Sure! Here’s the rewritten content with the HTML tags preserved:

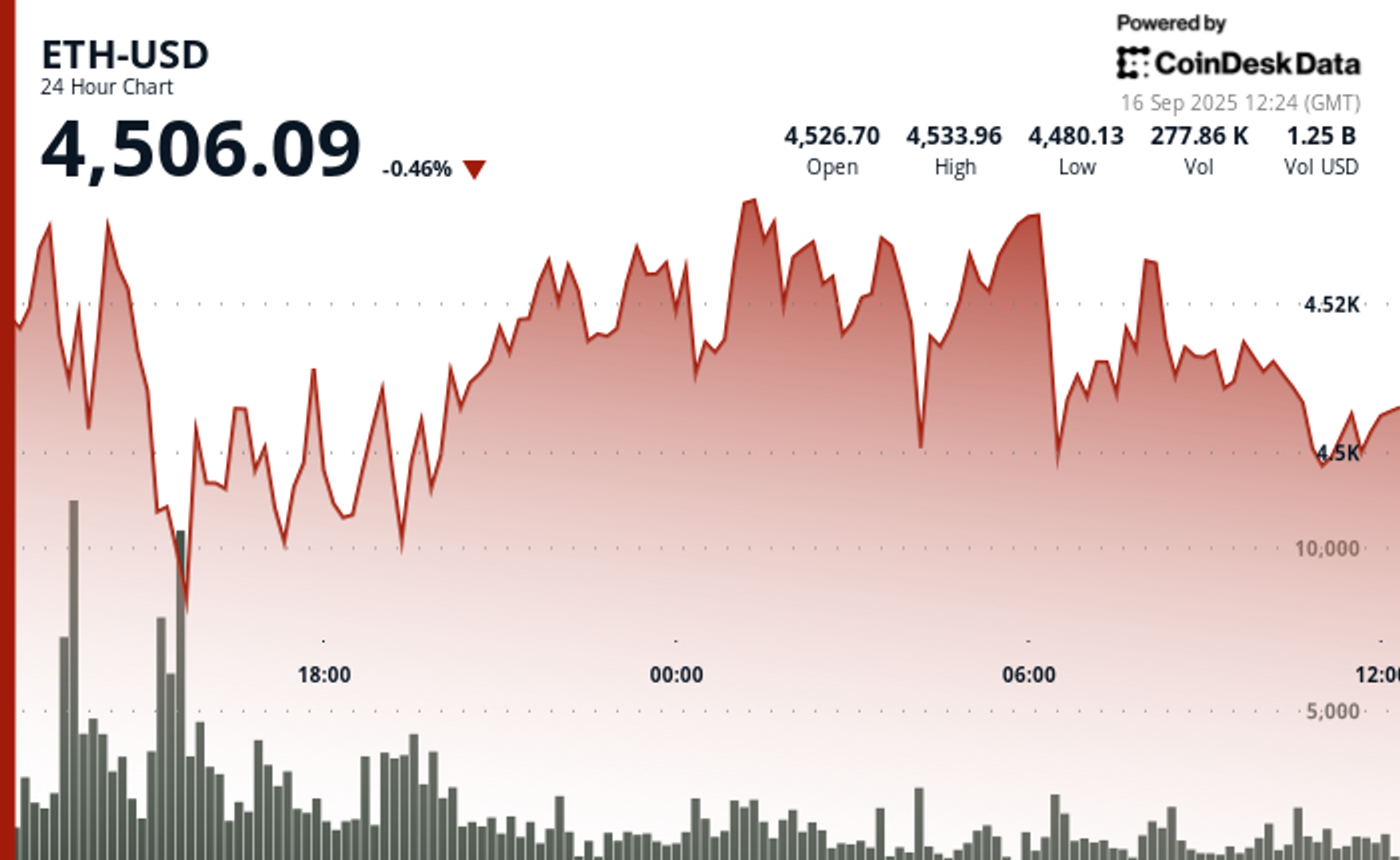

As per CoinDesk Data, ether (ETH) is trading at $4,506, reflecting a 0.5% decrease in the last 24 hours, noted at 12:24 UTC on Sept. 16. Traders are assessing whether this slight retreat may lead to the next upward movement.

Insights from Fundstrat

Mark Newton, the Global Head of Technical Strategy at Fundstrat Global Advisors, characterized the recent downturn as the necessary correction that the market missed during the previous week.

He anticipates that ether will not drop below the previous low of $4,233. Rather, he forecasts potential dips to $4,418 or $4,375 by the end of the week—levels he identifies as buying opportunities. Newton expects ether to potentially rise to $5,500 by mid-October, indicating ongoing market resilience.

Technical Analysis from CoinDesk Research

CoinDesk Research’s technical analysis data model indicates that ether experienced a loss of approximately 3% during the trading window on Sept. 15, falling from a peak of $4,619 to about $4,500.

The sharpest decline was between 07:00 and 08:00 UTC, where prices plummeted from $4,632 to $4,514. Trading activity surged during that interval with volumes exceeding the daily average of 194,000 units, leading to a total turnover of 501,741 units for that session.

After reaching a low of $4,471, buyer activity mitigated further decline, establishing this level as a short-term “floor.” On the upside, ether faced challenges in surpassing $4,671, which has served as a “ceiling.”

Later in the trading session, from 23:00 UTC on Sept. 15 to 00:00 UTC on Sept. 16, prices stabilized. Ether inched up from $4,497 to $4,505, consolidating within a narrow range of $4,479 to $4,505. Interest from buyers around $4,490–$4,495 aided in stabilizing the market, yet the token struggled to reclaim $4,530, indicating that sellers maintained control at higher levels.

Overall, the trading window exhibited a range of $200 between $4,471 and $4,671, highlighting increased uncertainty. The data suggests that ether is beginning to stabilize post the sharp decline, with demand evident at lower levels, though strong resistance limits near-term gains.

Recent 24-hour Chart Analysis

The latest CoinDesk Data chart, created at 12:24 UTC on Sept. 16, illustrates ether holding around $4,506 after a volatile day. The token remains confined between its $4,471 floor and $4,671 ceiling, making little headway in breaking higher. Trading over the last 12 hours has leaned towards consolidation, indicating the market may be poised for the next catalyst following Monday’s significant selloff.