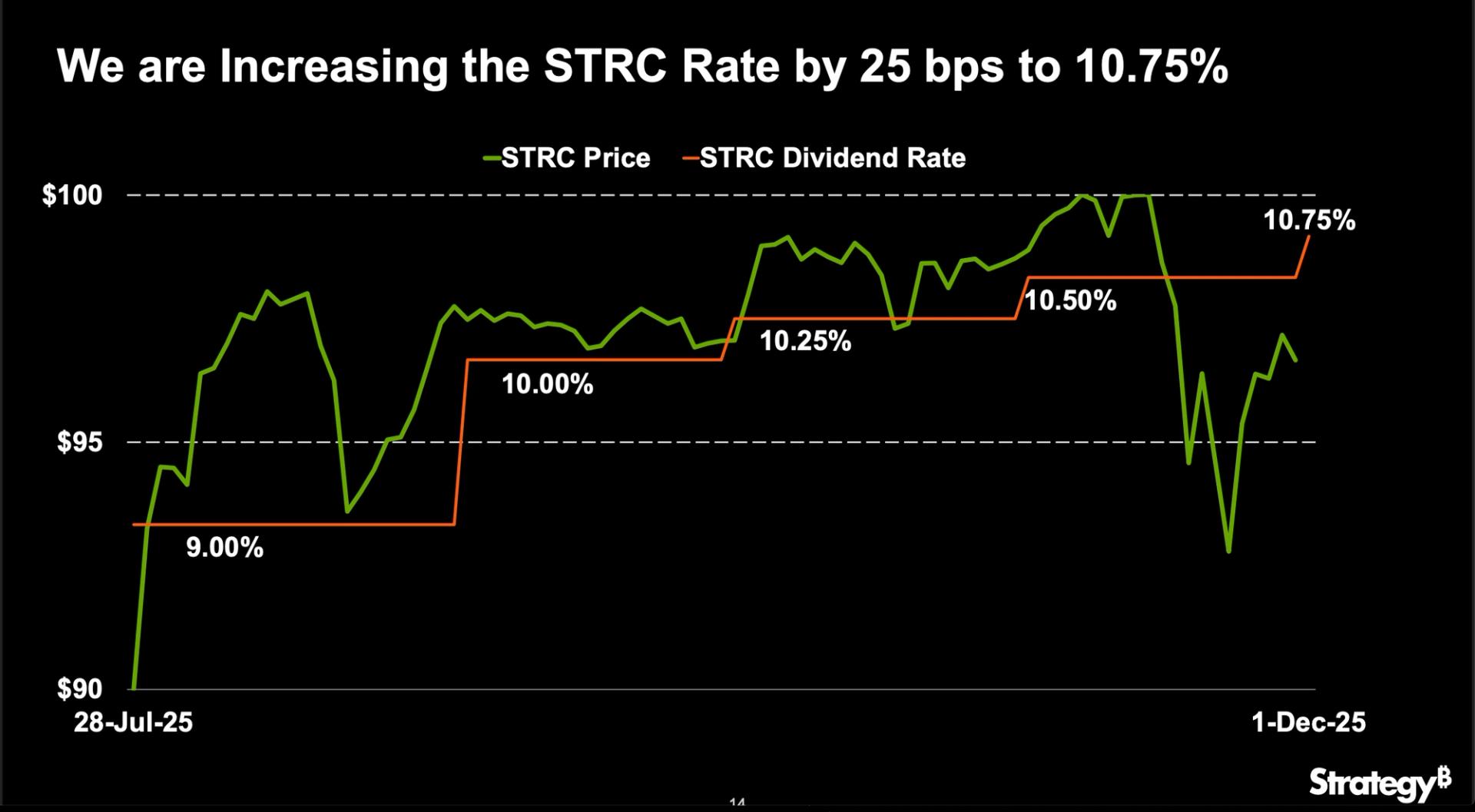

On Monday, Strategy (MSTR) revealed a further increase of 25 basis points in the dividend rate of its STRC preferred series, raising it to 10.75%. This marks the fourth rise since the IPO launch at the end of July.

The STRC, or “Stretch,” is one of Strategy’s perpetual preferred stocks, tailored to provide short-duration characteristics alongside high yield exposure. Currently, it offers a 10.75% annual dividend, paid out monthly in cash. The dividend rate is adjusted monthly to promote trading around STRC’s $100 par value while minimizing price volatility.

When initially launched in July, STRC had a dividend rate of 9% at the IPO price of $90. The company subsequently increased the dividend rate twice to 10.25%, but STRC still didn’t meet par. A third adjustment finally brought the price to $100, yet the decline in bitcoin prices and Strategy’s common stock impacted STRC, which dipped to approximately $90 during the November panic, prompting this recent increase.

As of press time, STRC was trading at $98.43.

The revised dividend rate announcement coincided with news of a $1.44 billion cash reserve aimed at funding perpetual preferred dividends. The annualized total dividend obligation for all perpetual preferred shares stands at about $800 million. Per the investor presentation, the company is projected to have 74 years of dividend coverage relative to its $59 billion bitcoin reserve. Nonetheless, the $1.44 billion cash reserve is anticipated to be the primary source for funding dividends in the near term.