Sure! Here’s a rewritten version of the content while maintaining the original HTML tags:

MSTR stock experienced a significant drop on Monday, establishing a strongly bearish trend that indicates a potential 30% decrease in the upcoming weeks.

Summary

- MSTR stock has created a death cross pattern on its daily chart.

- This pattern suggests a forthcoming dip of 30% in the near future.

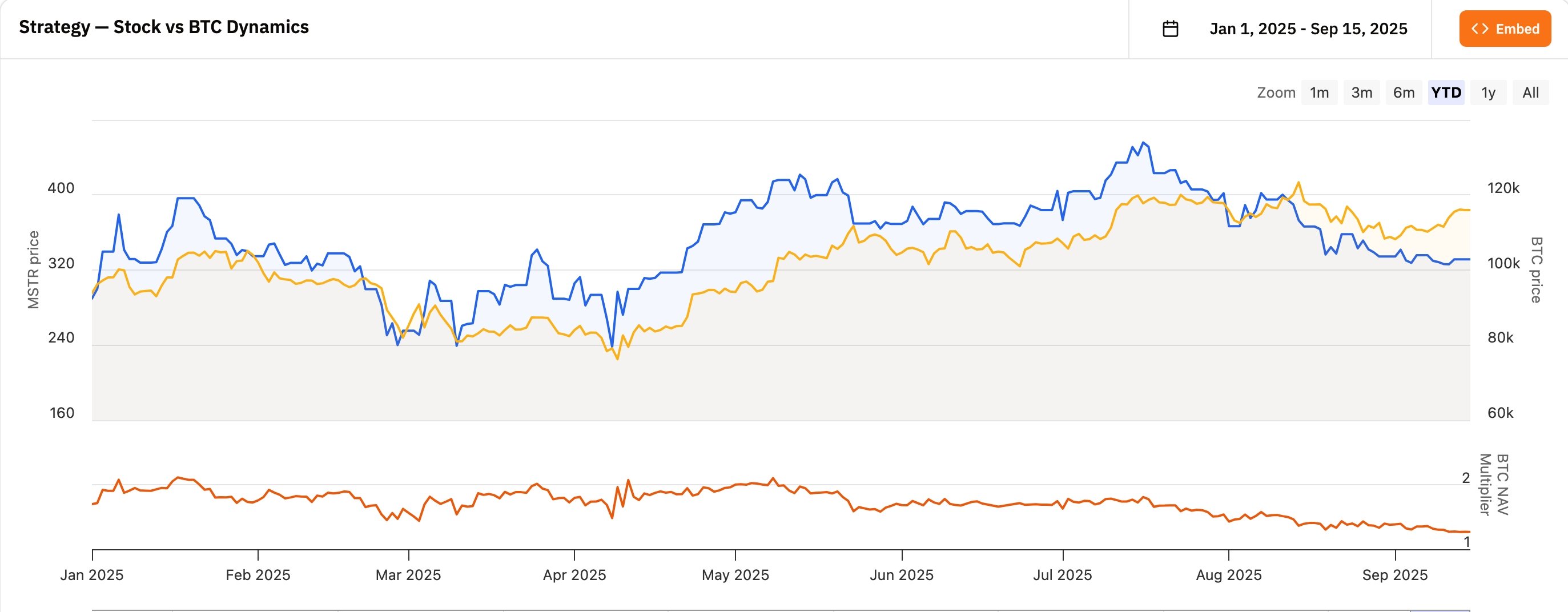

- The NAV of Strategy continues on a strong downward trajectory.

Michael Saylor’s Strategy has fallen to $323, marking its lowest point since April and representing a 40% decline from its peak in 2023. It has lagged behind Bitcoin (BTC), which sits roughly 7.2% below its year-to-date high.

Technical analysis of MSTR stock price indicates more downside

The daily chart reflects that the Strategy share price has been in a pronounced downtrend over the last several months, having breached crucial support at $360, the low from May.

Crucially, a death cross pattern has emerged, with the 50-day and 200-day weighted moving averages crossing each other. Such a crossover typically leads to additional declines.

Oscillator indicators further suggest that the stock may continue its decline. The Relative Strength Index is trending downward and is close to the oversold territory around 30. Additionally, the Percentage Price Oscillator is also on a downward path.

Consequently, the most probable outlook for MSTR stock price is bearish, with the next target set at $230, which corresponds to the March low and is approximately 30% below the current price.

Declining mNAV and rising dilution concerns

A significant worry among investors is the downward trend of Strategy’s modified net asset value (mNAV), which currently stands at 1.25, down from a peak of 3.4 last year.

The mNAV is crucial for Strategy as it reflects the additional value investors attribute to its Bitcoin holdings. Historically, the company followed a policy of refraining from issuing shares when the mNAV fell below 2.5 until Saylor altered this policy in August.

As a result, there are ongoing concerns regarding potential shareholder dilution, as the company primarily depends on at-the-market offerings for capital raising, instead of issuing preferred shares.

The price of MSTR stock has plummeted due to diminishing interest in treasury companies. A closer examination reveals that many Bitcoin treasury firms, including Metaplanet, Trump Media, Bullish, KindlyMD, and Semler Scientific, have also seen their stock prices tumble.