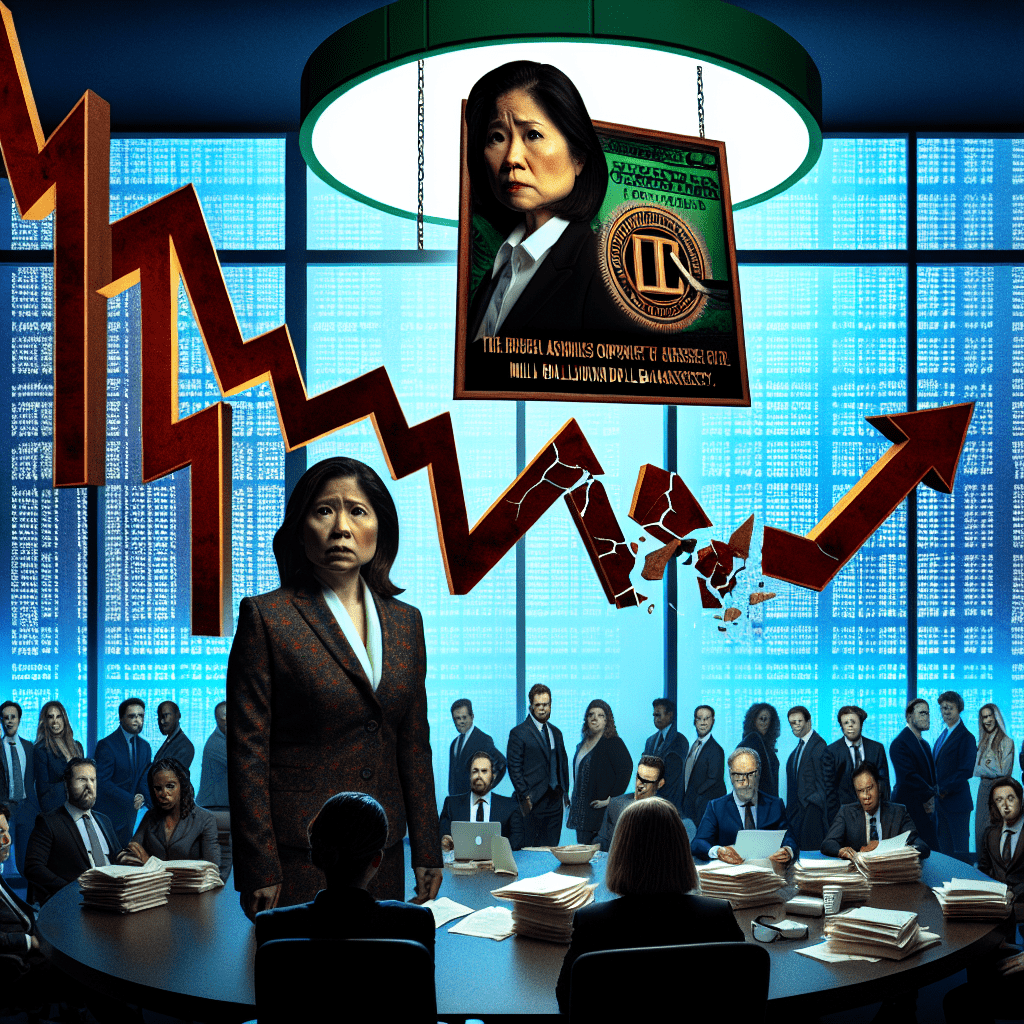

The administrator appointed by the bankruptcy court to manage the aftermath of the Terraform Labs collapse has filed a lawsuit against Jump Trading, alleging that the high-frequency trading firm illegally profited from and contributed to the $40 billion crash, according to the Wall Street Journal.

Todd Snyder, who is responsible for winding down the remaining assets of the crypto enterprise, is seeking $4 billion in damages from Jump Trading, its co-founder William DiSomma, and Kanav Kareiya, who started as an intern and became the platform’s president. Terra’s Post-Chapter 11 X account confirmed the WSJ’s report in a post on X this past Friday.

“Jump Trading exploited the Terraform Labs ecosystem through manipulation, deception, and self-dealing, enriching itself while causing financial ruin for countless unsuspecting investors,” Snyder stated. “This lawsuit is essential to hold Jump Trading accountable for illegal actions that directly led to the most significant crypto collapse ever.”

Terraform Labs collapsed in 2022 when its algorithmic stablecoin TerraUSD (UST) lost its dollar peg, triggering a dramatic market downturn. Within days, its sister token, Luna, fell to nearly zero. The $40 billion collapse erased the savings of hundreds of thousands of investors worldwide and initiated a chain reaction of failures across the cryptocurrency sector, culminating in the downfall of Sam Bankman-Fried’s FTX exchange that November.

The Singapore-based company filed for bankruptcy in January 2024, agreeing soon after to pay approximately $4.5 billion to the U.S. Securities and Exchange Commission (SEC) to settle a civil securities fraud case. Terraform’s founder, Do Kwon, who established the company in 2018, pled guilty in August to two criminal charges and received a 15-year prison sentence last week.

The bankruptcy administrator claimed that Jump Trading had a covert arrangement to support UST before its downfall and ultimately exited Terraform’s failure with billions in profit, according to filings in an Illinois district court.

Prior SEC filings referenced by the WSJ reveal that Jump earned about $1 billion from Luna sales.