Crypto mogul James Wynn stated that the downturn in the market during August is concluding, despite facing a recent liquidation of his memecoin holdings attributed to a supposed market maker “cabal.”

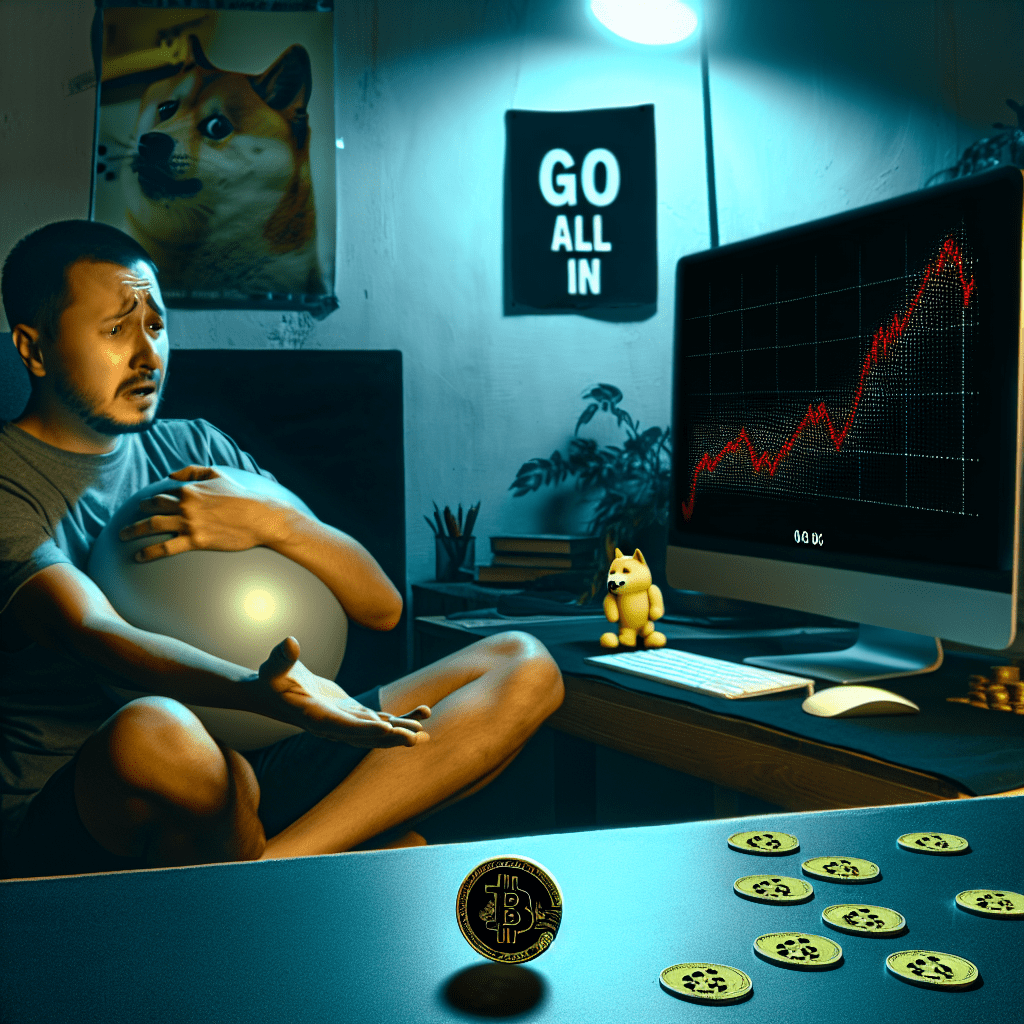

Wynn was liquidated on his latest 10x leveraged long position that anticipated a rise in Dogecoin (DOGE) prices, incurring a loss of $22,627, as indicated by blockchain data platform Onchain Lens in a Monday X post.

This loss is relatively modest for Wynn compared to the $100 million leveraged position that was liquidated on May 30, which occurred when BTC temporarily dropped below a 10-day low of $105,000.

Wynn attributed his recent liquidation to cryptocurrency market makers who he claims “wiped out” the leveraged long positions, suggesting this could indicate the end of the market correction.

“Timeline bearish and predicting the bear market. Time to go max long,” the millionaire leverage trader expressed in a Tuesday X post.

Leveraged positions utilize borrowed funds to amplify an investment, which can increase the magnitude of both profits and losses, rendering leveraged trading riskier than spot trading.

Related: Ether trader nearly wiped out after epic run from $125K to $43M

Nonetheless, Wynn has recorded a total loss of $21.7 million on a single account since March 19, when he commenced trading using wallet 0x5078 on the decentralized exchange Hyperliquid, according to data from Hyperdash.

The latest liquidation occurred less than two months after Wynn suffered nearly $25 million in losses on June 5, following the liquidation of a $100 million Bitcoin bet made on June 3.

After initiating a second $100 million leveraged Bitcoin position, Wynn claimed that coordinated actions from major market players were intentionally targeting his liquidation threshold.

Related: Mystery whale opens $300M leveraged Bitcoin bet: James Wynn alt account?

James Wynn accuses memecoin ‘cabal’ of exploitative practices

Wynn criticized the memecoin “cabal” for exploitative market tactics, including “orchestrated pump and dump” schemes.

“Forget the memecoin cabal; you provide them with supply, and they just dump it back on you. They’re thieving scavengers,” he declared in a Saturday X post, adding:

“I’m creating my own meme coins. Where KOLs receive absolutely nothing.”

This year, Wynn has faced multiple liquidations on memecoins, including a loss exceeding $1 million on his 10x leveraged Pepe (PEPE) position, which was valued at approximately $11.2 million when opened on July 20, as reported by Cointelegraph.

Magazine: Altcoin season 2025 is fast approaching… but the rules have altered