Morgan Stanley has announced new allocation limits for cryptocurrencies in client portfolios as it gears up to facilitate retail crypto trading next year.

Summary

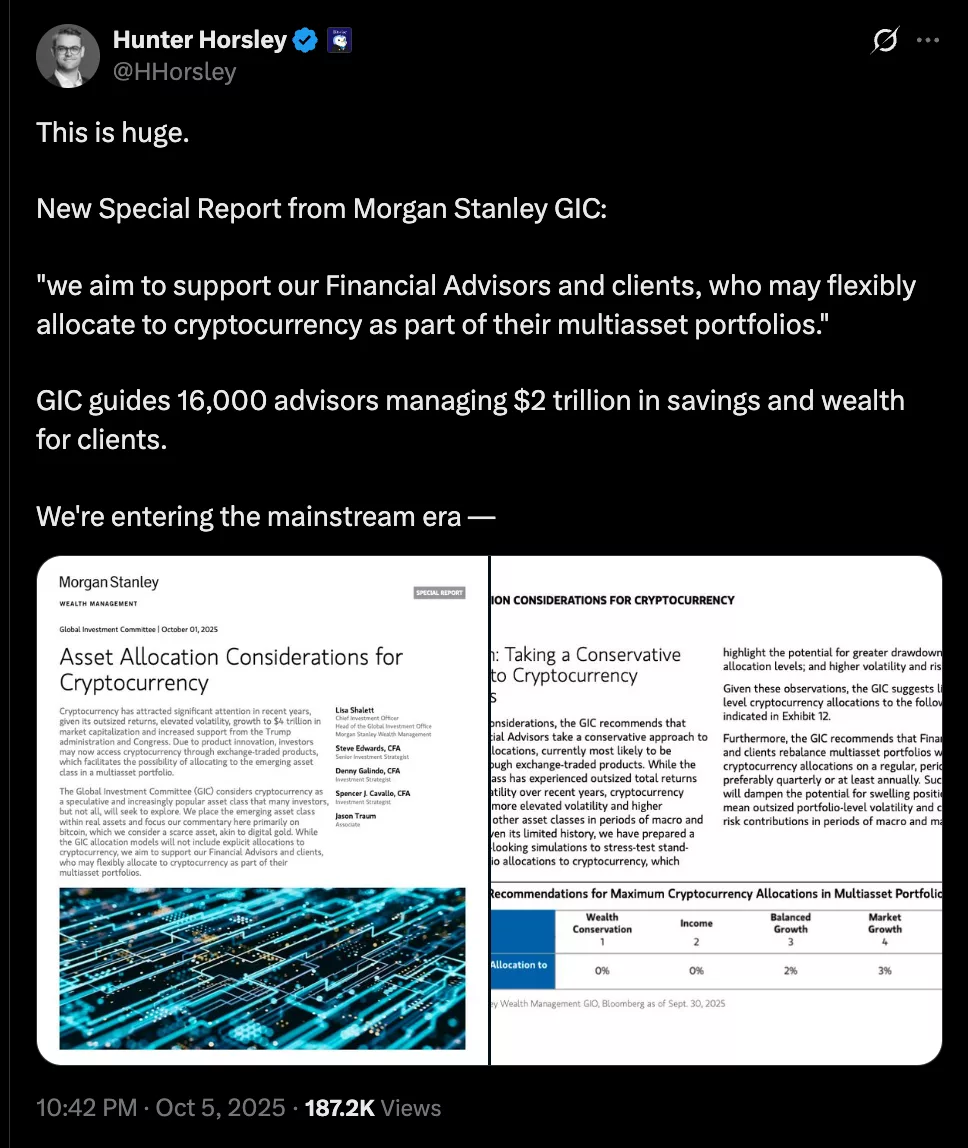

- Morgan Stanley analysts suggest a maximum crypto allocation of 4% in selected client portfolios.

- The financial firm considers Bitcoin as a form of digital gold.

- Morgan Stanley plans to offer retail crypto trading through its subsidiary, E-Trade.

In a report from the October Global Investment Committee, Morgan Stanley analysts advocated for cautious exposure in model portfolios, recommending 1% to 2% for income and balanced growth strategies, and up to 4% for those focused on “opportunistic growth.”

“While the GIC allocation models will not feature specific allocations to cryptocurrency, our objective is to aid our Financial Advisors and clients, allowing for flexible cryptocurrency allocations within their multi-asset portfolios,” the report indicated.

Morgan Stanley analysts are mainly concentrating on Bitcoin, as they consider it a scarce asset similar to digital gold, providing long-term value in diversified portfolios. However, they advised financial advisors to adopt a “conservative approach” due to the asset class’s volatile nature and its tendency to align with broader markets during stressful periods.

“GIC recommends that Financial Advisors and clients periodically rebalance multi-asset portfolios that include cryptocurrency allocations: ideally quarterly or at least annually,” the authors noted, emphasizing that rebalancing can help align risk with portfolio goals and prevent excessive exposure to one asset class over time.

In light of the developments, Bitwise CEO Hunter Horsley remarked that cryptocurrencies are moving into the “mainstream era,” calling the report a “significant” breakthrough.

Morgan Stanley Eyes Crypto Trading in 2026

Morgan Stanley has advocated for a thoughtful allocation and disciplined portfolio management strategy, as institutions increasingly adopt Bitcoin as a treasury asset and a long-term store of value. The leading cryptocurrency has recently reached a new all-time high above $125,000, fueled by institutional demand, with retail investors eager to follow suit.

The financial services powerhouse is also crafting plans to leverage this demand and is working towards introducing crypto trading through its discount brokerage platform, E-Trade, which it acquired in 2020.

To enhance the platform, Morgan Stanley has teamed up with the crypto startup Zerohash, though specific details regarding the integration and the timeline for product rollout remain undecided. Early reports hint at a potential launch in 2026.