The IREN stock price has plummeted by more than 55% from its peak this year due to heightened concerns about the artificial intelligence bubble.

Summary

- IREN shares have fallen 55% from their year-to-date high.

- They have reached their lowest point since September of this year.

- Ongoing worries about the AI bubble persist.

After reaching an all-time high of $76 in November, the stock has dropped to $35 today. This decline coincides with similar downturns for companies like CoreWeave, Nebius, and Bitfarms.

The downturn for IREN has worsened following last week’s earnings announcements from leading AI firms such as Oracle and Broadcom. Oracle reported negative free cash flow due to significant spending on data centers, resulting in a decline of over 50% from its peak this year.

Funding concerns also linger. Recently, the company secured over $2 billion through a mix of equity and convertible debt, which is crucial for enhancing its footprint in the AI sector, notably after receiving a $9.7 billion order from Microsoft.

Competition is intensifying as more Bitcoin (BTC) mining firms enter the field. For instance, Hut 8 recently secured a $10 billion order from Anthropic. Other neocloud players such as Lambda Labs, Nebius, and CoreWeave are also expanding their market share.

This increased competition gives potential customers more leverage, potentially impacting pricing and profit margins.

IREN stock is experiencing downward pressure as Bitcoin continues to struggle. Its price has fallen from $126,250 in October to the current $87,000. While IREN is classified as a neocloud infrastructure company, it mainly earns revenue from Bitcoin mining, so a drop in Bitcoin prices could lead to decreased earnings.

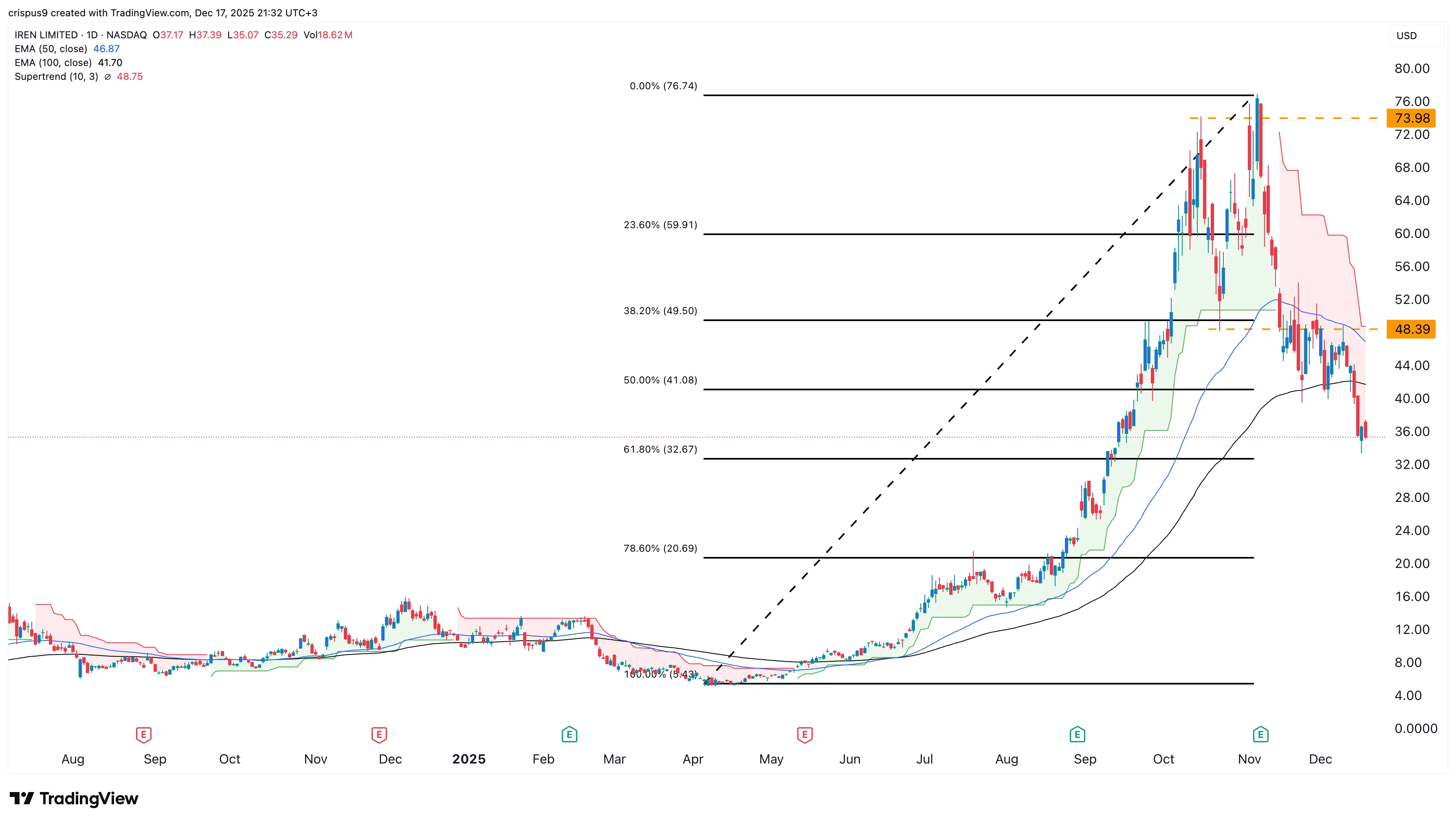

Technical Analysis of IREN Stock Price

Analysis of the daily chart shows a significant decline in the IREN share price over the last few days, dropping from $77 to $35 and falling below the 50% Fibonacci Retracement level.

IREN is trading below both the 50-day and 100-day Exponential Moving Averages, indicating bearish trends. It has also dipped under the Supertrend indicator and the critical support level at $48.40, marking its lowest point on October 23rd.

Consequently, the stock is likely to continue its downward trajectory as sellers aim for the key support level at $20. A breakout above the $48 resistance level would negate the current bearish outlook.