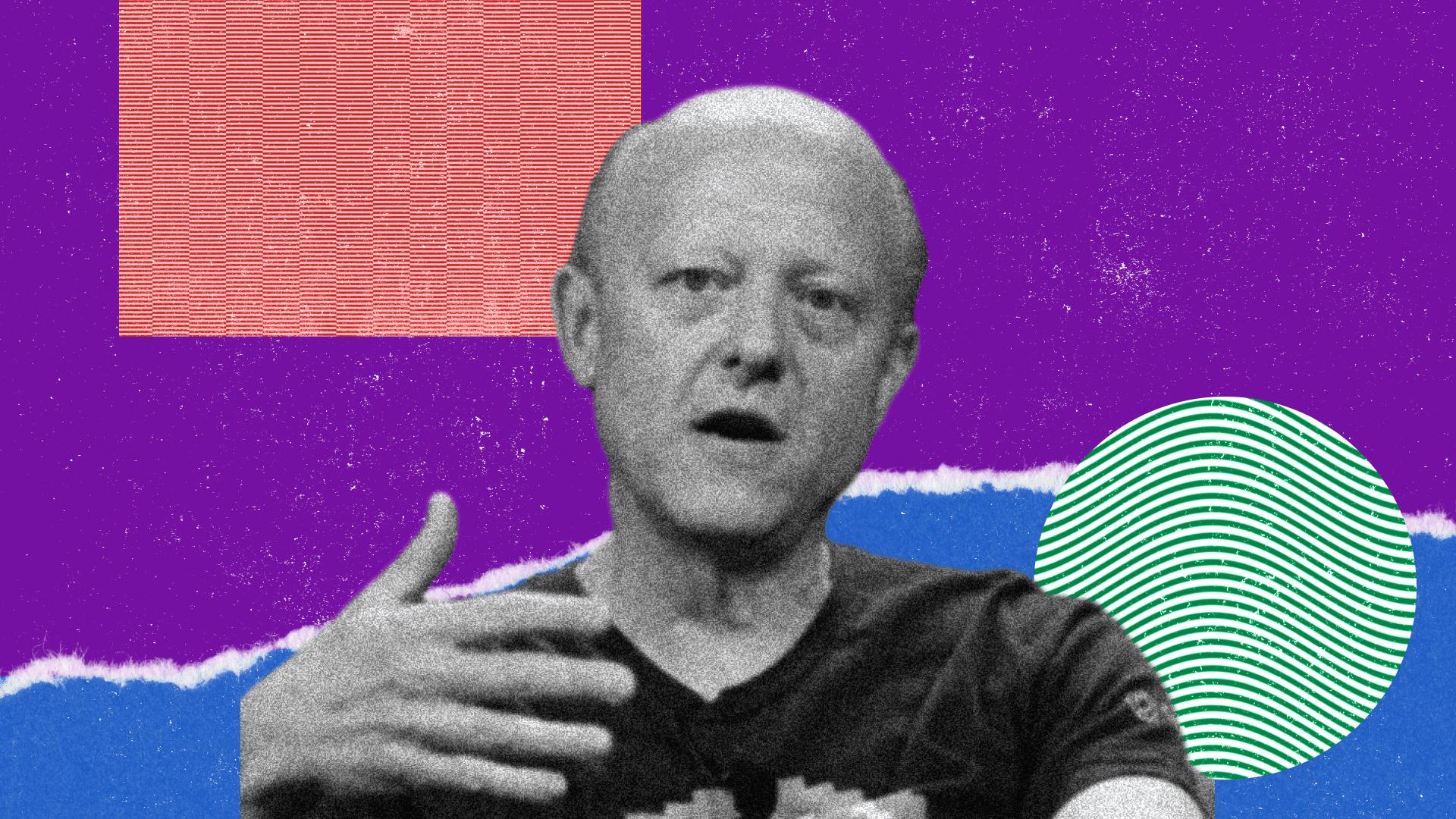

Circle (CRCL) Co-founder, Chairman and CEO Jeremy Allaire dedicated 2025 to transforming a longstanding belief—that dollar-backed digital currencies would become essential financial infrastructure—into a mainstream policy and tech initiative.

This feature is part of CoinDesk’s Most Influential 2025 list.

Allaire expressed pride in the robust regulatory groundwork of his company’s fiat-backed stablecoin, USD Coin (USDC), which ranks as the second-largest stablecoin by market cap. During a Feb. 25 interview with Bloomberg, he indirectly criticized competitor Tether’s stablecoin , stating: “It shouldn’t be a free pass, right? Where you can just ignore U.S. law and operate however you like while selling into the United States.”

“This concerns consumer protection and financial integrity,” Allaire elaborated. “Regardless of whether you’re an offshore firm or based in Hong Kong, if you intend to offer your dollar stablecoin in the U.S., you ought to register in the U.S. just as we must do in every other location.”

Allaire’s advocacy in Washington was pivotal in driving the Guiding and Establishing National Innovation for U.S. Stablecoins Act, or the GENIUS Act, the first federal legislation to create licensing and reserve standards for payment stablecoins, which passed the U.S. Senate on June 17 and the House on July 17 before being signed into law by President Trump on July 18.

On June 30, in a Circle press release announcing the company’s application to the Office of the Comptroller of the Currency (OCC) for establishing a national trust bank, First National Digital Currency Bank, N.A., Allaire stated, “Establishing a national digital currency trust bank of this nature marks a significant milestone in our mission to create a transparent, efficient, and accessible internet financial system.”

In the fall, Allaire’s strategic focus shifted toward Arc, the institutional blockchain Circle launched as a foundation for regulated, dollar-denominated financial transactions.

In late October, while speaking with CNBC’s Sara Eisen at the Future Investment Initiative in Riyadh, Saudi Arabia, he referred to Arc as “an economic OS for the internet,” designed for payments, foreign exchange, lending, and capital markets workflows with sub-second settlement, privacy controls, and predictable dollar-priced fees.

He remarked that demand for USDC in emerging markets was “very significant,” highlighting the Middle East, and mentioned that over 100 companies across banking, payments, technology, and AI were testing Arc’s public testnet as of Oct. 28 in anticipation of a planned mainnet launch in 2026.

Allaire concluded the year by broadening the conversation even further.

In a Dec. 4 discussion with WIRED’s Steven Levy, he described blockchain networks as “economic OS paradigms,” asserting that the transition to programmable financial systems will play a “huge role in shaping the internet over the next five to ten years.”

His influence in 2025 was founded on more than just products or policy achievements. It stemmed from his ability to articulate a clear vision for digital dollars, embrace federal oversight, and advocate for an institutional blockchain agenda—cementing his status as a key figure in defining the landscape of programmable finance in the coming years.