Ethereum’s price has dipped almost 5% after reaching a new all-time peak of $4,946 earlier today.

Summary

- The price of Ethereum has retracted after achieving an all-time high on Aug. 25.

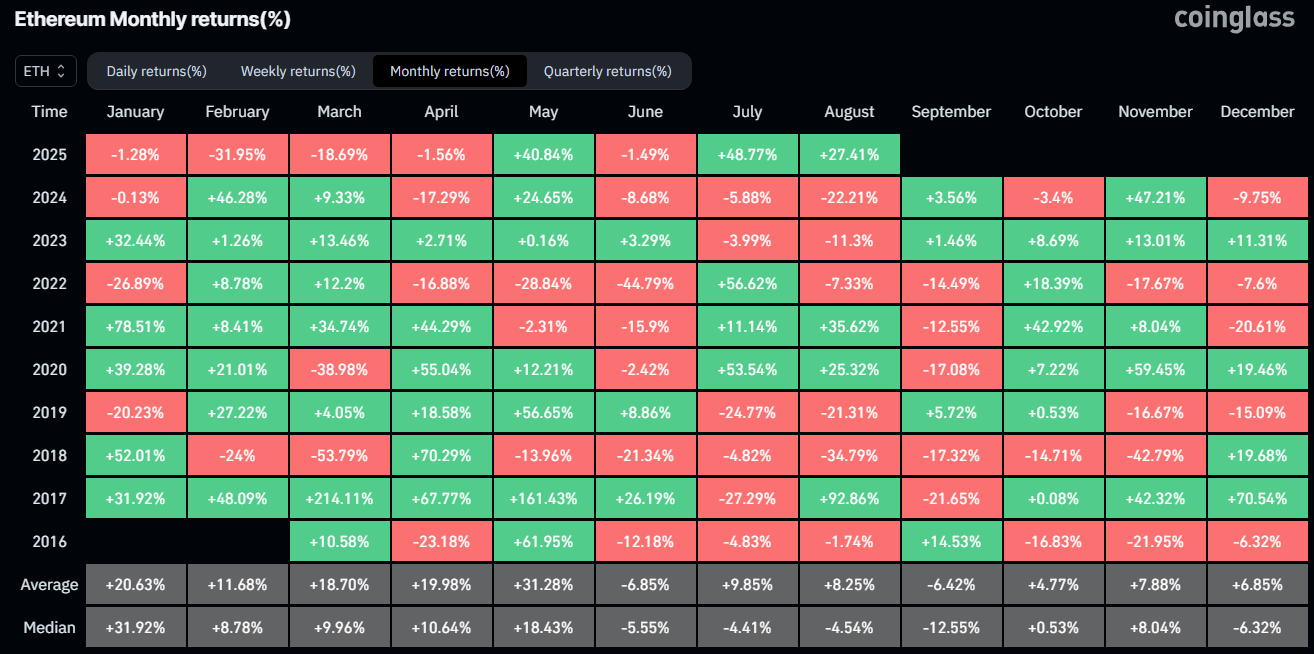

- Historical patterns indicate that September may be bearish for ETH.

- Technical indicators show a differing outlook as ETH operates within an ascending channel on the daily chart.

According to data from crypto.news, Ethereum (ETH) surged over 21% to a new all-time high of $4,946 on Aug. 25 before settling at $4,713 as of the latest update. This price represents a 26% increase since the start of August and 220% from its year-to-date low.

Despite the substantial gains made by the leading altcoin by market capitalization in August, historical data suggests that the next month could likely be bearish for it.

Analysis from CoinGlass reveals that since 2016, each time Ethereum experienced gains in August, a decline followed in September. Specifically, in August 2017, 2020, and 2021, ETH realized gains of 92.86%, 25.3%, and 35.6%, followed by declines of 21.65%, 17.08%, and 12.55% in the respective September months.

This likelihood is further supported by the proximity of ETH to its all-time highs. Cryptocurrencies often undergo sell-offs after reaching new peaks as early investors take profits.

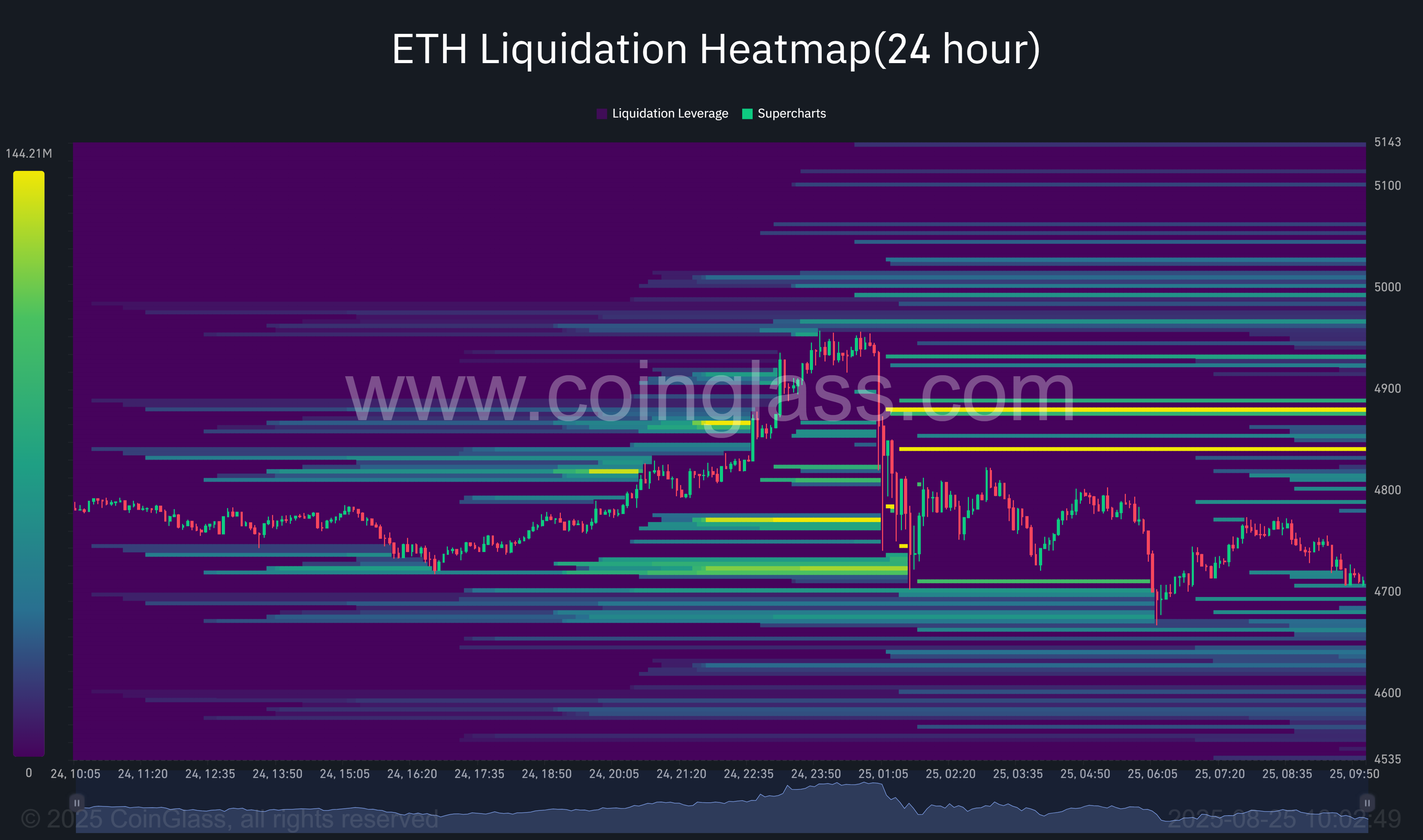

Meanwhile, data from CoinGlass indicates that Ethereum’s sharp decline from its recent high was prompted by a wave of long liquidations, as overleveraged positions were purged near the top. In the last 24 hours, total liquidations for ETH amounted to $216 million, with nearly $130 million originating from long positions.

As of the latest update, significant liquidation zones remain concentrated above $4,900. A renewed attempt to push higher might trigger another liquidation cascade. Should this happen, ETH may slide further into the $4,600–$4,680 range.

However, unlike previous cycles, Ethereum might enter this September under a different macroeconomic environment, characterized by the emergence of spot Ether ETFs and corporate treasuries holding ETH, neither of which were present during past August rallies.

The nine spot Ether funds have drawn in $2.79 billion in inflows for August, following $5.43 billion in July, showcasing strong demand for Ether among institutional investors. This contrasts with Bitcoin’s situation, which saw outflows of $1.19 billion this month.

Contributing to the shifting market dynamics, Ether has gained traction as one of the most closely monitored crypto assets this month, bolstered by regulatory advances and a wave of corporate accumulation.

On the daily chart, Ethereum has been trading within an ascending parallel channel since late June, characterized by higher highs and higher lows between two upward-sloping trendlines. This pattern typically indicates a continuation of the prevailing bullish trend, assuming the price stays within the channel boundaries.

As of the latest update, Ethereum is consolidating near the midline of the channel, indicating a period of balance between buying and selling pressure. Importantly, the token remains above the 20-day exponential moving average, suggesting that short-term momentum still favors the bulls.

Furthermore, the Supertrend indicator has turned green and is positioned below the price, providing additional bullish confirmation.

Additionally, the Relative Strength Index has decreased to a reading of 60, signifying that bullish momentum endures without entering overbought territory. This suggests that Ethereum still has room to rise before facing buyer exhaustion.

If bullish momentum persists, the next significant upside target is $5,200, representing a 10% increase from the current level and marking the upper boundary of the channel. A breakout above this point could accelerate further gains, particularly if accompanied by strong volume.

On the downside, immediate support is located at $4,349, aligning with the 78.6% Fibonacci retracement of the most recent upward movement.

A breach below this level would invalidate the existing pattern and could trigger a deeper correction towards the lower boundary of the channel.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.