Market analysts suggest a significant divide has emerged between Bitcoin enthusiasts and advocates for precious metals following a year of substantial movements in both sectors. Proponents of Bitcoin highlight its impressive long-term gains as evidence of its status as the leading asset, while gold and silver have experienced a remarkable rally that has taken some investors by surprise. Perspectives vary widely, contributing to a vigorous debate.

Related Reading

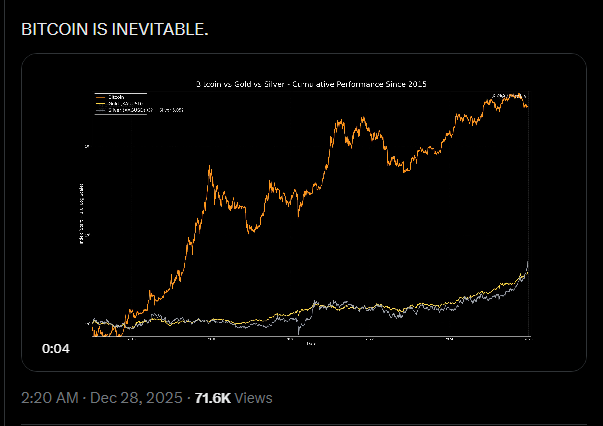

Bitcoin’s Remarkable Growth Since 2015

Since 2015, Bitcoin has surged approximately 27,700%, a statistic highlighted by analyst Adam Livingston. This figure significantly overshadows the gains seen in silver and gold during the same period, which stand at around 400% and 280% respectively.

Livingston contended that even when disregarding the early years of Bitcoin, the cryptocurrency still outperformed the metals considerably. Some interpret this as a definitive victory for the crypto argument, while others remain skeptical.

Bitcoin vs. Silver vs. Gold since January 1st, 2015:

Silver: 405%

Gold: 283%

Bitcoin: 27,701%Even ignoring the first 6 years of Bitcoin’s existence for the crybabies who whine about the timeframe comparison…

…gold and silver drastically underperform the APEX ASSET.… pic.twitter.com/vdAnatqRKG

— Adam Livingston (@AdamBLiv) December 27, 2025

Critics Challenge Timeframes

Gold supporter Peter Schiff encouraged Livingston to consider a shorter time period — the past four years — arguing that Bitcoin’s prime may have already ended. This challenge reflects broader concerns among metal supporters that historical performance may not repeat itself.

Now do the last four years only. Times have changed. Bitcoin’s time has passed.

— Peter Schiff (@PeterSchiff) December 27, 2025

Matt Golliher, co-founder of Orange Horizon Wealth, presented a different viewpoint, noting that commodity prices typically tend to revert toward their production costs, meaning higher prices often lead to increased supply. He highlighted that sources of gold and silver, which were previously unprofitable, are now being mined profitably.

Supply and Macroeconomic Forces Influencing Prices

Both gold and silver soared to new heights in 2025, with gold peaking at around $4,533 per ounce and silver nearing $80 per ounce. Concurrently, the US dollar has weakened, evidenced by a drop of approximately 10% in the US Dollar Index this year.

A number of analysts have linked these developments to anticipated Federal Reserve easing in 2026 and increased geopolitical tensions, which could drive investors toward scarce assets. Peter Grant, a strategist at Zaner Metals, remarked that reduced trading activity and the Fed’s perspective contributed to considerable price fluctuations.

Surprisingly unpopular opinion: Gold and silver do not need to slow down for Bitcoin to do well.

Bitcoiners thinking that needs to happen, are low T, and don’t understand any of these assets.

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) December 28, 2025

Related Reading

Bitcoin’s Trajectory Independent of Metals

Analysts from Glassnode and macro strategists assert that Bitcoin does not necessitate a downturn in gold or silver before it can experience another rise.

James Check, lead analyst at Glassnode, contended that the assets do not need to be in competition with each other. Macro strategist Lyn Alden supported this notion, emphasizing that both can attract interest simultaneously without being direct competitors.

Arthur Hayes additionally noted that Federal Reserve easing and a depreciating dollar should generally elevate scarce assets, encompassing both digital and physical stores of value.

Featured image from Unsplash, chart from TradingView