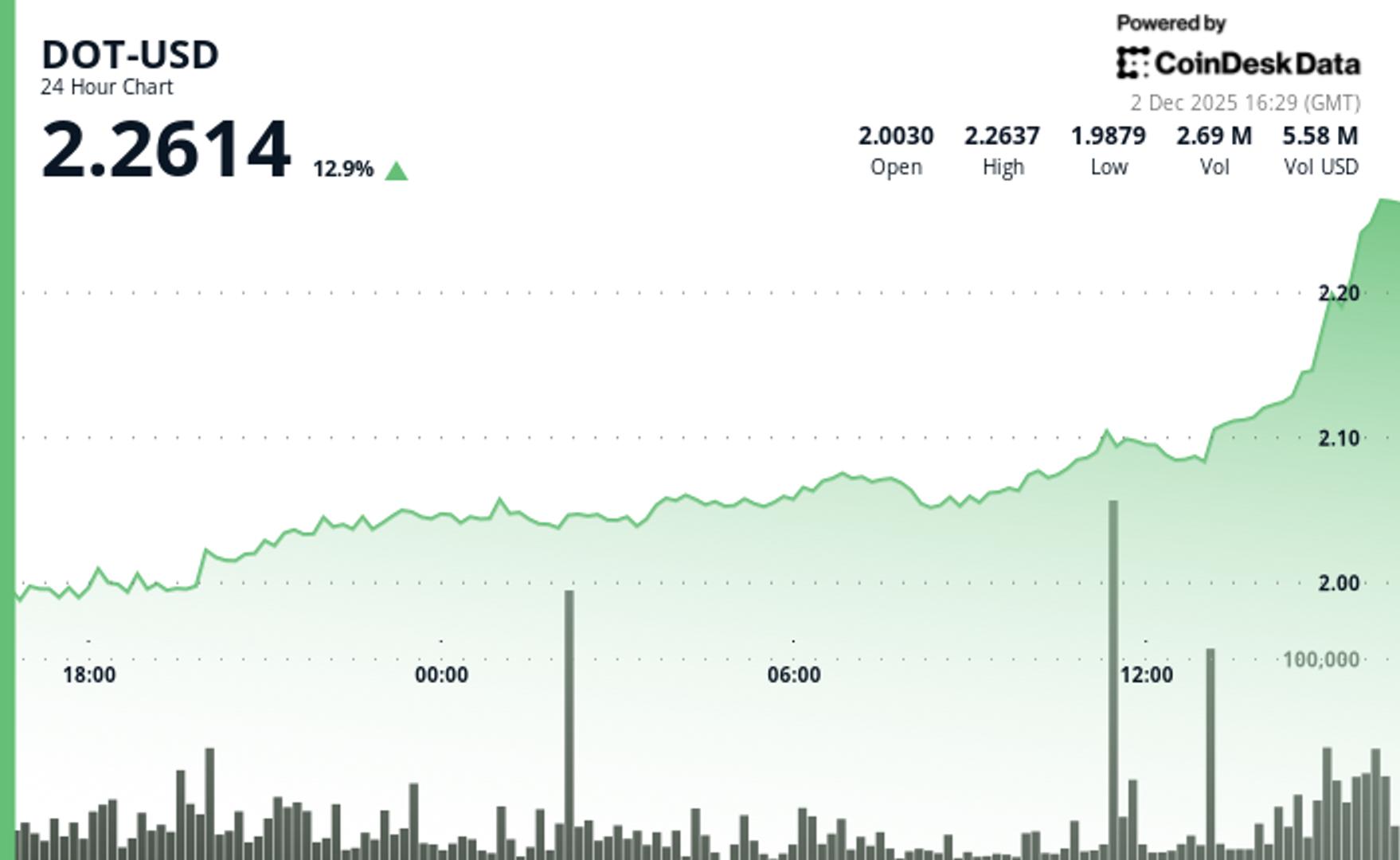

surged 13% to $2.26 in the past 24 hours, accompanied by a notable increase in volume.

The token started at $1.99 and maintained a steady upward trend throughout the 24-hour period, demonstrating strong technical positioning relative to the wider cryptocurrency markets, as noted by CoinDesk Research’s technical analysis model.

Volume patterns indicated authentic institutional engagement rather than mere retail speculation, the model emphasized. DOT’s trading volume over the past 24 hours surpassed weekly averages by 34%.

In contrast, the broader market index, the CoinDesk 20 index, saw a 9% increase during the same timeframe. DOT’s superior performance implies that specific asset factors influenced its price movements.

Recent trading activity reflects consistent bullish momentum, according to the analysis model. DOT advanced from $2.141 to $2.245 in the latest hour, achieving a 4.9% increase above initial breakout levels.

The rally established higher lows at $2.186 and $2.193 before breaking through the $2.220 resistance on remarkable volume, exceeding 200K, in a concentrated three-minute period.

Technical Analysis:

- Key support is maintained at $2.05 with the former $2.15 resistance now serving as support; next target is set at the $2.30 psychological level

- Breakout volume of 6.43M surpassed the 24-hour SMA by 195%, confirming institutional support for the move

- Ascending trend exhibiting higher highs and lows; successful breakout from the $2.00-$2.15 consolidation zone

- Immediate target is $2.30; stop-loss below $2.05 support sustains an appealing 3:1 reward-to-risk ratio

Disclaimer: Portions of this article were produced with AI tools and vetted by our editorial team to ensure precision and compliance with our standards. For further details, see CoinDesk’s complete AI Policy.