Ki Young Ju, the CEO of CryptoQuant, has reignited discussions about potential market peaks with a fresh model that estimates Bitcoin’s upper limit to be around $208,000 per coin. In a post on X, he shared CryptoQuant’s “Price Prediction Based on Realized Cap” dashboard, stating: “Nobody pays attention to my predictions anymore, but I want to express my bullish stance on Bitcoin. We’re seeing excessive capital inflows on-chain. It’s quite significant.”

This remark echoes his data-centric insights from early 2024, when he predicted that “#Bitcoin could hit $112K this year, with a worst-case scenario of $55K.” This forecast was remarkably close, as Bitcoin reached a 2024 peak just above $108,000, narrowly missing his $112,000 target.

Reasons Why Bitcoin Price May Exceed $208,000

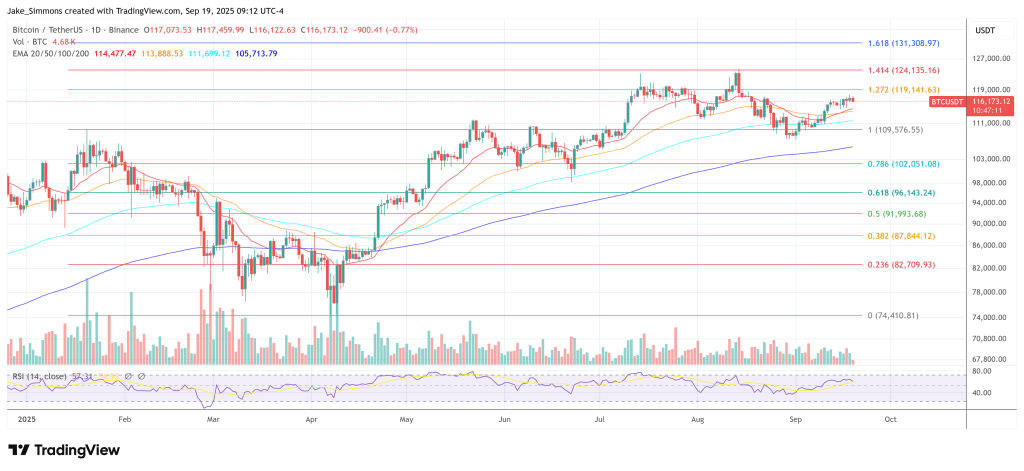

The chart Ki shared on September 18 illustrates three time series derived from CryptoQuant’s realized-cap analysis: the current BTC price (black), a model “ceiling_price” (red), and a model “floor_price” (green).

As of September 17, 2025 (UTC), the model pinned a spot price marker at $116,453, a ceiling at $208,310, and a floor at $41,662, indicating it was “last run” two hours earlier. Essentially, the model situates Bitcoin significantly above its inferred floor while still well below the range it identifies as overvalued.

Related Reading

Ki’s statement does not serve as a guarantee, but rather as an indication that, considering current on-chain capital inflows and the realized-cap structure, the market has room—per this metric—to aim for the $208,000 upper limit.

Realized cap evaluates the network by calculating the sum of each coin based on the price at which it last transacted on-chain, rather than its current market price. This method tends to reflect the historical investor cost basis. CryptoQuant’s dashboard displays dynamic “floor” and “ceiling” bands around spot prices that have historically delineated multi-year market expansions and contractions.

Ki’s renewed optimism links those bands to what he sees as soaring demand pressure evidenced by settlement flows and ETF-related capital influx onto the network. His continuity with the observations from February 2024 is clear: back then, he pointed to inflows from exchange-traded products as the key factor driving a rise towards six figures; now, he highlights “excessive on-chain capital inflows” alongside a model that positions the ceiling near $208,000.

Related Reading

It’s important to note that Ki is not laying out an infinite forecast but suggesting a model snapshot that adapts to market conditions. The same dashboard indicating a $208,310 ceiling today also notes a risk floor at $41,662, emphasizing the range of outcomes contemplated by the realized-cap approach. His accurate prediction of the $112,000 mark “this year”—followed by an actual print just above $108,000—will undoubtedly influence how traders interpret the latest update.

However, the framing remains analytical: a data assessment of Bitcoin’s position relative to its realized-value envelope after a year and a half shaped by U.S. ETF adoption and increasing institutional interest. For now, Ki’s message is straightforward—“I’m bullish on Bitcoin”—and grounded in the same on-chain perspective he employed ten months ahead of the 2024 peak.

Whether the market ultimately reaches the model’s $208,000 ceiling will rely on the evolution of those on-chain inflows against macro liquidity, ETF and corporate treasury demand, as well as miner supply dynamics. What his chart illustrates is that, according to CryptoQuant’s realized-cap bands, Bitcoin has yet to test the upper limit of its statistical range in this cycle.

As of press time, BTC was trading at $116,173.

Featured image created with DALL.E, chart from TradingView.com