Hut 8 (HUT), a bitcoin mining and digital infrastructure firm, experienced a surge on Tuesday after announcing plans to double its power capacity with four new locations in the US. These initiatives, backed by a $2.4 billion liquidity framework, will enhance the company’s position in the bitcoin mining and digital infrastructure space.

Shares climbed 10.49% to close at $25.91, reaching the highest point in seven months, even while bitcoin traded below $110,000.

Four New Projects Across the US Add 1.5 GW

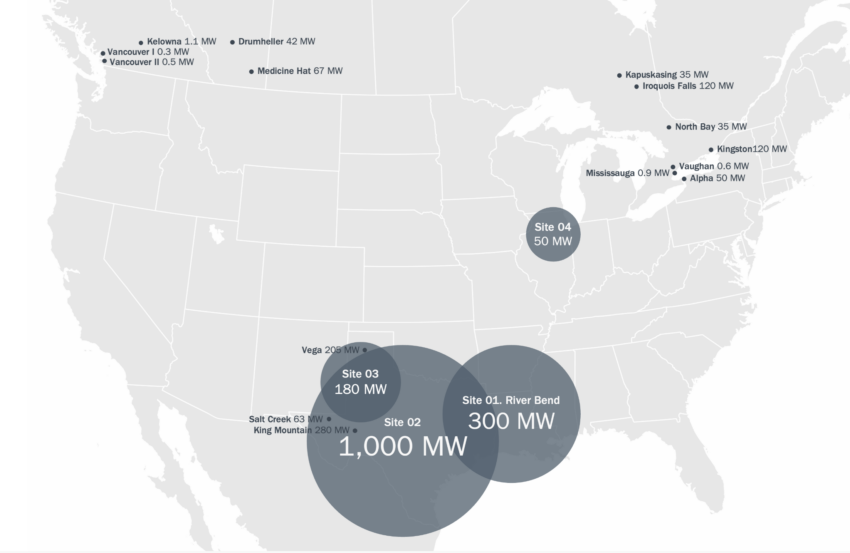

Hut 8 (HUT) announced the construction of four new facilities totaling 1,530 megawatts (MW) of power capacity across Louisiana, Texas, and Illinois. The projects vary in size from 50 MW to a massive 1,000 MW and are connected to regional power networks for quicker deployment.

Two sites in Texas under the ERCOT grid will contribute 1,180 MW. Louisiana’s facility, linked to MISO, will add 300 MW, while Illinois will see a 50 MW project connected to PJM. The company has reclassified these assets from “exclusivity” to “development,” indicating that land and power agreements are secured and design work is actively underway.

Once operational, Hut 8 anticipates managing over 2.5 gigawatts across 19 sites. This represents the initial phase of a multi-gigawatt growth strategy in North America. As of August 25, 2025, the firm reported a wider development pipeline of 10,620 MW, with more than 14% currently in an active development phase.

Executives stated that this structured strategy assists in methodically moving projects through design, buildout, and commercialization while maintaining financial discipline. In a press release, CEO Asher Genoot highlighted the strategic significance of the initiatives. “Hut 8 is moving with purpose to secure prime sites that will anchor our next decade of growth,” he remarked.

The stock increased 10.49% to close at $25.91 following the news, but remains significantly below its all-time closing high of $79.40 recorded on November 8, 2021. That peak coincided with Bitcoin’s rise above $64,800 during the third halving cycle.

$2.4 Billion Liquidity Backed by Coinbase

To facilitate the expansion, Hut 8 has secured up to $2.4 billion in liquidity through a combination of bitcoin holdings, credit facilities, and equity programs. The company currently possesses 10,278 bitcoins, valued at approximately $1.2 billion.

Additional financing includes a $200 million revolving credit line with Two Prime and a $130 million expanded loan from Coinbase, providing a total of $330 million in liquidity at an average interest rate of 8.4%. Hut 8 has also initiated a $1 billion at-the-market (ATM) equity program to improve flexibility, following the retirement of a prior ATM program that was only partially utilized.

Rising Demand and Peer Rally with TeraWulf

This announcement arrives as the demand for data centers and computational power grows exponentially, propelled by advancements in artificial intelligence. Tech companies are increasingly seeking partnerships with bitcoin miners for infrastructure solutions. Earlier this year, Google acquired a minority stake in TeraWulf as part of a $3.2 billion AI infrastructure initiative.

“This expansion marks a defining step in Hut 8’s evolution into one of the largest energy and digital infrastructure platforms in the world,” CEO Asher Genoot stated.

Investment bank Roth Capital described the expansion as a “notable step-up,” indicating that the projects could significantly enhance Hut 8’s stock value once the new locations become operational and begin servicing AI and high-performance computing demands.

The post Hut 8 Stock Jumps 10% on $2.4B US Projects appeared first on BeInCrypto.