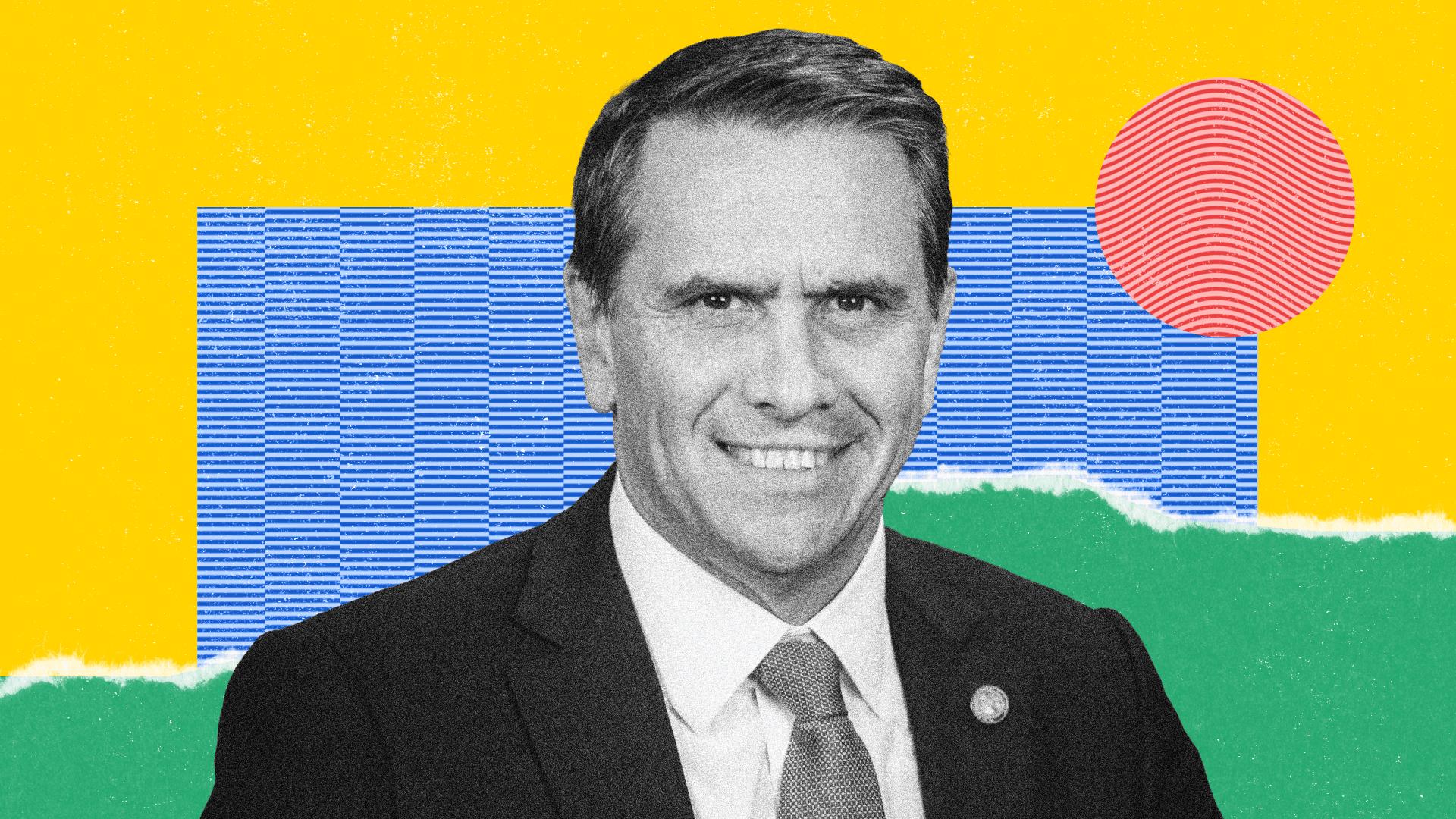

A four-page memo from Deputy Attorney General Todd Blanche instructed the U.S. Department of Justice (DOJ) to exercise greater discretion in prosecuting cryptocurrency cases, halting any actions that “superimpose regulatory frameworks on digital assets” until new frameworks are established by regulatory agencies.

This feature is a part of CoinDesk’s Most Influential 2025 list.

The memo received acclaim from the crypto industry, while also raising concerns about potential leniency towards fraud and other crimes. Attorneys noted in April, following the memo’s release, that they did not anticipate the DOJ reducing enforcement against undeniably fraudulent actions. Instead, they believed the DOJ would wait for clearer guidance from the U.S. Securities and Exchange Commission or Commodity Futures Trading Commission on how different crypto assets may be classified as either securities or commodities.

Assessing the actual impact of the memo is challenging. It’s difficult to determine how many cases the DOJ might have considered but for the memo, and in ongoing issues, prosecutors largely indicated the memo had no bearing.

Defense lawyers for Keonne Rodriguez and William Lonergan Hill asked a court to dismiss the case against Samourai Wallet developers, referencing the memo; both ultimately admitted guilt to a conspiracy count and were sentenced to five and four years in federal prison, respectively. Prosecutors in the case against Terra/Luna creator Do Kwon asserted that the memo was not applicable; Kwon later pleaded guilty to conspiracy and wire fraud and was sentenced to 15 years in prison last week.

In one instance where prosecutors acknowledged adjusting their approach due to the memo, the case against Tornado Cash developer Roman Storm saw only a single part of one charge dismissed; Storm was still found guilty of conspiracy to run an unlicensed money transmission business and is scheduled to be sentenced in the coming months.

Nonetheless, Blanche’s memo indicated a shift in how the DOJ might handle crypto-related cases, reflecting a broader change in federal government outlook under the current administration of President Donald Trump, which appears more supportive of the crypto sector compared to former President Joe Biden’s administration.