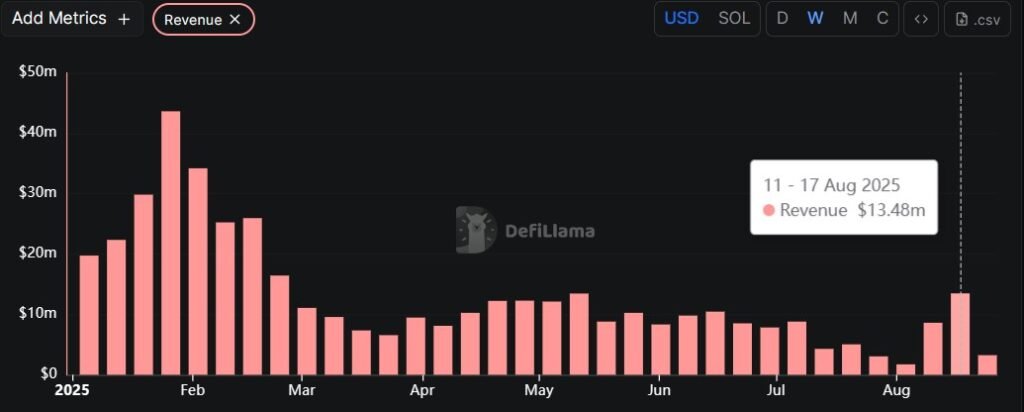

The Solana-based memecoin launchpad Pump.fun experienced one of its best revenue weeks of 2025 in mid-August as the sector rebounded from an earlier dip this month.

Decentralized finance (DeFi) data tracker DefiLlama reported that Pump.fun generated $13.48 million between Aug. 11 and Sunday, marking the platform’s strongest weekly revenue performance since February.

This increase followed a significant revenue drop from July 28 to Aug. 3, where Pump.fun made only $1.72 million in weekly revenue, the lowest figure since March 2024. This downturn contributed to a drop in monthly revenue for July, which was the lowest for the year.

The revenue dip corresponded with a broader decline in the memecoin market. According to CoinMarketCap data, memecoins witnessed a decrease, dropping to a $62.11 billion market cap on Aug. 3, a 20% decrease from the $77.73 billion valuation on July 28, resulting in a loss of nearly $16 billion in just one week.

Pump.fun regains top position in Solana launchpad rankings

The revenue growth for Pump.fun aligns with a rebound in the overall memecoin space.

As per CoinMarketCap, the memecoin sector rebounded to nearly $75 billion on Aug. 11 before settling at $70 billion by Sunday. As of the latest update, memecoins had a total market cap of $66 billion.

Along with achieving its strongest weekly revenue record, the Pump.fun platform has also reclaimed its leadership in the Solana memecoin launchpad rankings.

A newly launched Solana platform, LetsBonk, had taken the lead for 24-hour revenue on July 7, overtaking Pump.fun.

Jupiter, the Solana decentralized exchange (DEX) aggregator, noted that LetsBonk’s dominance persisted throughout July, gaining more market share than Pump.fun on several occasions.

However, data from Jupiter indicates that Pump.fun has reclaimed the top slot. Over the last week, the platform held a 73.6% market share and generated $4.68 billion in trading volume.

Additionally, Jupiter data revealed that the platform registered 1.37 million traders and over 162,000 token mints during the week.

LetsBonk, the closest competitor, lagged behind with a 15.3% market share and a $974 million weekly trading volume, along with 511,000 traders and just over 6,000 token mints.

Related: Nasdaq-listed firm slumps 50% on BONK memecoin treasury play

Pump.fun faces a $5.5 billion lawsuit

Despite its regained momentum, Pump.fun is encountering legal issues. A class-action lawsuit filed on Jan. 30 accuses the platform of employing “guerrilla marketing” tactics to create false urgency around volatile tokens.

The lawsuit was amended on July 23, labeling the memecoin launchpad an “unlicensed casino.” The updated filing claimed that Pump.fun’s structure is akin to a “rigged slot machine,” where only the initial players benefit by dumping their tokens on those who join later. The lawsuit alleges that investor losses have already reached $5.5 billion.

Notwithstanding the legal challenges, the platform continues to perform well. As per a Dune Analytics dashboard, the platform’s cumulative revenue has already topped $800 million.

Co-founder of Solana Labs, Anatoly Yakovenko, commented on the platform’s potential. He stated that the platform has the potential to evolve into a global streaming service.

Magazine: Solana Seeker review: Is the $500 crypto phone worth it?