systematic buying.

TON is currently at a pivotal point. A breakout above $1.635 could confirm a reversal, while a decline below $1.602 would reignite downward risk. Traders monitoring the $1.620 pivot are likely to view it as a crucial level for assessing whether this bounce could evolve into a broader trend shift.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to guarantee accuracy and compliance with our standards. For further details, see CoinDesk’s comprehensive AI Policy.