Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

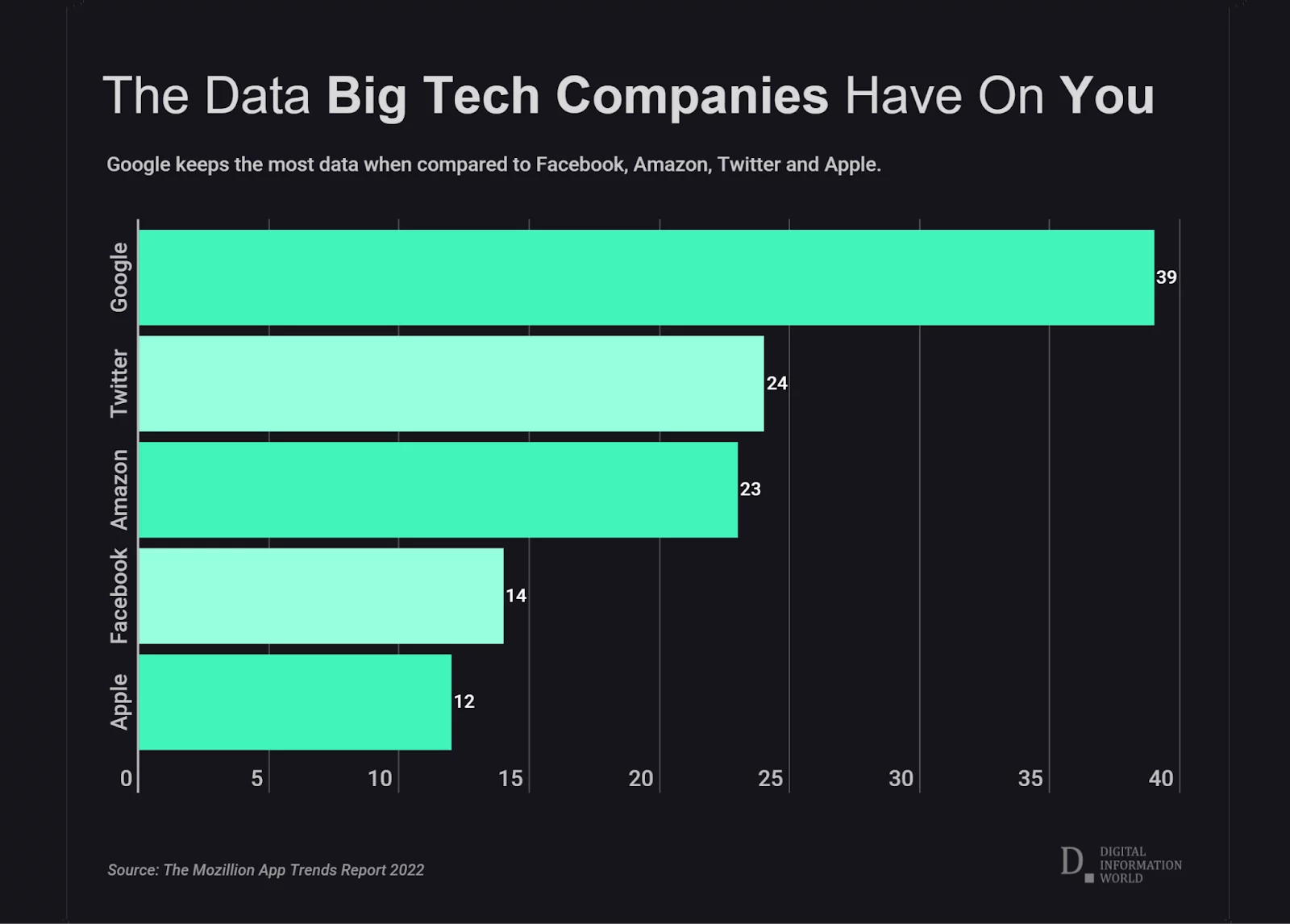

Big Tech exudes a level of confidence that reflects the power of sovereign entities rather than private companies. Google defines global knowledge. Meta influences communication. Amazon dictates purchasing choices. These entities have transcended being mere platforms; they have transformed into empires that extract value.

Summary

- Big Tech has instigated “Feudalism 2.0,” where global platforms extract user data akin to feudal lords, operate above national authorities, and wield powers akin to sovereigns without democratic oversight.

- Web3 provides a means to challenge this digital feudalism by promoting user-controlled identity, data sovereignty, transparency, and decentralized frameworks that shift power away from monopolistic corporations.

- The next revolution must be architectural rather than political: to reclaim digital autonomy, individuals and institutions alike must embrace decentralized technologies that replace platform rulers with open, interoperable, user-controlled systems.

We find ourselves in Feudalism 2.0, or techno-feudalism, where lords are not monarchs in fortresses but CEOs in boardrooms, and the serfs are not tied to soil but to digital platforms. Our labor has shifted from farming to generating data. Each click, scroll, message, search, location signal, and digital trace becomes raw material for a global extraction mechanism.

Like traditional feudal systems, Big Tech operates beyond national frameworks. While governments regulate within borders, platforms function across them. Your citizenship is less vital to your digital existence than your internet access.

The unsettling truth is that we constructed this system. We traded control for convenience, agency for speed, and digital autonomy for the mirage of free services. This raises an age-old question: who truly holds power? If the answer is “platforms,” we need a revolution — not political, but technological.

The new feudal order

In medieval Europe, peasants had no claim to the products of their labor, which belonged to the lord. Feudalism represented not just an economic system but a dependency-driven ideology.

Big Tech has replicated this model with disturbing sophistication. We don’t own our data; we merely generate it. Our digital identities are not ours; we rent them. We don’t truly consent to data extraction; we’re subtly pushed into it through design choices and default configurations.

The common argument is “if you dislike it, use something else.” However, this is a misleading choice. Feudal serfs could leave the manor but had nowhere to turn. Today, attempting to live meaningfully without search engines, email, social media, or cloud platforms is nearly impossible. Opting out is virtually unfeasible.

This isn’t user retention; it’s dependency engineering. When technology becomes essential for societal existence, it encroaches on domains once reserved for sovereign power.

The most striking facet of Feudalism 2.0 is its geopolitical construct. Big Tech does not seek permission; governments request meetings. Big Tech does not negotiate; it establishes terms. It does not observe borders; it redefines them through code.

Google Maps has altered international boundaries, varying them based on the viewer’s location. Meta decides which political factions receive exposure, shaping which narratives are promoted or suppressed. Amazon’s logistics operations rival the GDP of numerous nations.

We never elected them. We never voted for them. Yet they govern us daily. This represents post-national authority: unregulated, beyond accountability, and structurally inclined to continue large-scale extraction. Our digital identities, formed from preferences, actions, biometrics, and pasts, serve as the mines.

The web3 promise: A new Industrial Revolution

The Industrial Revolution dismantled the former feudal structure by equipping ordinary individuals with new tools, rights, and leverage. Web3, if implemented effectively, could replicate this transformation — not as mere jargon, not as a speculative marketplace, but as Industrial Revolution 2.0 — a radical reorganization of power.

Decentralized technologies can redistribute control in the way industrial advancements reshaped labor:

- Ownership: Users hold possession of their data through self-custody.

- Identity: You are not merely a profile in a database but a sovereign digital individual.

- Interoperability: You can transition between applications without losing history or reputation.

- Transparency: Algorithms function openly rather than in opaque mechanisms.

- Incentives: Platforms reward participation instead of exploiting it.

The goal is not to obliterate technology but to reformulate its power dynamics. If the future is to be digital — and it will be — the crucial question is: Digital for whom? The Kings of Feudalism 2.0? Or the individuals who truly generate value?

Retail adoption: Reclaiming everyday agency

For everyday users, the revolution commences with something seemingly straightforward: ownership of digital identity.

Currently, losing your email or social media account equates to a more disastrous event than misplacing your house keys. This isn’t merely poor user experience; it signals that we lack ownership of our digital existence. Web3 facilitates identity wallets, verifiable credentials, ownership-based logins, and user-governed data storage. Retail adoption isn’t about NFTs or DeFi; it’s about the general populace reclaiming rights they were unaware they had surrendered.

A digital landscape where your data travels with you, not the platform. Where you decide who accesses what. Where your engagement produces value for you, not for a monopoly that trades your habits for advertisements.

Institutional adoption: Breaking the monopolies

Institutions confront the same challenges, albeit on a grander scale. They are reliant on Big Tech ecosystems: cloud solutions, AI systems, advertising networks, and analytics. This dependency centralizes national-level influence within a select few corporations that any single nation struggles to regulate effectively.

Web3 infrastructure — including decentralized storage, accessible AI models, programmable networks — provides institutions with an alternative. This isn’t solely due to lower costs or trendy appeal; it’s sovereign. It redirects control away from corporate monarchs and into open systems. This is why various governments, central banks, and enterprises are exploring blockchain: not from curiosity, but from apprehension.

Fear of becoming vassals in someone else’s digital dominion.

The revolution will be decentralized — or it won’t happen

Revolutions often commence before people recognize them as such. Web3’s revolution centers on the political framework of the digital domain. Rights. Authority. Agency. Ownership. Governance. These are crucial issues.

Feudalism 2.0 was gradually, insidiously constructed, one consent box at a time. Dismantling it will require intentional design, cultural transformations, and technologies that resist centralization.

Ironically, Web3 must dismantle Feudalism 2.0 — not through violence, but through design, for the world requires no new kings. It requires protocols. It needs open infrastructures. It demands scalable sovereignty. A revolution where people regain what was quietly taken from them: their (digital) autonomy.