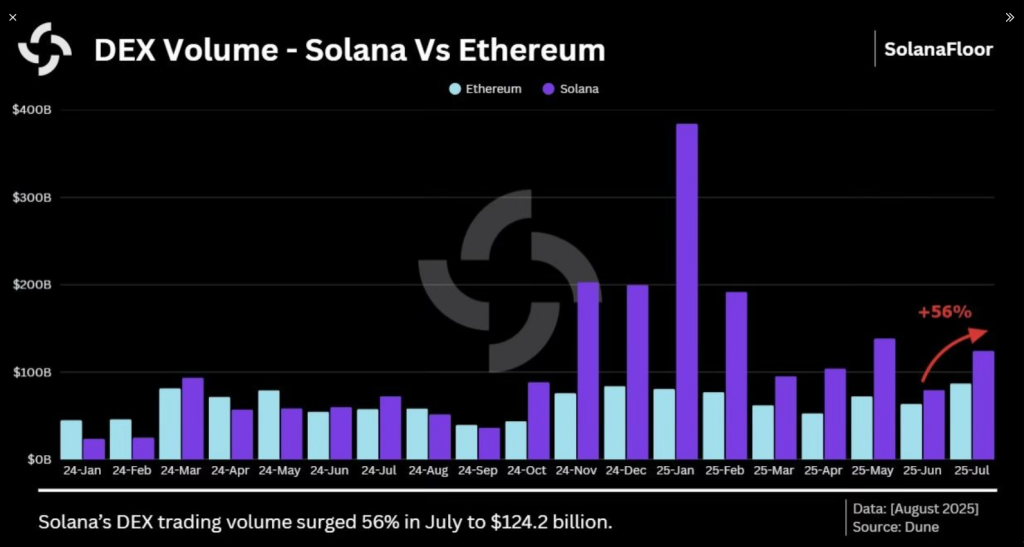

In July, Solana continued to assert its dominance in decentralized finance with impressive performance metrics. Reports reveal that DEX activity on its platform soared to $124 billion, marking a remarkable 10-month winning streak against Ethereum. Analysts note this gives Solana a significant 40% advantage over its competitor in this sector, indicating a noticeable shift in user preferences.

Related Reading

Acceleration Towards Solana

Recent data highlights a notable increase in new projects selecting Solana. Alliance DAO statistics indicate that over 40% of founders opted for Solana in the first half of 2025, a rise from 25% the previous year.

This trend is attributed to Solana’s capability to facilitate a high volume of transactions swiftly and cost-effectively, making it an appealing option for teams developing high-performance DeFi applications.

This week in data from @SolanaFloor:

Solana has surpassed Ethereum in DEX trading volume for the 10th consecutive month, achieving $124B in July, which is 42% higher than Ethereum. pic.twitter.com/TT0nb8wrtm

— Solana (@solana) August 23, 2025

Developers emphasize the need for speed and predictable transaction fees, both of which Solana provides. This migration of creators signifies a pivotal shift in where new liquidity and smart-contract developments occur.

Solana’s DEX volumes are not only increasing but also remaining stable. For ten consecutive months, Solana has outperformed Ethereum in this regard.

This prolonged streak is atypical and indicates robust trading activity and functioning automated market makers on Solana’s network. Observers note that increased DEX engagement can attract more users, leading to a surge in developers—creating a positive feedback loop.

Technical Insights

According to reports, SOL is currently trading above the $205 mark following a recent breakout. The 20-day SMA is situated around $191 and is being observed as a potential short-term support level.

Market indicators are viewed positively, with the MACD reflecting green movement bars, suggesting potential upward momentum to some traders.

$SOL is on a direct trajectory to the moon. 🚀 Following a significant drop, Solana has regained stability and is moving confidently within an upward trend channel. The road to $300 appears clear pic.twitter.com/vR4HdL272O

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) August 24, 2025

Analysts have identified near-term resistance levels at $215, $228, and $240. Kamran Asghar is among those predicting a long-term price target of $300 if the current trends maintain their momentum.

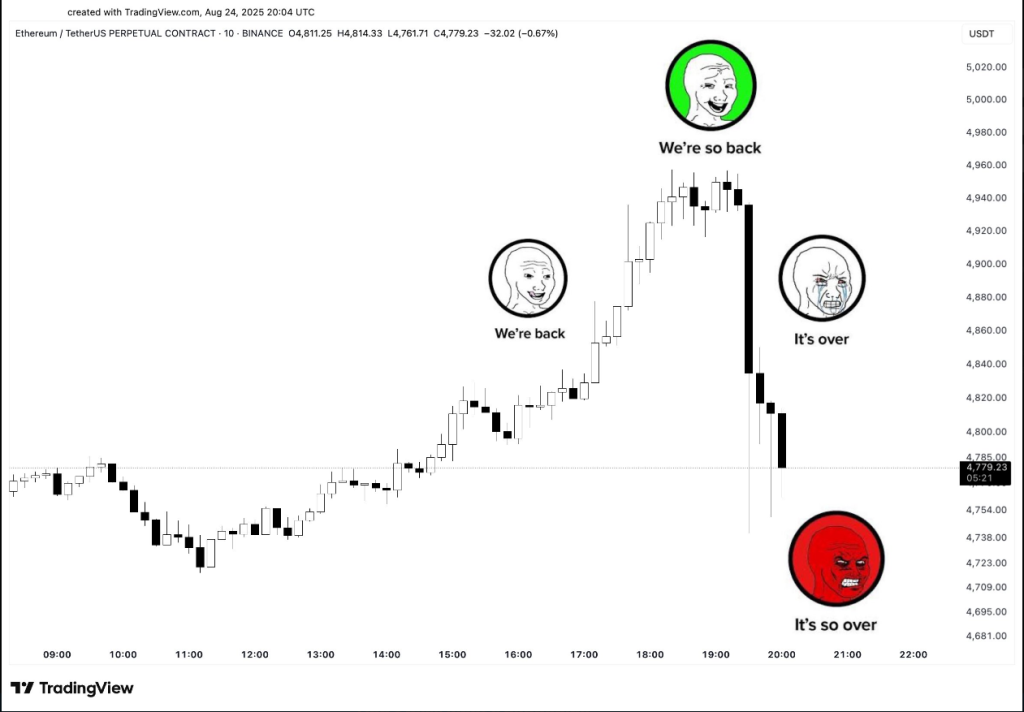

Simultaneously, Ethereum has experienced volatility, dropping below $4,800 and fluctuating from around $4,940 to just under $4,720 within hours, reflecting ongoing market turbulence. Crypto analyst Ali echoed this sentiment on X, expressing a bearish outlook as market sentiment shifted.

IT’S FINISHED! $ETH pic.twitter.com/atcQbHhMJi

— Ali (@ali_charts) August 24, 2025

Related Reading

Solana’s recent gains occur amid ongoing institutional interest in Ethereum, which remains a leader in various metrics.

This juxtaposition suggests a segmentation in market activity—DEX volume gravitating towards one blockchain while institutional flows follow another.

The migration of emerging projects to Solana is viewed as a practical solution to the limits in transaction throughput, rather than a total dismissal of Ethereum.

Featured image from Equiti, chart from TradingView