Strategy’s (MSTR) senior perpetual preferred stock, STRF, is becoming increasingly notable as the company’s leading credit instrument since its debut in March.

Currently trading at $110, STRF has appreciated by 36% since its issuance and has bounced back by 20% from its Nov. 21 low of $92. That same date coincided with bitcoin’s local bottom near $80,000, underscoring the strong relationship between STRF and bitcoin.

STRF is positioned at the top of Strategy’s preferred structure. It offers a fixed 10% annual cash dividend along with governance rights and penalty-based step-ups if payments are missed. Even with its premium pricing reducing the effective yield to about 9.03%, demand is robust due to the security’s senior protections and long-duration credit profile.

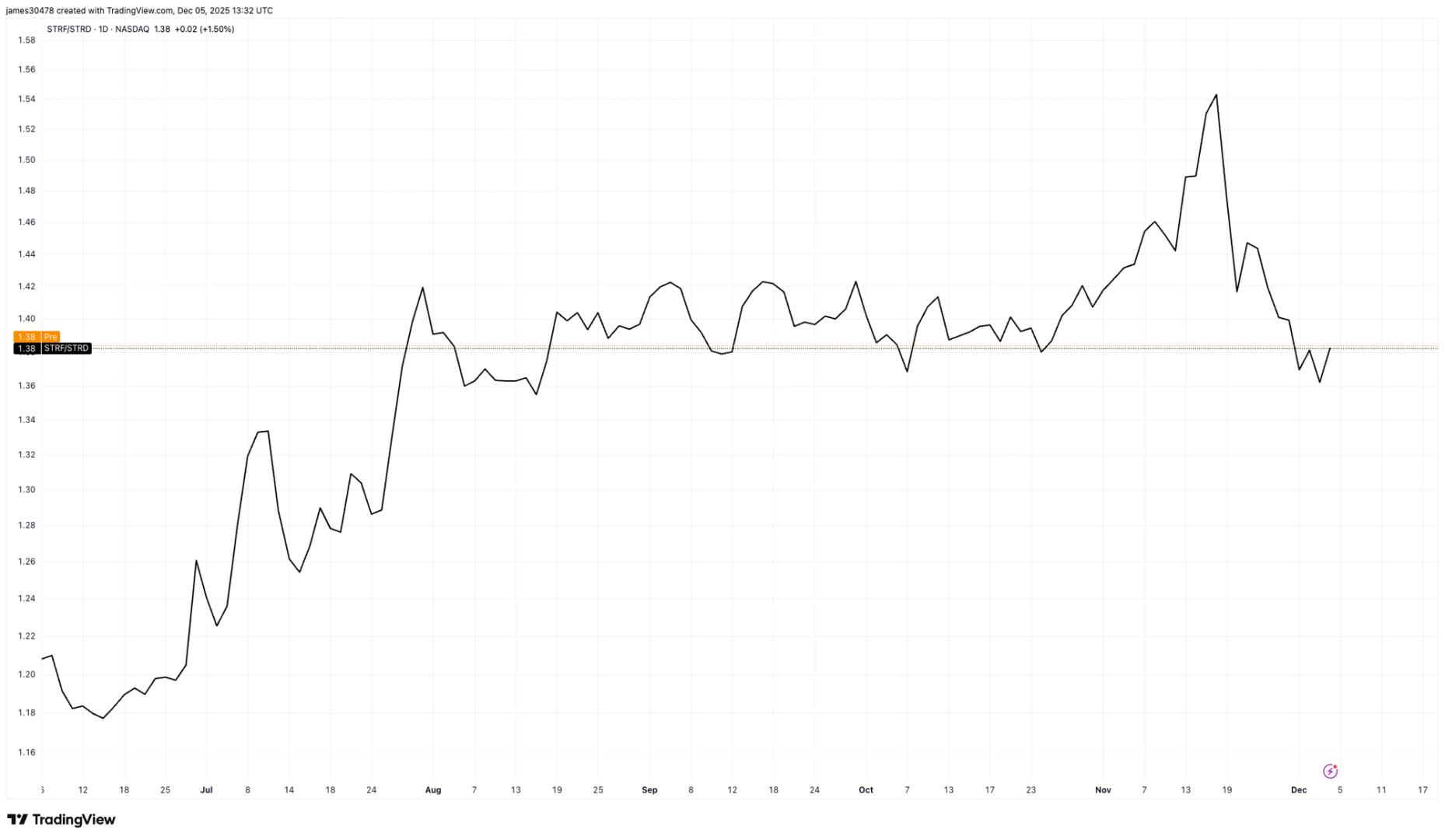

In late October, executive chairman Michael Saylor pointed out an increasing credit spread between STRF and the junior STRD. The spread indicates the additional yield investors expect for holding higher-risk junior securities, now at 12.5%. During the Nov. 21 low, that differential widened to an all-time high of 1.5 as investors flocked to senior exposure, causing STRD to trade as low as $65. The spread has since stabilized around 1.3.

Divergence is now evident within Strategy’s preferred suite. STRC has experienced four dividend rate increases to maintain investor interest.

Strategy’s equity has also rebounded, rising from a Dec. 1 low of $155 to approximately $185, signaling improved sentiment regarding both the company’s balance sheet and the bitcoin market since announcing a $1.44 billion cash reserve earmarked for preferred dividend payments.