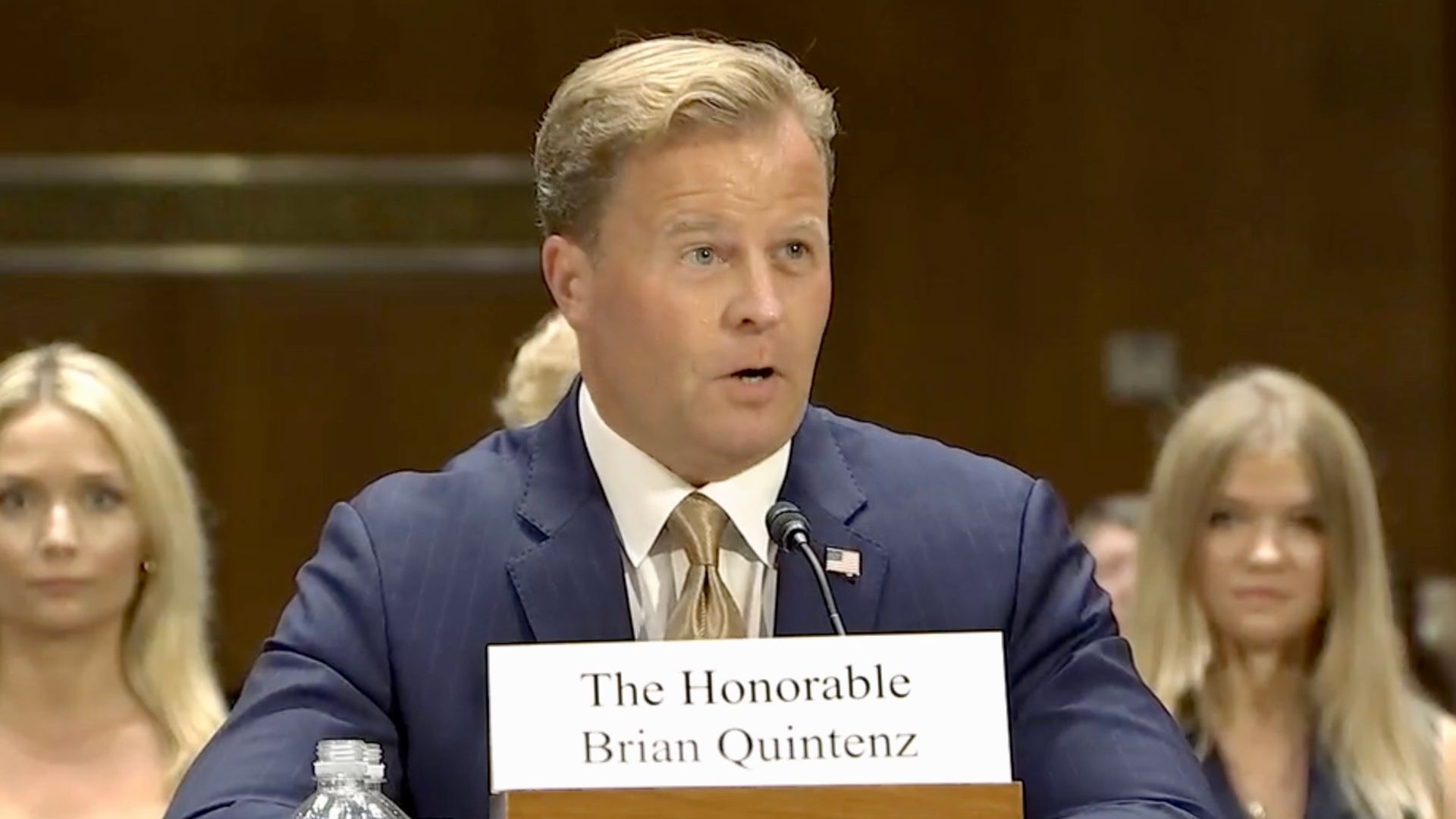

SUI Group (SUIG), a publicly traded company associated with the Sui blockchain ecosystem, has named Brian Quintenz as an independent director on its board, as announced in a press release on Tuesday.

Quintenz will also participate in the board’s audit committee, according to the company.

SUIG shares dipped by 2.2% on Tuesday, while the SUI token maintained its 2026 surge, rising by 14% in the last 24 hours.

This appointment follows the transition of SUI Group’s chief financial officer, Joseph A. Geraci II, from a board position to a board observer role. The board now consists of five members, with three classified as independent according to Nasdaq listing criteria.

Quintenz previously served as a commissioner of the U.S. Commodity Futures Trading Commission (CFTC), having been appointed by Presidents Barack Obama and Donald Trump and confirmed unanimously by the Senate.

During his time at the agency, he oversaw derivatives markets, financial technology, and the initial regulation of bitcoin futures.

Most recently, Quintenz served as global head of policy at a16z crypto, the digital asset division of venture capital firm Andreessen Horowitz, where he managed regulatory and government relations.

He is currently on the board of Kalshi, a CFTC-regulated derivatives exchange, and has provided guidance to companies in digital assets and traditional financial markets.

The White House withdrew Quintenz’s nomination to lead the CFTC in September, ending a month-long battle regarding President Donald Trump’s choice for agency chair. Michael Selig took the oath as the sixteenth Chairman in December.

SUI Group mentioned that this appointment enhances its regulatory and policy knowledge as it works on a treasury strategy focused on the SUI token.

“Brian is a respected figure in the digital asset arena, known for his unique blend of capital markets savvy, regulatory integrity, and in-depth infrastructure expertise,” stated Marius Barnett, chairman of the board, in the announcement.

“His joining our board and backing our SUI treasury strategy is a significant endorsement of both SUIG and the long-term viability of the Sui ecosystem,” he continued.

The company continues to foster a formal alliance with the Sui Foundation, aiming to build what it describes as an institutional-grade digital asset treasury platform, while also maintaining its specialty finance operations.

Read more: Sui Blockchain to Host Native Stablecoins Backed by Ethena and BlackRock’s Tokenized Fund