Michael Saylor’s suggestion regarding a new Bitcoin acquisition has reignited discussions among traders and investors. This comes at a time when on-chain stress indicators are signaling a challenging phase for the network. The combination of significant purchases by public companies and indications of miner strain is capturing the interest of both bullish and bearish traders.

Related Reading

Saylor’s Tracker Signals

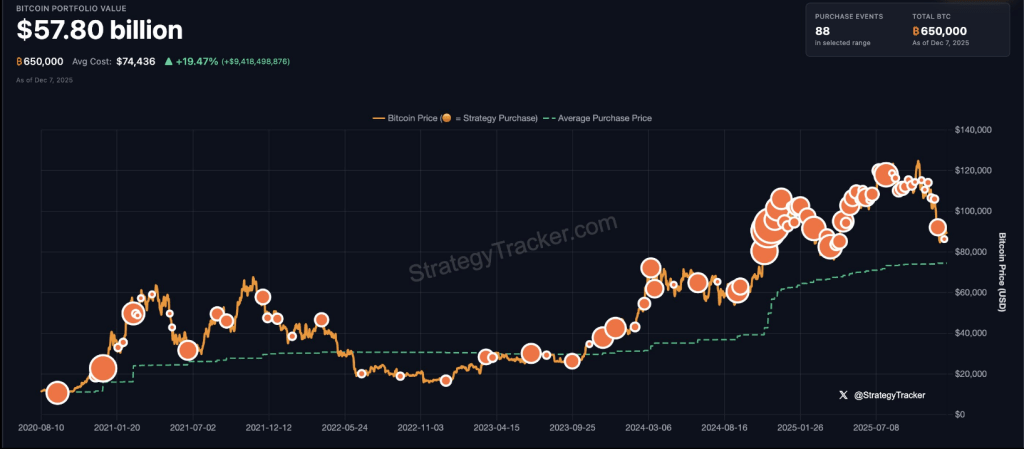

As per a StrategyTracker graph shared by Michael Saylor, Strategy possesses approximately 650,000 BTC, with a portfolio value nearing $58 billion. The graph reflects an average purchase price of $74,436 and highlights 88 confirmed buy instances over time.

Saylor’s caption read, “Back to Orange Dots?” — a brief, recognizable reference that often precedes a new accumulation phase.

Strategy’s latest publicly reported transaction involved a purchase of 130 BTC, consistent with the company’s historical tendency to buy during times of market anxiety. This pattern is significant, as continuous buying through downturns influences the behavior of other investors.

₿ack to Orange Dots? pic.twitter.com/npB0NWSZ52

— Michael Saylor (@saylor) December 7, 2025

Corporate Buying Persists

Reports from BitcoinTreasuries.NET indicate that the top 100 public companies collectively hold about 1,059,453 BTC. ABTC reportedly added 363 BTC, the largest increase this week, while Cango Inc. purchased 130.6 BTC.

Among other companies mentioned in recent filings are Bitdeer, BitFuFu, Hyperscale Data, Genius Group, and Bitcoin Hodl Co. These actions indicate that some firms continue to boost their reserves despite price fluctuations.

For market observers, consistent corporate accumulation can provide stability, although it doesn’t entirely mitigate the broader selling pressure.

On-Chain Stress Indicators

According to Glassnode charts shared by the Bitcoin Archive, the Hash Ribbon has once again moved into bearish territory, indicating that some miners are experiencing strain or possibly halting their operations.

The Short-Term Holder NUPL has dropped below zero, suggesting that many recent buyers are currently holding their coins at a loss. Historically, episodes where miners are under pressure while new holders are facing losses have typically coincided with significant market lows.

While this outcome is not guaranteed, the conjunction of technical miner strain and unrealized losses among short-term wallets is a configuration traders are monitoring closely.

Related Reading

What Traders Are Monitoring Now

Traders are keeping an eye on whether the stress experienced by miners and the losses among new buyers will align with renewed purchases by major holders.

Some analysts believe that corporate acquisitions and purchases by Strategy could help mitigate downside risks and potentially trigger a rebound. Others remain cautious, as on-chain indicators reveal significant strains.

Market behavior surrounding major events, such as central bank announcements, has also illustrated that Bitcoin can hesitate before policy decisions and then react sharply afterward.

Featured image from Unsplash, chart from TradingView