Decentralized Physical Infrastructure Networks (DePIN) was one of the most talked-about sectors in crypto and experienced substantial growth in 2024. However, as crypto metas like meme coins, NFTs, and others regain traction, DePIN has struggled to maintain its momentum.

This year, it has fallen behind in the race for investor attention. Nonetheless, Naman Kabra, CEO and co-founder of NodeOps, a DePIN protocol, emphasized that the sector isn’t dead; rather, it will have an inevitable breakthrough in 2025.

Why Was DePIN Famous?

Naman Kabra explained that DePIN’s initial growth was driven by crypto’s promise of decentralizing critical infrastructure. Projects like Helium demonstrated how decentralized networks could efficiently deploy physical infrastructure, outpacing traditional telecom providers.

“This wasn’t cost arbitrage but proof that decentralized coordination could outperform centralized planning in complex infrastructure deployment. For those of us who understood Bitcoin’s distributed consensus breakthrough, seeing similar principles applied to physical infrastructure felt like crypto’s natural evolution,” Kabra told BeInCrypto.

He added that DePIN offered investors a solution to the artificial scarcity and geographic monopolies controlled by traditional providers. For developers, it provided the chance to build on infrastructure that would grow more decentralized over time rather than succumb to the rent extraction and platform risk posed by centralized services.

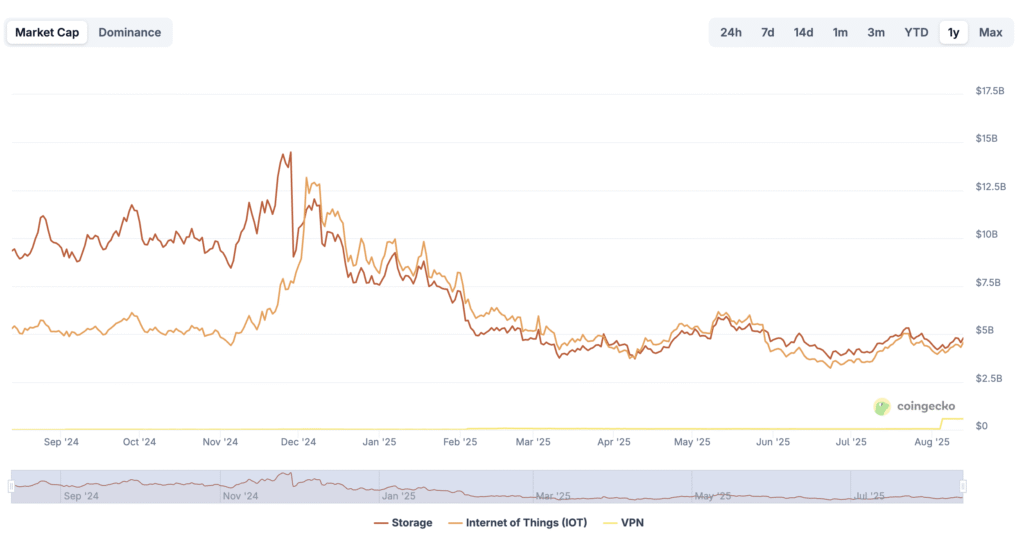

Nonetheless, this year the sector hasn’t had the best time. According to Onchain Magazine, the total market capitalization of DePIN projects reached $25 billion in 2024. However, since then, the market has experienced a noticeable decline in value.

Despite this, Kabra noted this ‘slowdown’ is simply the sector maturing. He said that this process,

“Represents the sector’s transition from speculative excitement to infrastructure reality, a process that always appears less dynamic than token-driven narratives but creates more sustainable value.”

Kabra also drew parallels to Bitcoin’s evolution, from cypherpunk curiosity to institutional infrastructure.

“Early Bitcoin adoption was driven by ideological conviction and speculative opportunity. The first major cycle brought mainstream attention but also unsustainable expectations. The crash and subsequent bear market winnowed out projects that couldn’t deliver utility without speculative support. DePIN is following a similar path,” he mentioned.

Kabra stressed that the initial surge of interest provided crucial attention and capital to validate the technical viability of DePIN projects. Now, in this ‘apparent slowdown’ phase, focus is shifting from speculative token growth to proving long-term utility. Thus, filtering out weaker projects ultimately strengthens the sector by highlighting what approaches deliver real value.

Why DePIN’s ‘Boring’ Trajectory Is Its Biggest Strength in 2025

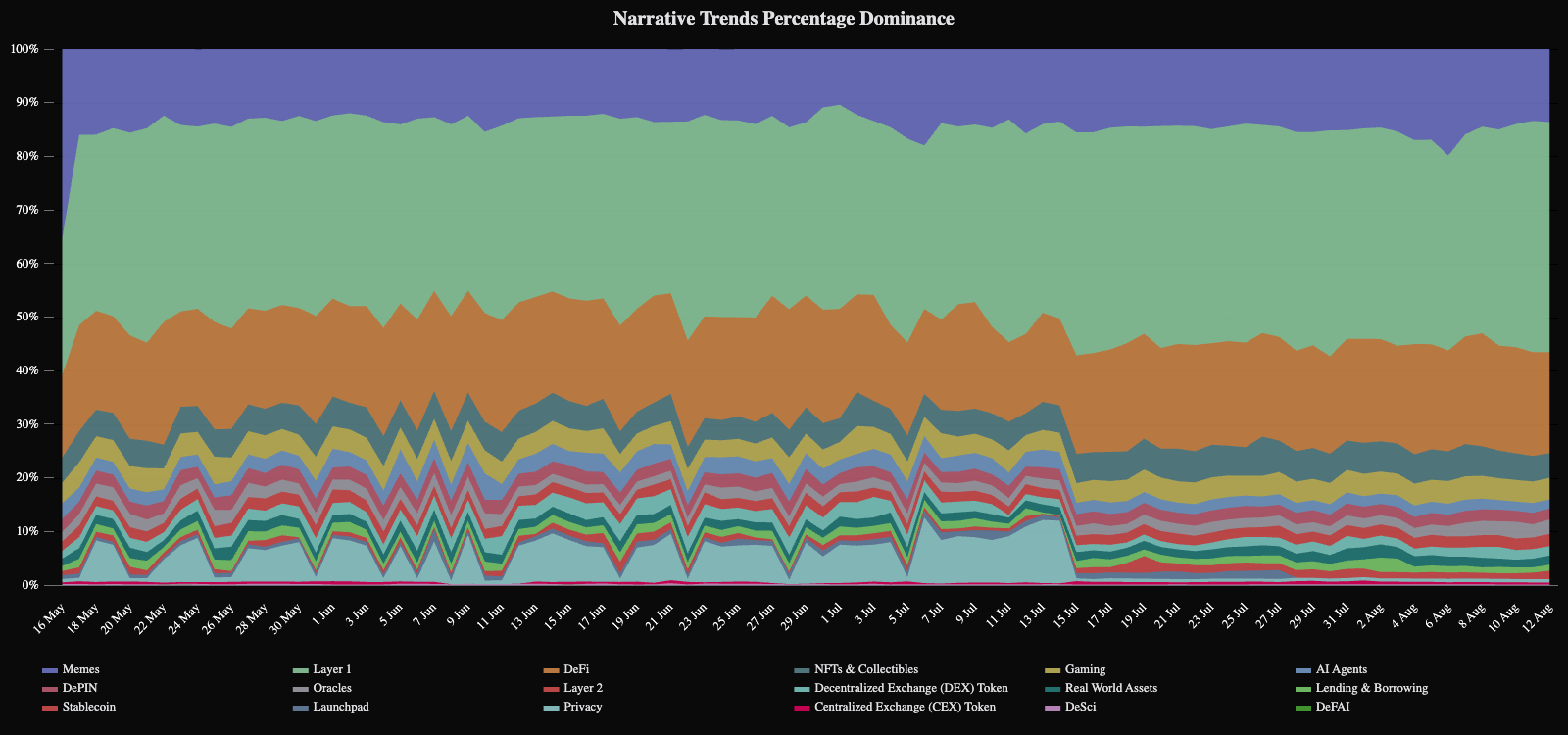

While DePIN’s potential is strong, its popularity isn’t. According to data from Sharpe AI, over the past three months, layer1, DeFi, meme coins, and real-world assets’ mindshare has grown, continuing to dominate crypto discussions. In contrast, DePIN remains a little far down in this list.

This raises the question: Is DePIN the most boring crypto narrative in 2025? According to Kabra, this narrative that DePIN is ‘boring’ reveals a fundamental misunderstanding of how transformative infrastructure operates.

“This perception actually signals DePIN’s maturation beyond speculative excitement into genuine utility. The most successful technologies become invisible precisely because they work so well they fade into the background,” the executive said

Kabra pointed out that technologies like TCP/IP protocols and Amazon Web Services, though crucial to our digital lives, rarely make headlines or trend on social media. This invisibility paradox suggests that DePIN is transitioning towards real utility, moving beyond speculative hype into something more foundational and impactful.

“Infrastructure becomes interesting only when it fails, see for example power grids make headlines during blackouts, internet providers trend during outages. DePIN’s ‘boring’ trajectory indicates it’s achieving the ultimate infrastructure goal: reliable invisibility. While crypto focuses on meme coins and AI tokens, DePIN builders are constructing the infrastructure foundations for Web3’s next phase,” he added.

The DePIN proponent also noted that the sector faces a mismatch with crypto’s attention economy. In the crypto space, narrative velocity, short-term price fluctuations, and speculative excitement often overshadow the delivery of real utility and long-term value.

DePIN operates on infrastructure timelines, measured in years of steady development, whereas crypto’s attention spans are more attuned to rapid narrative cycles measured in just weeks.

This leads to the undervaluation of the sector, which generates real revenue from service delivery, compared to tokens promising unproven breakthroughs.

“The irony is profound: while speculators chase AI tokens that may never deliver on their promises, DePIN networks are solving real infrastructure problems that become more valuable as AI adoption accelerates. The computing resources needed for AI workloads don’t materialize from token speculation—they require the unglamorous work of coordinating distributed hardware, managing service quality, and creating reliable infrastructure,” Kabra highlighted.

He stated that the ultimate goal for DePIN isn’t to win mindshare within the crypto space but to become so integral to digital operations that its decentralized nature fades into the background as essential infrastructure.

“DePIN can be as boring as water… until you’re thirsty. And for many organizations facing AI-driven compute scarcity and cloud oligopoly pricing, that thirst is approaching rapidly,” Kabra commented.

Is DePIN Dead? Here’s Why 2025 Marks Its Revival

Meanwhile, Kabra emphasized that DePIN is not going anywhere and will have a breakthrough this year.

“Far from being dead, 2025 marks DePIN’s inevitable breakthrough, not through speculative fervor, but through the quiet revolution of shared ownership meeting genuine necessity,” he disclosed to BeInCrypto.

Kabra argued that DePIN represents a return to crypto’s core principles. It offers a solution beyond the false choice between institutional adoption and mainstream utility. Furthermore, the space creates enterprise-grade and community-owned networks, addressing the growing scarcity of infrastructure driven by AI demand.

He added that as centralized providers focus on profit, DePIN provides a decentralized alternative that is becoming essential. This shift mirrors historical patterns, like the rise of alternative lending platforms after the 2008 financial crisis.

“The choice won’t be between decentralized and centralized infrastructure but between shared ownership and digital feudalism. DePIN offers a path where infrastructure serves users rather than extracting from them, where network effects benefit participants rather than platform owners,” Kabra declared.

Expert Sees Untapped Potential in DePIN

The NodeOps CEO outlined several key opportunities for innovation within the DePIN space, emphasizing that it is far from reaching its peak.

“Rather than reaching peak innovation, DePIN is entering its most crucial development phase. The infrastructure layer of any technology stack typically follows a predictable evolution: initial proof of concept, speculative expansion, market correction, and mature optimization,” Kabra claimed.

He explained that DePIN’s modular approach enables horizontal innovation throughout the infrastructure stack. The opportunities include:

- AI-Native Infrastructure: DePIN can optimize infrastructure for AI workloads, offering dynamic resource allocation, specialized hardware for AI tasks, and geographic distribution for edge computing. This addresses demands that traditional infrastructure struggles to meet.

- Edge Computing Democratization: DePIN networks are well-suited for the distributed model required by the growing number of IoT devices. By coordinating resources across diverse locations, rather than relying on centralized data centers, DePIN can optimize for latency, cost, and reliability.

- Revenue-Based Tokenomics: Kabra highlighted the potential for DePIN projects to implement burn-and-mint mechanisms tied to infrastructure usage. This would establish sustainable token demand based on utility.

- Hybrid Economic Models: Innovation is also happening in combining traditional business models with cryptoeconomic coordination, which can expand DePIN’s appeal beyond crypto-native users.

- Evolving Economic Coordination Models: Lastly, he pointed out that a critical innovation opportunity lies in moving beyond simple token-for-service models to more sophisticated economic mechanisms. Early DePIN projects faced challenges with token utility design, creating artificial demand through staking or governance participation that didn’t align with the actual infrastructure value.

Kabra also identified several promising, yet underexplored, use cases for DePIN, offering new opportunities.

“The most promising unexplored territory lies at the DeFi-DePIN intersection, where infrastructure becomes financialized through new primitives. We’re seeing early experiments in infrastructure bonds, compute futures, and bandwidth derivatives that let users hedge or speculate on network capacity,” he revealed.

The expert drew attention to another significant frontier: the transformation from “rented ownership” to true ownership. In this model, end-user devices such as smartphones, laptops, or IoT devices become monetizable network nodes.

“This creates new economic models where users capture value from their own infrastructure usage rather than paying rent to platforms. These primitives enable infrastructure-backed lending, yield farming on network capacity, and governance tokens tied to actual resource provision—fundamentally restructuring how we interact with and benefit from digital infrastructure,” Kabra elaborated.

What Is Hindering DePIN’s Adoption?

In addition to focusing on its use cases, Kabra acknowledged several challenges preventing DePIN from mass adoption.

- Technical Complexity: This arises from the gap between blockchain development and traditional IT expectations. Early projects required users to manage crypto wallets and understand tokenomics, creating friction.

- User Engagement: These issues stem from forcing users to act as token traders, creating barriers for organizations that want infrastructure without crypto complications.

- Coordination Challenges: It involves balancing supply and demand, with DePIN needing to bootstrap both sides while maintaining decentralization.

He explained that the solution to improving user engagement lies in creating multiple interaction layers. In this system, crypto users can engage directly with tokens, while mainstream users access infrastructure through traditional methods.

To tackle coordination challenges, Kabra suggested,

“The breakthrough occurs as networks reach critical mass, where market dynamics become self-sustaining. Early adopters provide initial supply and demand, token incentives bridge the gap during growth phases, and eventual network effects create organic coordination that doesn’t require constant intervention.”

What Will Make DePIN Interesting Again?

While Kabra advocated previously that DePIN doesn’t need to win mindshare, he still acknowledged the need to take steps to attract investor attention again.

“DePIN projects need to ignite curiosity rather than hide behind boring infrastructure narratives! The opportunity lies in making decentralized infrastructure irresistibly compelling—not just functionally superior,” he remarked.

According to him, to regain momentum in 2025 and beyond, DePIN projects can:

- Gamify Participation: Make infrastructure engaging by offering interactive experiences like deploying nodes, earning credits, or contributing bandwidth.

- Create Multi-Channel Experiences: Host events, workshops, and challenges that turn infrastructure into tangible, shareable moments.

- Form Strategic Partnerships: Collaborate with traditional infrastructure giants while demonstrating DePIN’s advantages, creating market tension.

- Introduce Novel Access Models: Use subscription, pay-per-use, or passive income models to make infrastructure personally compelling.

- Promote Shared Ownership: Help users realize they co-own the internet’s future, fostering a sense of belonging and empowerment.

- Create a Movement: Position decentralized infrastructure as a movement, not just a service, to inspire excitement and participation.

Thus, these strategies can make DePIN more engaging, compelling, and attractive to users and investors.

The post Is DePIN Dead? Expert Reveals Why 2025 Will Be Its Breakthrough Year appeared first on BeInCrypto.