Fidelity’s leading market strategist has cautioned that Bitcoin’s October record of $126,000 may signify the peak of the current cycle, urging investors to prepare for a tumultuous 2026.

Jurrien Timmer highlights the likelihood of a notable pullback next year, with essential support anticipated in the $65,000 to $75,000 range. This perspective aligns with data points and trader insights that evoke memories of significant declines that follow steep peaks.

Fidelity’s Cycle Alert

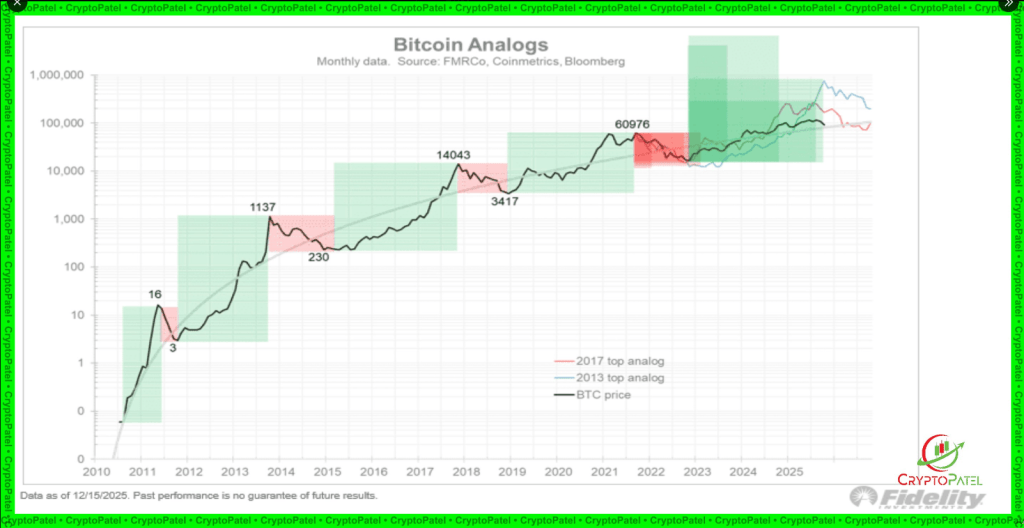

Timmer stated that Bitcoin’s price trajectory adheres to a roughly four-year cycle linked to halving events. Historically, these peaks have been succeeded by dramatic corrections of approximately 70 to 85%.

For instance, following a peak of $1,137 in 2013, the price plummeted to about $230, and after the 2017 high near $14,050, it dipped toward $3,415. Prices surged once more thereafter, reiterating this pattern of rapid ascent followed by steep decline. Some traders believe these downturns test patience rather than indicate that the overall narrative is flawed.

Fidelity Warns: #Bitcoin Cycle Peak May Already Be In

According to Jurrien Timmer of Fidelity, the $126K high reached in October may mark the culmination of this cycle. Anticipating a downturn in 2026, he points to historical $BTC halving patterns and expects support to lie between $65K and $75K.

Short-Term Pain, Long-Term… pic.twitter.com/t9wNeF5lTo

— Crypto Patel (@CryptoPatel) December 21, 2025

Historical Charts Illustrate Parabolic Trends

Reports suggest that long-term logarithmic charts provide perspective on these fluctuations by showcasing percentage growth across cycles, simplifying the interpretation of significant dollar movements.

Market trends frequently exhibit a swift ascent to a peak, a rapid drop, and then an extended period of sideways price movement where gains appear sluggish. Those lateral periods often reward long-term holders, albeit after several years.

BTC will hit $250k by year-end 2027. While 2026 may present challenges, new all-time highs for Bitcoin in 2026 remain plausible. Current options markets are pricing equal probabilities of $70k or $130k by month-end June 2026, and of $50k or $250k by year-end…

— Alex Thorn (@intangiblecoins) December 21, 2025

Galaxy Research has indicated that overlapping macroeconomic and market risks complicate forecasts for 2026, with options and volatility patterns suggesting Bitcoin behaves more like a macro asset rather than a straightforward growth opportunity. Nonetheless, Galaxy Research maintains a bullish outlook for the long term, projecting a trajectory towards $250,000 by the end of 2027.

Role of First Quarter Trends

As noted by traders, the first quarter historically has supported price stability in previous cycles, although recent trends show diminished consistency. Significant inflows and treasury purchases anticipated in 2025 could be counterbalanced by early-cycle selling from major holders.

The interplay between institutional demand and whale supply is likely to become apparent in the first half of 2026, making this phase crucial for determining whether traditional four-year cycles continue to hold.

Featured image from Unsplash, chart from TradingView