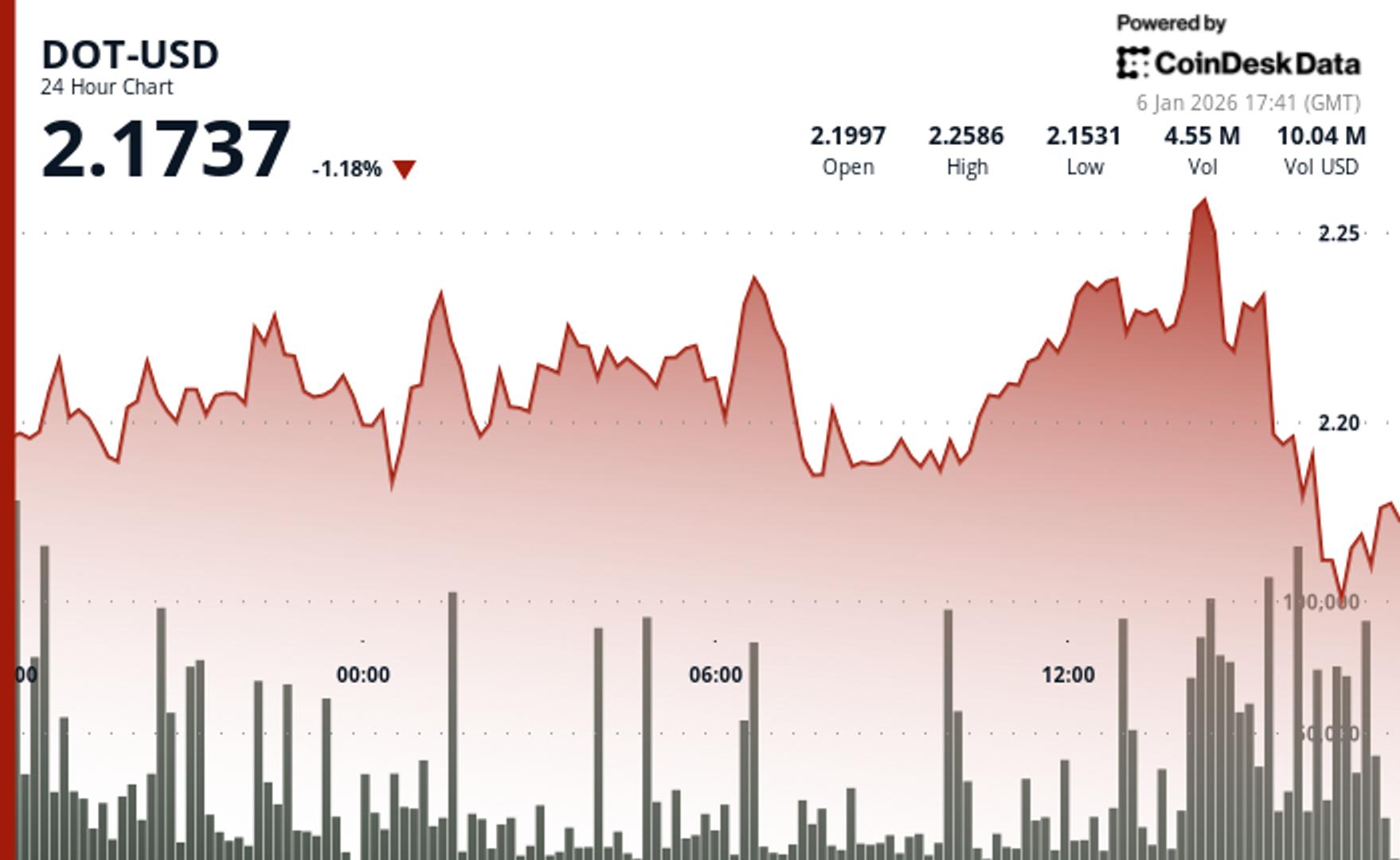

surrendered its earlier gains in a sharp downturn on Tuesday, trading 3.3% lower over the last 24 hours.

The token lagged behind the broader cryptocurrency markets. At publication time, the Coindesk 20 index was down 1.3%.

DOT’s trading volume was 17% above the 30-day moving average, indicating institutional selling rather than retail capitulation, as per the technical analysis from CoinDesk Research.

The day started with DOT rising to $2.17 amid increasing participation, closely aligned with the overall cryptocurrency market trends.

Resistance in the $2.24-2.26 range thwarted a breakout attempt, paving the way for the subsequent decline, according to the analysis.

Price decline intensified as DOT broke through several support levels in three distinct capitulation waves, as highlighted by the model.

This plunge below the significant $2.19 support level negated daily gains and left portfolio managers exposed to increased volatility risks.

Technical Insights:

- Immediate resistance now established at $2.19

- Critical support at the demand zone of $2.14-2.15

- 24-hour volume was elevated 17% over the 30-day moving average

- Breakout failure at $2.26 confirmed a strong resistance area

- Significant downtrend with lower highs at $2.203, $2.191, $2.187, and $2.167

- Technical structure shifted decisively bearish

- Recovery resistance: $2.19 must be reclaimed to counteract breakdown

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For complete details, see CoinDesk’s full AI Policy.